- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Why Q1 Results are more Important than the Risky Merger Arbitrage from Berkshire Hathaway (NYSE:BRK.A)

Key takeaways:

- Investors are slowly losing confidence in the gains from the ATVI merger arbitrage as risks for a delay or blockage from the FTC increase.

- Warren Buffets ATVI merger arbitrage stake represents only 0.8% of Berkshire's market cap.

- Berkshire beat bottom line expectations, as the company is showing resilience to the current unfavorable business climate.

Warren Buffett announced that Berkshire Hathaway (NYSE:BRK.A) has built up a 9.5% stake in Activision Blizzard Inc. (NASDAQ:ATVI) stock, which is under an acquisition bid from Microsoft (NASDAQ:MSFT) for US$95 per share. Investors are monitoring the situation for an opportunity to get in on the arbitrage, and we will discuss the current status and review quarterly results.

Acquisition Progress

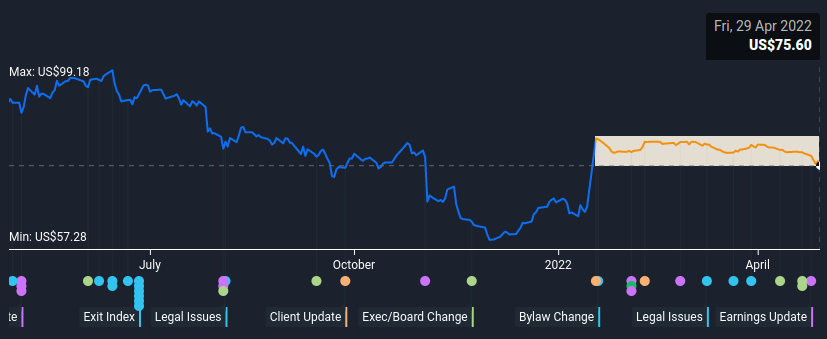

Currently, the price of ATVI is trading at US$75.6, about 20% below the acquisition bid, and 8.1% lower than peak investor enthusiasm when the deal was announced on the 18th of January.

On the 28th of April, (98% of) ATVI shareholders approved the US$69b Microsoft acquisition.

Berkshire has revealed that it has a 9.5% stake in Activision, which would be bought off from Microsoft if the transaction is allowed to go forward from the FTC (federal trade commission). Investors, may have a harder time estimating the likelihood of a success, since democratic senators demanded a tougher investigation by the FTC regarding the treatment of workers and labor issues.

The FTC has expressed a tougher stance on acquisitions and, under the leadership of Lina Khan has blocked NVIDIA's acquisition of Arm Ltd., Lockheed Martin's bid for Aerojet Rocketdyne, as well as initiated a restructuring of the case against Meta - which seeks to split away Instagram and WhatsApp.

If it gets timely approval, Microsoft's acquisition is still expected to happen by the 30 June 2023.

One of the more pressing concerns for the acquisition is that it may be significantly delayed and the net benefit of the offered US$95 per share may be diluted by time. However, it seems that the merger will ultimately happen, even if there is a lawsuit by the FTC, as Bloomberg conveys that the law is tilted on the side of Microsoft. However, negotiations can be used to extract further costs to the company regarding labor issues.

As time passes by, it seems that investors are less optimistic about the merger, and that is reflected in the slow 8% decline of Blizzard's stock, after the initial announcement.

Berkshire's current stake in ATVI is worth US$5.6b, as measured by the latest close price. This is in-effect what the company has on the line while it is waiting for the decision from the FTC. From a Berkshire investor's point of view, this is not worth quite so much, as it represents a 0.8% portion of Berkshire's US$713.4b market cap.

Q1 Earnings

Arguably, the latest earnings have a larger impact on Berkshire, and they were released on the 30th of April.

Earnings highlights:

- Q1 Revenue US$70.8, a miss on the US$72.9b expected from analysts

- Q1 Net Income US$5.585b vs US$11.84b a year ago

- Q1 EPS US$3.702 vs US$7.638 a year ago, beating the US$3 prediction by 23%

Berkshire also rejected proposals for further climate disclosures, emphasizing that the operating businesses already disclose and manage environmental risks.

The company's earnings seem to have a cyclical pattern, and analysts are currently expecting the bottom line to further decline in the FY 2022 to about US$11.2b, from US$89.8b in FY2021.

Conclusion

Berkshire is engaged in merger arbitrage for the Acquisition of ATVI by Microsoft. Currently, the FTC is expected to declare if it allows the deal, or if it intends to proceed with a lawsuit. Should the FTC try to block the merger, Microsoft has a reasonable chance to fight the lawsuit, however some concessions might be made in the meantime and the value of the premium for shareholders may wane with time - this includes the value of the 9.5% stake from Berkshire.

The stake represents 0.8% of Berkshires market cap, and the overall performance of the company is arguably more important for investors, rather than the acquisition.

The company has just released Q1 earnings, and managed to control risk, and preserve capital in a time when the market is falling by more than 8%. Quarterly results beat bottom line estimates, and investors should look to the fundamentals of the company in order to get a better picture of how Berkshire might perform in the future.

Like most companies, Berkshire Hathaway does come with some risks, and we've found 1 warning sign that you should be aware of.

While Berkshire Hathaway may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives