- United States

- /

- Capital Markets

- /

- NYSE:BX

Is Blackstone’s Drop an Opportunity After Expansion in Private Credit?

Reviewed by Bailey Pemberton

If you’re mulling over what to do with your Blackstone shares, or just considering getting in, there’s a lot to unpack right now. The stock has had quite the ride lately, and anyone watching their portfolio closely has probably noticed the slight turbulence in recent months. Over the last week, Blackstone dipped by 3.4%. Stretch that timeline out to the last 30 days, and the decline widens to 6.3%. Even year-to-date, it’s down 6.5%. That might sound concerning, but it’s not the whole story. Long-term holders have seen a massive 108.1% return over three years and an even more impressive 250.6% climb over five years. Those are the kinds of numbers that demand attention, especially as investor sentiment and sector trends continue to shift around alternative asset managers like Blackstone.

So what’s really driving these moves? Much of it links back to ongoing changes in the broader market for private equity and alternative investments. Institutions and retail investors alike are reassessing risk, and Blackstone’s position as a top player inevitably puts it in the spotlight. However, as tempting as it is to focus just on short-term price action or market headlines, the real question is: Is Blackstone actually undervalued right now?

Looking at the numbers, the company registers a value score of 0 out of 6, which means it doesn’t meet the standard undervaluation checks under any of the six common methods. As we dig into each of those valuation approaches, keep in mind there’s another perspective that might reveal even more about the stock’s true value, and we’ll get to that at the end of this article.

Blackstone scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Blackstone Excess Returns Analysis

The Excess Returns valuation method dives into how well a company generates returns above its cost of equity. Instead of focusing solely on earnings or cash flows, this approach examines how efficiently Blackstone puts its equity to work, measuring what’s left after accounting for the cost of capital. This is considered a forward-looking lens, centered on sustainable profitability and value added by management over time.

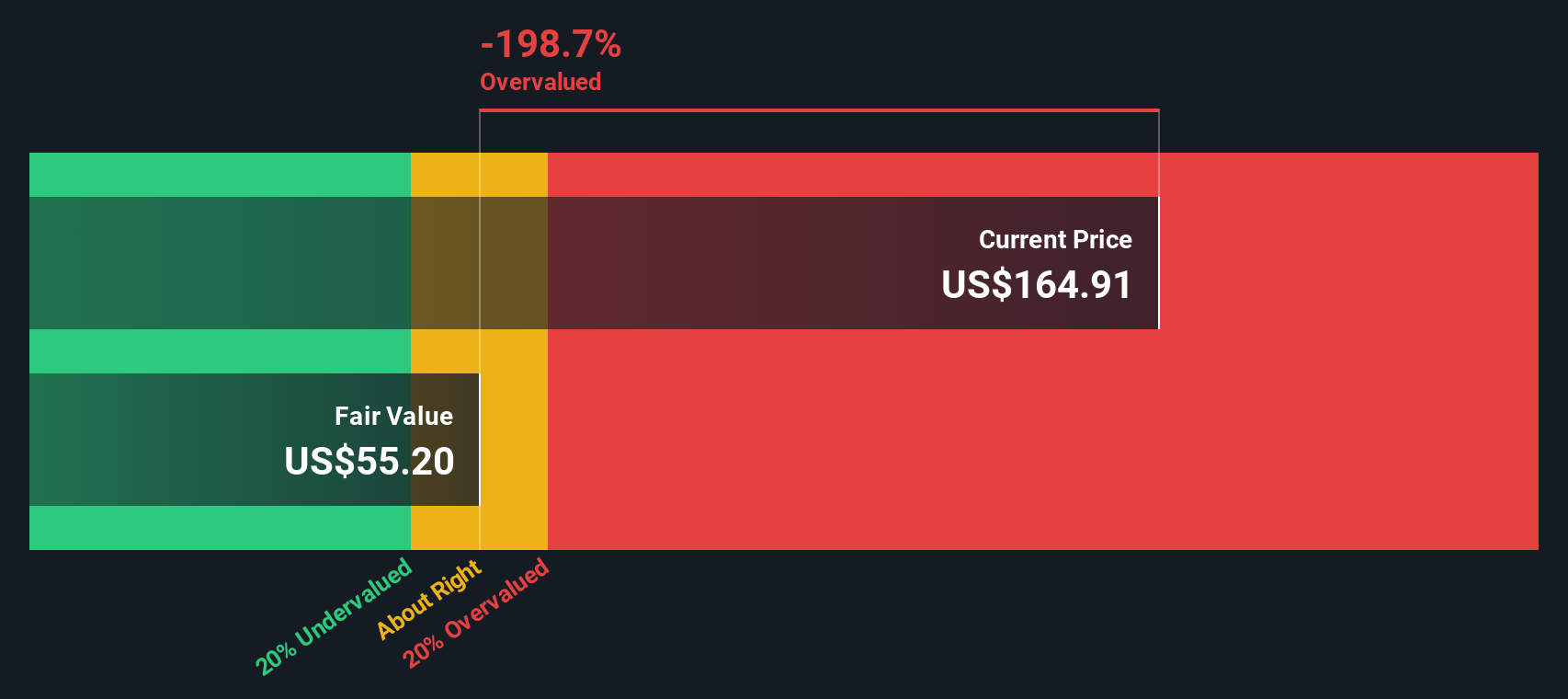

For Blackstone, the current data tells a compelling story. The company’s Book Value stands at $10.67 per share, with a stable EPS projected at $3.09 per share, based on future Return on Equity estimates from five analysts. The Cost of Equity is $0.60 per share, translating to an Excess Return of $2.49 per share. Over recent years, Blackstone achieved an impressive average Return on Equity of 42.57%. Analysts peg its stable Book Value estimate at $7.25 per share, further supporting robust capital efficiency going forward.

Despite these strong performance metrics, the Excess Returns model calculates the stock’s intrinsic value at $55.27 per share. When set against Blackstone’s current market price, this implies the stock is roughly 193.9% overvalued based on this measure. In other words, the market is already pricing in a hefty premium.

Result: OVERVALUED

Our Excess Returns analysis suggests Blackstone may be overvalued by 193.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Blackstone Price vs Earnings

For established, profitable companies like Blackstone, the Price-to-Earnings (PE) ratio is often the go-to metric for valuation. This ratio is especially useful because it relates a company's current market price to its annual earnings, making it easy to compare profitability across companies in the same sector.

What counts as a “normal” or “fair” PE multiple depends on factors such as expected future growth in earnings and the level of risk investors perceive. Rapidly growing, lower-risk businesses usually justify higher PE ratios, while riskier or slower-growth stocks often trade at lower multiples.

