- United States

- /

- Capital Markets

- /

- NYSE:BLK

BlackRock (NYSE:BLK) Declares Quarterly Dividend of US$5.21 Per Share

Reviewed by Simply Wall St

BlackRock (NYSE:BLK) announced a quarterly cash dividend of $5.21 per share on May 15, 2025. During the past month, the company's share price rose 11%. The confirmation of the dividend could have bolstered investor confidence, reinforcing the stock's upward momentum alongside the broader market gains. Additionally, BlackRock's executive reshuffling and the launch of the iShares S&P 500 3% Capped ETF reflect strategic adaptations amid changing market dynamics. The positive market sentiment driven by the suspension of tariffs and robust U.S. economic indicators likely further contributed to the company's stock performance, aligning with significant market advances.

The recent rise in BlackRock's share price by 11% following the announcement of a US$5.21 per share dividend reflects heightened investor confidence, possibly buoyed by stable dividend offerings and strategic company moves like executive reshuffling and the launch of a new ETF. This optimism aligns with BlackRock's broader strategy of expanding into private markets and alternative investments, which could support longer-term revenue and earnings growth.

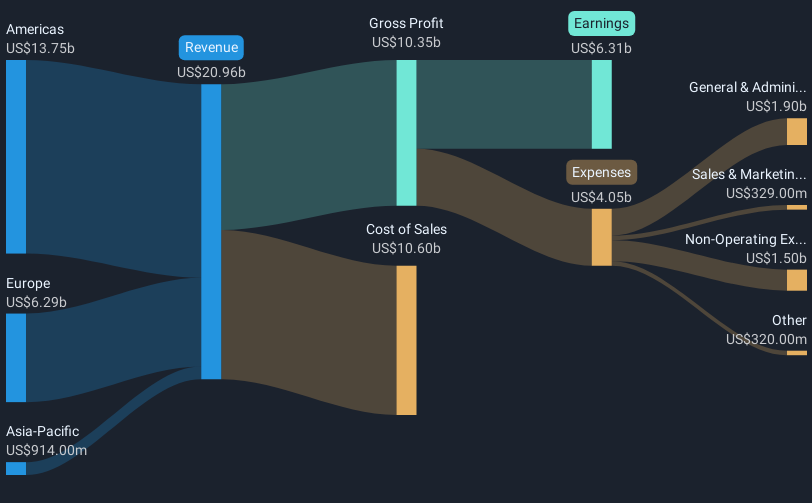

Over the past five years, BlackRock has delivered a total return of 118.58%, showcasing strong long-term performance. However, over the last year, the company's returns lagged behind the Capital Markets industry's 24.6%, suggesting room for improvement. Current revenue of US$20.95 billion and earnings of US$6.31 billion are projected to grow, with future estimations signaling positive market dynamics, yet dependent on BlackRock's execution of its strategic initiatives.

The current share price of US$914.97 remains below the analyst consensus price target of US$1,026.03, indicating potential for further growth if the company continues to meet or exceed market expectations. The dividend announcement and other strategic shifts could positively influence revenue and earnings forecasts as the firm continues its global expansion and focuses on technology enhancements. However, geopolitical tensions and economic uncertainties remain key risk factors to monitor.

Examine BlackRock's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives