- United States

- /

- Capital Markets

- /

- NYSE:BRDG

These Analysts Think Bridge Investment Group Holdings Inc.'s (NYSE:BRDG) Sales Are Under Threat

Market forces rained on the parade of Bridge Investment Group Holdings Inc. (NYSE:BRDG) shareholders today, when the analysts downgraded their forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. The stock price has risen 6.6% to US$9.09 over the past week. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

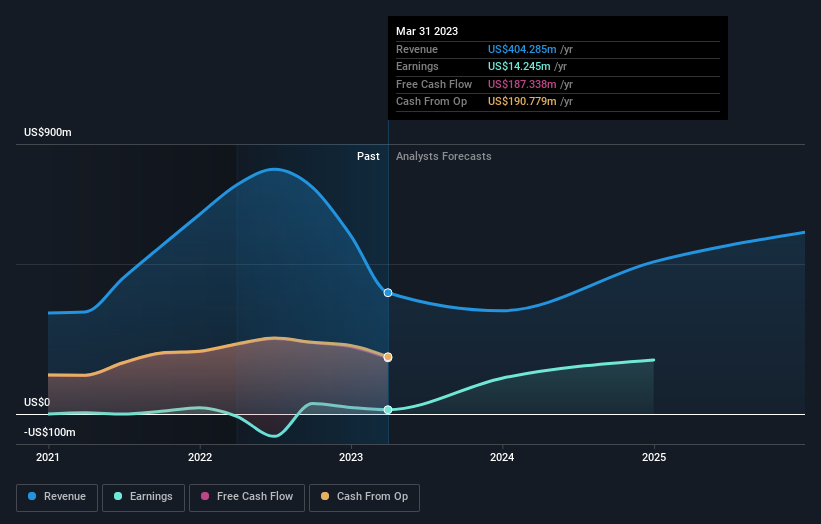

Following the latest downgrade, the four analysts covering Bridge Investment Group Holdings provided consensus estimates of US$344m revenue in 2023, which would reflect an uncomfortable 15% decline on its sales over the past 12 months. Prior to the latest estimates, the analysts were forecasting revenues of US$395m in 2023. It looks like forecasts have become a fair bit less optimistic on Bridge Investment Group Holdings, given the measurable cut to revenue estimates.

Check out our latest analysis for Bridge Investment Group Holdings

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would also point out that the forecast 19% annualised revenue decline to the end of 2023 is better than the historical trend, which saw revenues shrink 47% annually over the past year By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 8.8% per year. So while a broad number of companies are forecast to grow, unfortunately Bridge Investment Group Holdings is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The clear low-light was that analysts slashing their revenue forecasts for Bridge Investment Group Holdings this year. They're also anticipating slower revenue growth than the wider market. Given the stark change in sentiment, we'd understand if investors became more cautious on Bridge Investment Group Holdings after today.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. See why we're concerned about Bridge Investment Group Holdings' balance sheet by visiting our risks dashboard for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

If you're looking to trade Bridge Investment Group Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bridge Investment Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BRDG

Bridge Investment Group Holdings

Bridge Investment Group Holdings Inc is a publicly owned real estate investment manager..

Moderate with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives