- United States

- /

- Capital Markets

- /

- NYSE:BRDG

April 2025's Top Insider-Owned Growth Stocks

Reviewed by Simply Wall St

The United States market has experienced a notable upswing, climbing 7.1% over the last week and showing a 7.7% increase over the past year, with earnings projected to grow by 14% annually. In this context of robust market performance, identifying growth companies with significant insider ownership can be particularly appealing as it often signals confidence in the company's long-term potential and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 25.6% | 29.8% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.2% | 65.1% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Clene (NasdaqCM:CLNN) | 19.4% | 64% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.2% |

| BBB Foods (NYSE:TBBB) | 16.2% | 29.6% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

Let's review some notable picks from our screened stocks.

United States Antimony (NYSEAM:UAMY)

Simply Wall St Growth Rating: ★★★★★☆

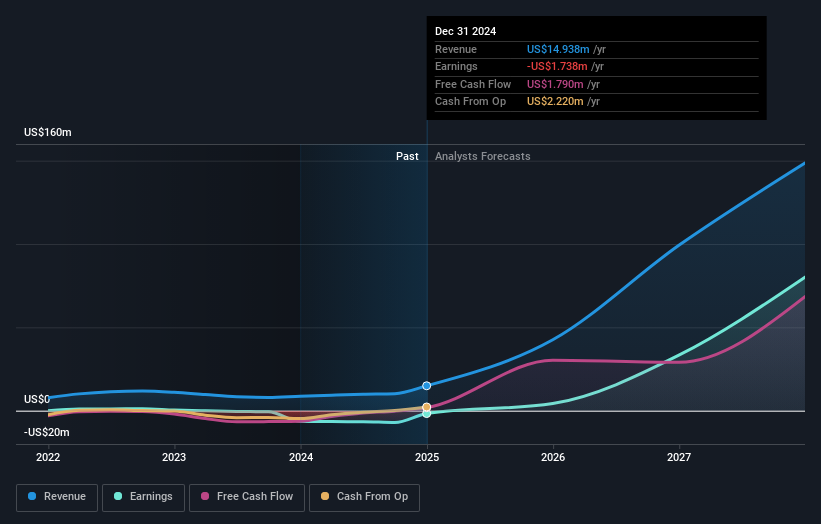

Overview: United States Antimony Corporation engages in the production and sale of antimony, zeolite, and precious metals in the United States and Canada, with a market cap of approximately $389.75 million.

Operations: The company's revenue is primarily derived from the sale of antimony at $12 million and zeolite at $2.94 million.

Insider Ownership: 18.1%

Earnings Growth Forecast: 44.8% p.a.

United States Antimony is poised for substantial growth, with revenue expected to increase by 35.9% annually, outpacing the US market's 8.2%. Despite recent share price volatility, earnings are projected to grow at 44.76% per year and the company is anticipated to achieve profitability within three years. While insider trading activity has been minimal recently, strong leadership presence at multiple investor conferences underscores management's commitment to transparency and strategic communication.

- Dive into the specifics of United States Antimony here with our thorough growth forecast report.

- Our expertly prepared valuation report United States Antimony implies its share price may be too high.

Bridge Investment Group Holdings (NYSE:BRDG)

Simply Wall St Growth Rating: ★★★★☆☆

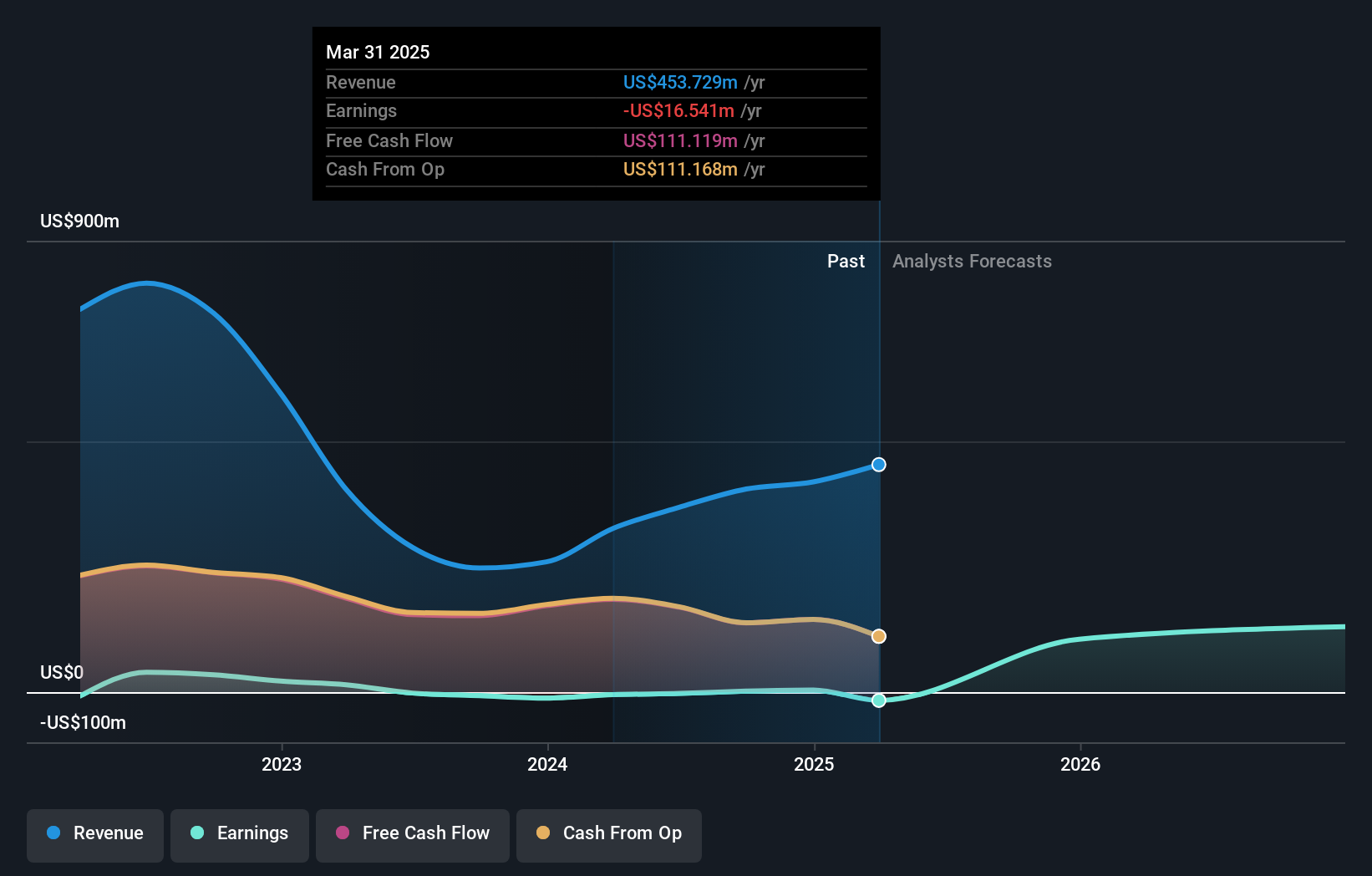

Overview: Bridge Investment Group Holdings Inc is a publicly owned real estate investment manager with a market cap of approximately $1.25 billion.

Operations: Bridge Investment Group Holdings Inc generates revenue of $419.22 million as a fully integrated real estate investment manager.

Insider Ownership: 20.3%

Earnings Growth Forecast: 78.8% p.a.

Bridge Investment Group Holdings is set to be acquired by Apollo Global Management in a US$1.5 billion all-stock deal, with the transaction expected to close in Q3 2025. This acquisition will result in Bridge becoming privately held, retaining its brand and management team under Apollo's asset management division. Despite recent profitability and significant forecasted earnings growth of 78.8% annually, Bridge faces challenges such as high debt levels and slower revenue growth compared to the market.

- Delve into the full analysis future growth report here for a deeper understanding of Bridge Investment Group Holdings.

- The analysis detailed in our Bridge Investment Group Holdings valuation report hints at an inflated share price compared to its estimated value.

Youdao (NYSE:DAO)

Simply Wall St Growth Rating: ★★★★☆☆

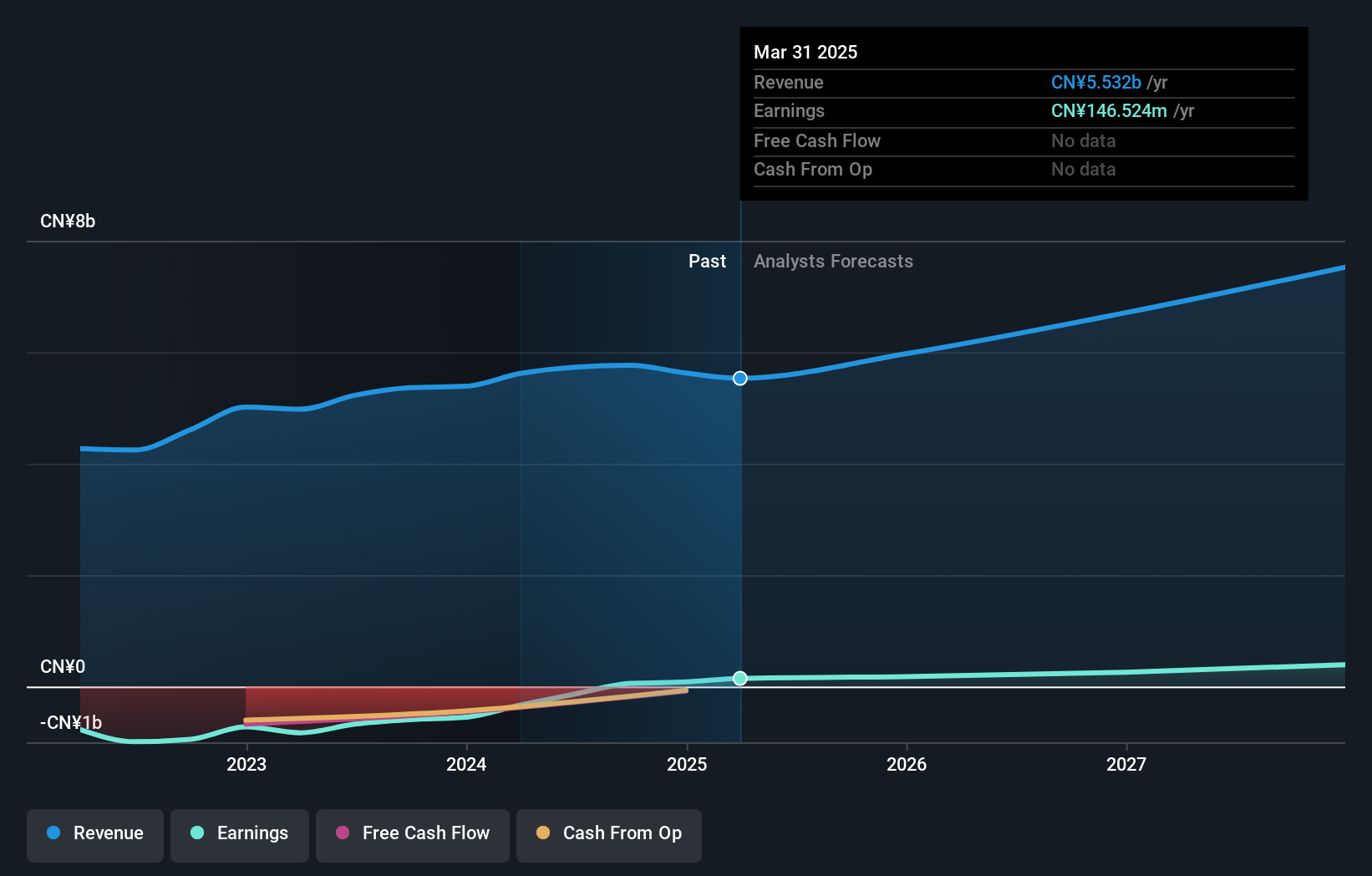

Overview: Youdao, Inc., an internet technology company based in China, offers online services across content, community, communication, and commerce sectors with a market cap of approximately $1.02 billion.

Operations: The company's revenue is primarily derived from three segments: Learning Services (CN¥2.75 billion), Online Marketing Services (CN¥1.97 billion), and Smart Devices (CN¥903.67 million).

Insider Ownership: 20.3%

Earnings Growth Forecast: 45.7% p.a.

Youdao, Inc. recently reported a decline in quarterly revenue to CNY 1.34 billion, yet net income increased to CNY 83 million, reflecting improved profitability. Despite negative shareholders' equity and interest payments not being well covered by earnings, the company is forecasted to experience significant annual profit growth of 45.7%, outpacing the US market average. However, its share price remains highly volatile and revenue growth at 10.8% annually lags behind its profit expansion rate.

- Take a closer look at Youdao's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Youdao is trading beyond its estimated value.

Key Takeaways

- Unlock our comprehensive list of 199 Fast Growing US Companies With High Insider Ownership by clicking here.

- Ready For A Different Approach? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bridge Investment Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRDG

Bridge Investment Group Holdings

Bridge Investment Group Holdings Inc is a publicly owned real estate investment manager..

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives