- United States

- /

- Capital Markets

- /

- NYSE:BX

Blackstone (BX): Valuation in Focus After Strategic Push Into Retirement Savings Market

Reviewed by Kshitija Bhandaru

Blackstone (NYSE:BX) has kicked off a new initiative to bring private market investments to retirement savers, focusing on defined contribution plans like 401(k)s. This move positions Blackstone to participate in a massive and evolving investment market.

See our latest analysis for Blackstone.

Recent momentum around Blackstone is as much about strategy as stock price. While shares have dropped 10.8% over the past month, the total shareholder return has climbed 5.4% over the past year, reflecting steady long-term value creation despite short-term volatility. High-profile moves, such as expanding into retirement solutions, selling UK logistics assets, and eyeing acquisitions, seem to be stirring renewed interest and suggest management is focused on long-term opportunities even as near-term price action remains cautious.

If Blackstone’s approach has you looking for what else is gaining traction, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With Blackstone’s shares trading below many analyst price targets despite robust long-term growth, the big question is whether this marks an attractive entry point or if the market already reflects the company’s future potential.

Most Popular Narrative: 9.8% Undervalued

Analyst consensus places Blackstone's fair value noticeably above its last close, suggesting a gap between market sentiment and growth-driven expectations. The numbers signal confidence in revenue expansion, margin improvement, and scaling opportunities, making analyst projections hard to ignore.

Blackstone has raised $62 billion of inflows in Q1 2025, marking the highest level in three years. This boosts assets under management (AUM) and gives the company a strong foundation for future revenue growth. The firm is well positioned to benefit from market dislocation with $177 billion of dry powder available for opportunistic investments, potentially increasing future earnings as capital is deployed in undervalued assets.

Want to know the engine behind this bullish price? The narrative bets on a unique combination of massive inflows, aggressive capital deployment, and a future profit margin leap. What financial projections justify this optimistic outlook? Only by reading further will you see what drives this ambitious fair value target.

Result: Fair Value of $181.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade negotiations and market volatility could stifle Blackstone’s earnings growth. These factors may serve as potential catalysts for a shift in the current outlook.

Find out about the key risks to this Blackstone narrative.

Another View: What Do Market Ratios Say?

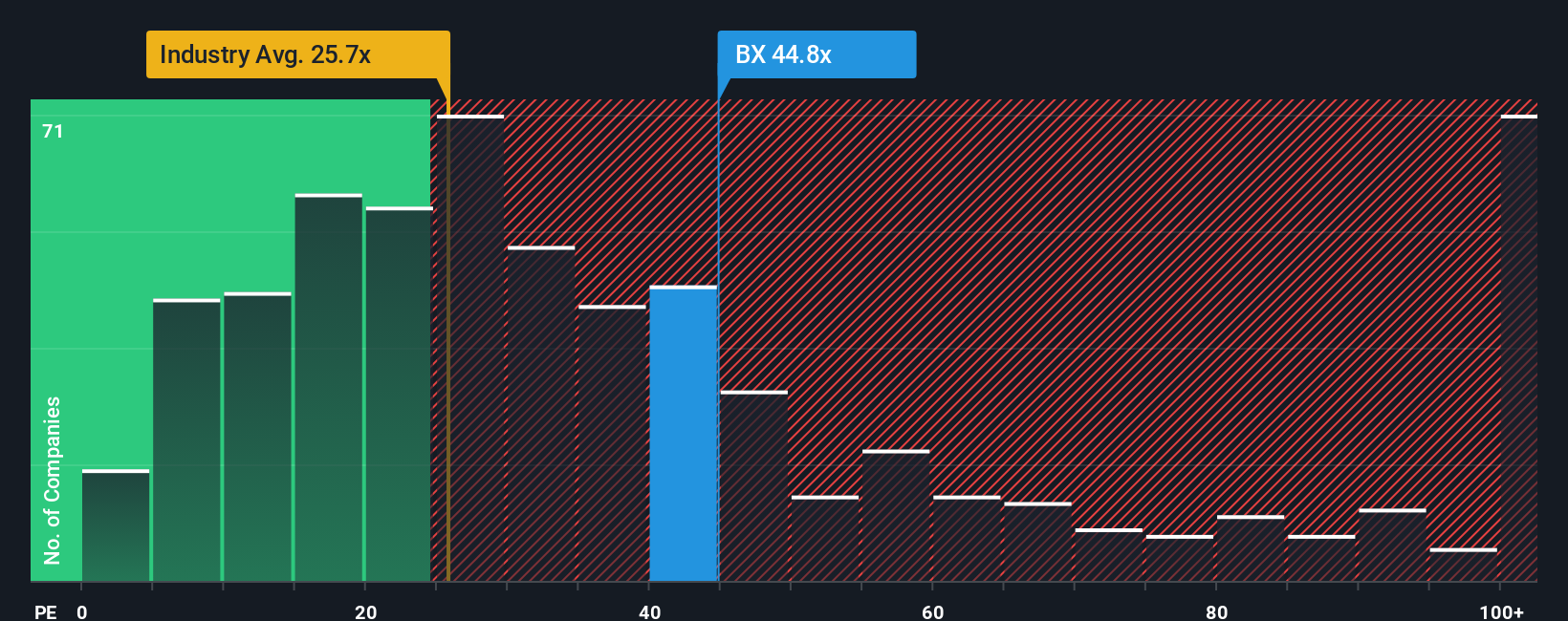

Looking through the lens of price-to-earnings, Blackstone appears pricey. The market assigns it a ratio of 44.8x, well above both the US Capital Markets industry average of 25.7x and its peer average of 43.1x. The fair ratio estimate stands at 26.7x, suggesting investors are banking on higher future returns or premium leadership. However, how long this premium will hold and whether the risk is worth it remain important questions.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Blackstone Narrative

Not convinced by the consensus or want to dive deeper into the figures? With just a few clicks, create your own story in under 3 minutes and Do it your way.

A great starting point for your Blackstone research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by acting on fast-moving opportunities. Don’t limit yourself. The next standout performer could be just one smart screen away.

- Spot growth potential by checking out these 24 AI penny stocks making strides in artificial intelligence breakthroughs and transforming entire industries.

- Put your money to work with these 18 dividend stocks with yields > 3% offering reliable high-yield income, perfect for building long-term wealth and financial security.

- Get in early on innovation by scanning these 26 quantum computing stocks that are powering advancements at the frontier of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blackstone might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BX

Blackstone

An alternative asset management firm specializing in private equity, real estate, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives