- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Little Excitement Around Berkshire Hathaway Inc.'s (NYSE:BRK.A) Earnings

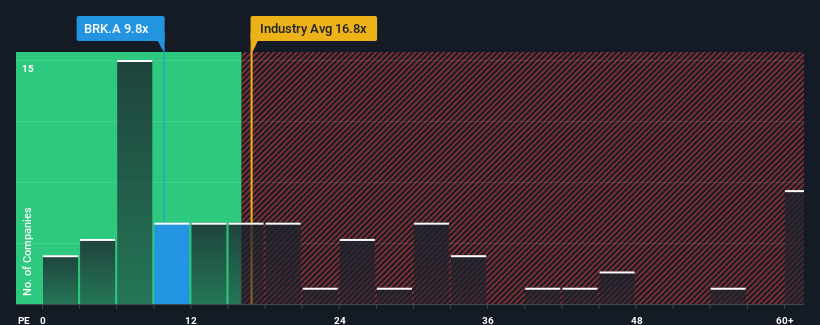

Berkshire Hathaway Inc.'s (NYSE:BRK.A) price-to-earnings (or "P/E") ratio of 9.8x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Berkshire Hathaway as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Berkshire Hathaway

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Berkshire Hathaway's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 41% last year. The latest three year period has also seen an excellent 32% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 24% per annum during the coming three years according to the four analysts following the company. Meanwhile, the broader market is forecast to expand by 11% per annum, which paints a poor picture.

In light of this, it's understandable that Berkshire Hathaway's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Berkshire Hathaway's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Berkshire Hathaway's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Berkshire Hathaway that you need to take into consideration.

Of course, you might also be able to find a better stock than Berkshire Hathaway. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives