- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (NYSE:BX) Exits Haldiram's Deal Over US$2 Billion Valuation Dispute With Temasek Still In Race

Reviewed by Simply Wall St

Blackstone's (NYSE:BX) recent exit from Haldiram's Snacks negotiations, due to valuation disagreements, reflects an uncertain period for the company, resulting in a 4% decline in its stock price over the past week. This decision coincided with Rodney Zemmel's appointment as Global Head of Portfolio Operations, a move aligned with strengthening operational leadership. Additionally, Blackstone closed its energy-transition-specific private equity fund, raising $5.6 billion, underlining its commitment to energy investments. These developments occurred as major market indexes, including the S&P 500 and Nasdaq, oscillated amid broader economic concerns and tariff updates, with the market overall experiencing a 3.1% decline. The company's stock movement reflects both internal strategic shifts and external market pressures. With the market digesting multiple economic factors, Blackstone's focused strategic maneuvers highlight its adaptability but haven't shielded its stock from recent market fluctuations.

Click here and access our complete analysis report to understand the dynamics of Blackstone.

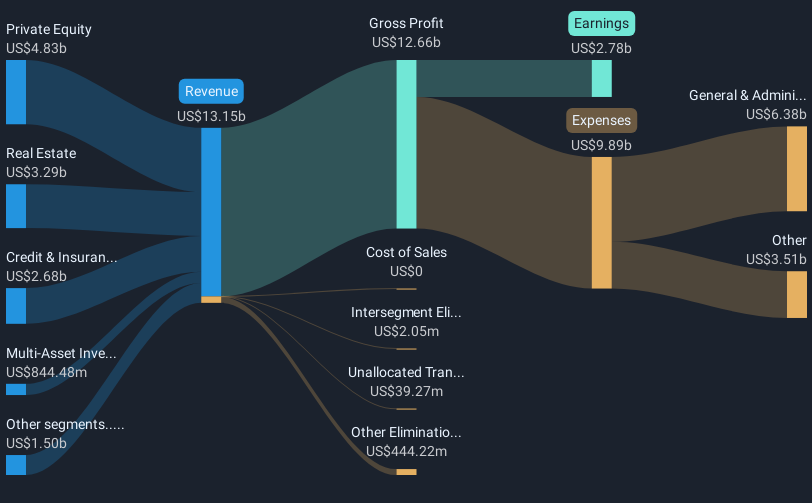

Over the last five years, Blackstone's share performance has been remarkable, with a total return of 254.38%, showcasing its ability to create substantial wealth for investors despite some recent headwinds. During this period, significant financial maneuvers have bolstered its performance, including robust earnings growth and strategic dividends. For example, its revenue grew significantly, from US$8.02 billion in the previous year to US$13.23 billion for the full year ending December 2024, while net income doubled to US$2.78 billion.

Furthermore, the company completed the repurchase of 15.29 million shares under a buyback program initiated in December 2021, spending US$1.77 billion, which likely supported the stock price. Elsewhere, Blackstone’s substantial investment in an Indian real estate portfolio worth INR 127.45 billion also marked a major commitment to growth through strategic expansion. In the past year, while Blackstone's returns fell short of the broader Capital Markets industry, its consistent operations and calculated investments have contributed significantly to its impressive five-year return.

- Get the full picture of Blackstone's valuation metrics and investment prospects—click to explore.

- Discover the key vulnerabilities in Blackstone's business with our detailed risk assessment.

- Already own Blackstone? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Blackstone, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.