- United States

- /

- Diversified Financial

- /

- NYSE:BRK.A

Berkshire Hathaway Inc.'s (NYSE:BRK.A) Low P/E No Reason For Excitement

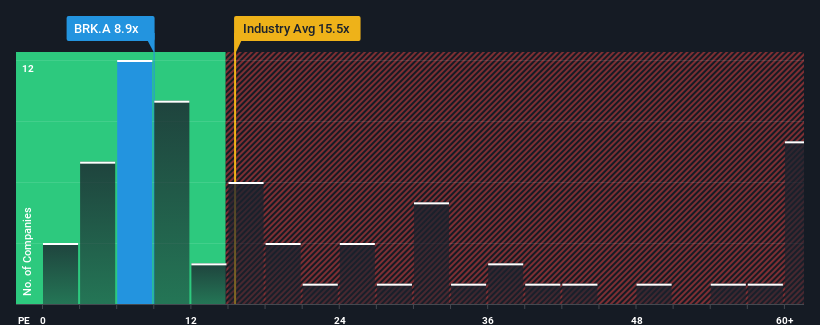

Berkshire Hathaway Inc.'s (NYSE:BRK.A) price-to-earnings (or "P/E") ratio of 8.9x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 18x and even P/E's above 34x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Berkshire Hathaway certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Berkshire Hathaway

How Is Berkshire Hathaway's Growth Trending?

Berkshire Hathaway's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 41% last year. The latest three year period has also seen an excellent 32% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 42% per annum as estimated by the two analysts watching the company. That's not great when the rest of the market is expected to grow by 11% per year.

With this information, we are not surprised that Berkshire Hathaway is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Berkshire Hathaway's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - Berkshire Hathaway has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Berkshire Hathaway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BRK.A

Berkshire Hathaway

Through its subsidiaries, engages in the insurance, freight rail transportation, and utility businesses worldwide.

Undervalued with excellent balance sheet.