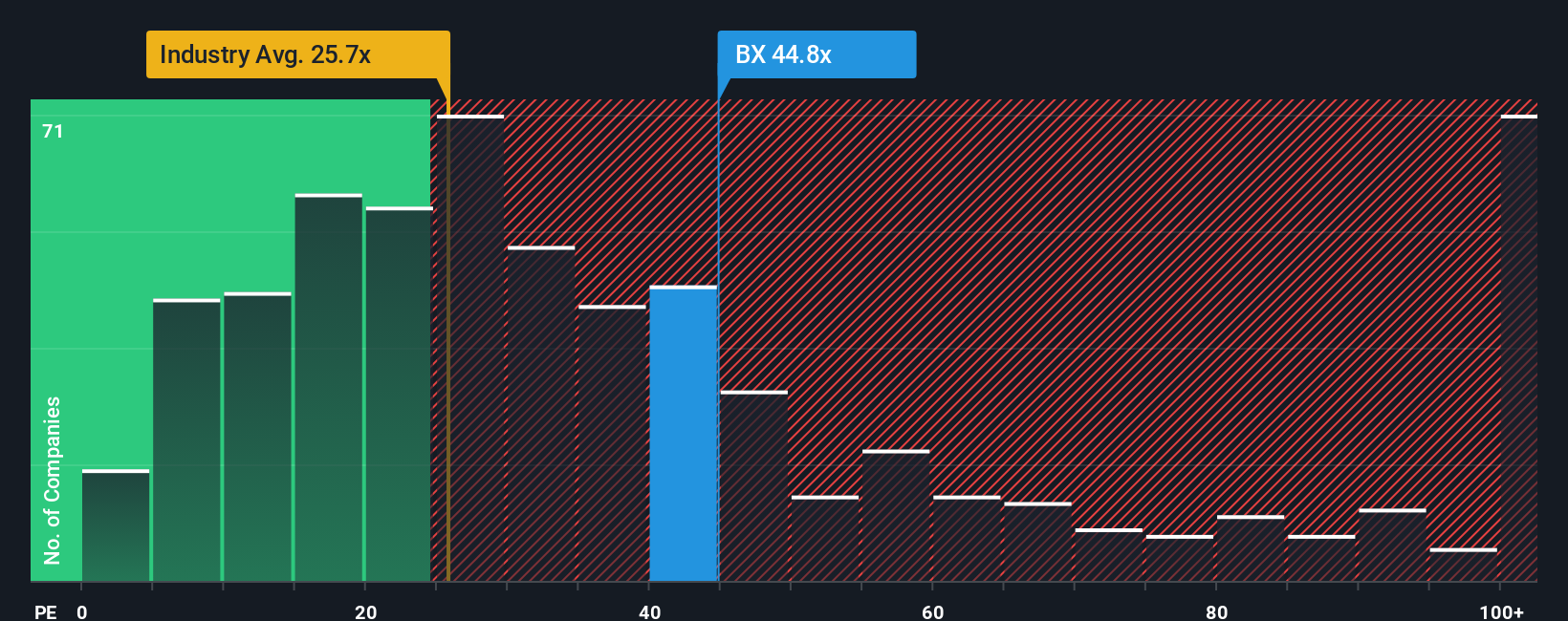

Blackstone currently trades at a PE of 44.4x. That is noticeably higher than the Capital Markets industry average of 25.7x, and even above the average for its closest peers at 42.4x. On the surface, this suggests the stock is priced at a significant premium to both its sector and its major competitors.

Enter the "Fair Ratio," a proprietary metric developed by Simply Wall St. Unlike a simple peer or industry comparison, the Fair Ratio factors in Blackstone’s unique combination of earnings growth, risk, profit margin, industry, and market cap. This model finds Blackstone’s Fair PE ratio to be 26.5x, a much lower multiple than where the stock currently trades.

Because the Fair Ratio is custom-fit to Blackstone’s actual characteristics, it offers a more tailored and arguably more reliable valuation than broad industry or peer averages. Comparing the current PE of 44.4x to the Fair Ratio of 26.5x shows that Blackstone’s shares are trading well above the level justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Blackstone Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or viewpoint about a company, based on what you believe about its industry, catalysts, risks, and future prospects. Instead of only relying on backward-looking metrics, Narratives let you tie your understanding of Blackstone's direction, such as expected growth from strategic alliances or challenges from economic risks, directly to your own financial forecasts, margin assumptions, and ultimately, your estimate of fair value.

On Simply Wall St, Narratives are an easy, accessible tool found within the Community page and used by millions of investors around the world. They help you decide when to buy or sell by clearly showing how your fair value compares to the latest market price. Narratives also update automatically as fresh company news, earnings, or sector shifts roll in, ensuring your valuation remains relevant.

For example, one investor might see Blackstone’s strategic global partnerships and rapid expansion as reasons to value it at $193, while another might point to risks from competition and market volatility and set their fair value at $124. This demonstrates how Narratives powerfully reflect different perspectives and keep your investment decisions grounded in your own research and logic.

For Blackstone, we’ll make it really easy for you with previews of two leading Blackstone Narratives:

- 🐂 Blackstone Bull Case

Fair Value: $181.68

Currently 10.6% below this narrative fair value

Annual Revenue Growth Forecast: 16.7%

- Blackstone is expected to benefit from strong capital inflows and substantial "dry powder" for opportunistic investments, positioning it for robust growth.

- Strategic alliances, such as those with Wellington and Vanguard, and innovations in private credit and private wealth management are projected to drive revenue and profit margin expansion.

- Analyst consensus assumes earnings will more than triple by 2028, with margins and market reach both increasing. However, cautions remain around global economic uncertainties and tariffs.

- 🐻 Blackstone Bear Case

Fair Value: $124.55

Currently 30.5% above this narrative fair value

Annual Revenue Growth Forecast: 15.9%

- Rapid growth in infrastructure and private wealth may introduce operational inefficiencies, challenging Blackstone's ability to sustain high margins and earnings.

- Heavy reliance on large deployments and exposure to technological and industry shifts could leave future revenues and profitability unpredictable.

- The more cautious analyst cohort sees the current share price as overestimating positive outcomes, expecting a lower fair value even while recognizing Blackstone’s strengths in credit and infrastructure.

To see more perspectives, explore what the wider community is saying or try building your own Narrative to track how changing assumptions would affect your view of Blackstone's value.

Do you think there's more to the story for Blackstone? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives