- United States

- /

- Capital Markets

- /

- NYSE:BLK

BlackRock (NYSE:BLK) Completes Preqin Acquisition Founder Mark O'Hare Appointed Vice Chair

Reviewed by Simply Wall St

BlackRock (NYSE:BLK) recently completed its acquisition of Preqin, a leader in private markets data, marking a significant enhancement in its capabilities in this sector. The addition of Preqin’s founder, Mark O’Hare, as Vice Chair is expected to enhance the company's operations. Over the past week, BlackRock saw its share price increase by 1.43%, a notable contrast to the broader market, which experienced a 2.5% decline. This upward movement aligns with investor optimism surrounding BlackRock's growth strategies amid the acquisition. Despite the broader market's downturn driven by new U.S. tariffs impacting leading stocks such as Goldman Sachs and Tesla, BlackRock's focused expansion could be seen as a buffer against prevailing market volatility. However, investors should also keep in mind that the company's performance is subject to broader market trends and economic factors that may continue to influence its valuation.

Unlock comprehensive insights into our analysis of BlackRock stock here.

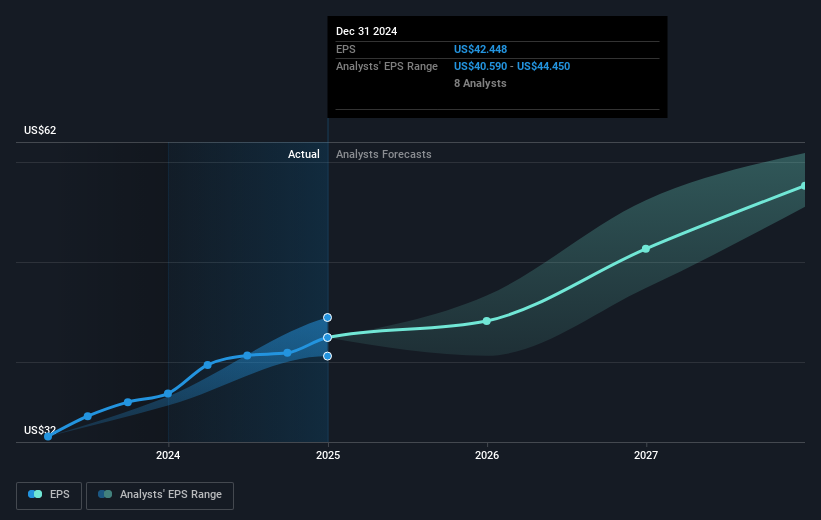

BlackRock has achieved a total shareholder return of 159.37% over the past five years, showcasing sustained growth along with dividend payouts. This return highlights a solid track record, particularly in comparison to the US Capital Markets industry, where BlackRock underperformed over the past year. Several factors likely influenced this performance. The company's revenue increased significantly, from US$17.86 billion in 2023 to US$20.41 billion in 2024, alongside a rise in net income. The recent acquisition and integration of Preqin also potentially strengthened BlackRock’s foothold in the private markets sector.

In terms of corporate actions, BlackRock has continuously returned value to shareholders through buybacks, with recent repurchases of 375,391 shares amounting to US$350.62 million in the last quarter of 2024. Additionally, consistent dividend increases, including a 2% rise in early 2025, further solidify its commitment to enhancing shareholder returns. Meanwhile, executive changes and product innovations reflect a focus on adapting to industry demands and opportunities in the alternatives market.

- Unlock the insights behind BlackRock's valuation and discover its true investment potential

- Gain insight into the risks facing BlackRock and how they might influence its performance—click here to read more.

- Are you invested in BlackRock already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLK

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives