- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (NYSE:BX) and TPG Eye US$16 Billion Hologic Buyout in Rejected Offer

Reviewed by Simply Wall St

Recent rumors of a $16 billion acquisition deal between private equity firms TPG Inc. and Blackstone (NYSE:BX) for Hologic, Inc. have sparked significant interest in the medical technology sector. Over the past month, Blackstone's stock recorded a moderate 5% increase, likely reflecting market reactions to these discussions as well as other strategic moves, such as their offer for Statkraft India and talks to acquire TXNM Energy. These activities, combined with the market's general movements and its subtle rise of about 0.7% for the year, suggest that these developments may have added positive momentum to Blackstone's performance.

The potential acquisition of Hologic by TPG and Blackstone could significantly influence the medical technology sector by expanding Blackstone's footprint into new areas. This move comes amid Blackstone's total shareholder return of 186.60% over the last five years, showcasing a strong historical performance. However, in contrast, the company's one-year performance lagged behind the US Capital Markets industry, which rose by 26.2% compared to Blackstone's return over the same period.

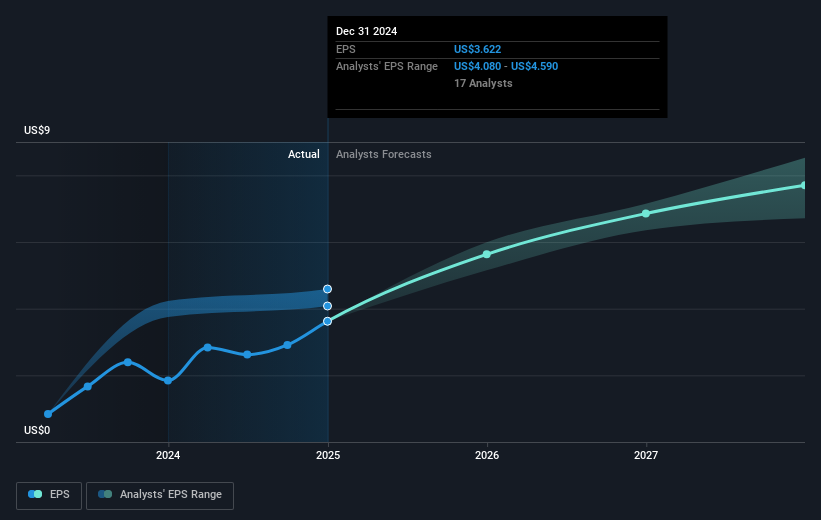

This prospective acquisition may impact Blackstone's revenue and earnings forecasts. The company's infrastructure and private wealth sectors are experiencing rapid growth, but this expansion might introduce operational inefficiencies that hamper future earnings. Current discussions have nudged Blackstone's share price higher by 5% in the short term, yet it still stands at US$137.36, slightly below the consensus price target of US$147.30 and very close to the more bearish analyst target of US$138.17. This suggests market caution around the potential updates in financial projections and the sustainability of its growth strategy. Investors should consider these factors when evaluating Blackstone's long-term value proposition.

Unlock comprehensive insights into our analysis of Blackstone stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives