- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (NYSE:BX) Experiences 12% Price Dip As Trump Tariffs Heighten Market Volatility

Reviewed by Simply Wall St

Blackstone (NYSE:BX) experienced a significant price move last week, declining by 12.09%. This development comes amid a series of strategic investment maneuvers, including being in the final stages to reacquire Trans Maldivian Airways. Furthermore, Blackstone's withdrawal from the acquisition talks with Haldiram's reflects persistent valuation challenges. The market environment, marked by Trump's recent imposition of higher tariffs, has contributed to increased volatility, weighing on overall investor sentiment. This week's movement in the Dow Jones and S&P 500, both experiencing declines, underscores the broader market's uncertainty affecting sectors sensitive to geopolitical and fiscal policy changes. Despite Blackstone's proactive energy transition efforts, highlighted by the successful closure of the Blackstone Energy Transition Partners IV, the overarching tariff concerns may have compounded the firm's recent stock dip. This context reflects a period of reassessment for investors monitoring the company's ongoing and forthcoming transactions amidst fluctuating market conditions.

See the full analysis report here for a deeper understanding of Blackstone.

Over the past five years, Blackstone (NYSE: BX) has delivered a substantial total shareholder return of 309.41%. This performance reflects a combination of factors, including substantial earnings growth and a series of strategic mergers and acquisitions. In August 2020, Blackstone's acquisition endeavors, like those involving Kansas City Southern and logistics facilities in Japan, showcased its commitment to sectors with growth potential, such as infrastructure and e-commerce. Moreover, increased earnings were buoyed by robust revenue growth in 2020, which helped counter earlier net losses.

Blackstone's commitment to shareholder value is evident through its consistent dividends and share repurchase actions. By January 2025, the company had completed share buybacks totaling over 15 million shares. These efforts, paired with a high return on equity of 27.9% over the past year, bolstered investor confidence. Despite facing recent challenges, such as trade tensions, Blackstone's diversified investment approach and focus on profitability contributed to its impressive long-term performance, exceeding the US market's annual return of 8.8% over the past year.

- See whether Blackstone's current market price aligns with its intrinsic value in our detailed report

- Analyze the downside risks for Blackstone and understand their potential impact—click to learn more.

- Is Blackstone part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Blackstone, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

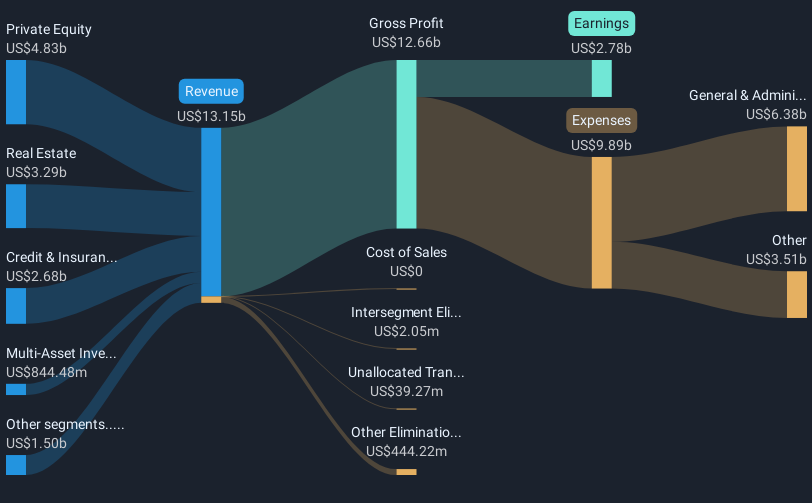

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives