- United States

- /

- Capital Markets

- /

- NYSE:BK

BNY Mellon’s 19 Percent Dividend Hike and Payments Overhaul Might Change the Case for Investing in BK

Reviewed by Sasha Jovanovic

- In recent days, The Bank of New York Mellon Corporation announced a 19% increase in its annualized dividend amid analyst optimism for strong upcoming quarterly earnings, with the next earnings report scheduled for October 16, 2025. This move, alongside growing interest in blockchain innovation and tokenized deposits, highlights the company's efforts to modernize its payments infrastructure and meet evolving client needs.

- Investor sentiment has been further supported by the company’s track record of beating earnings estimates, as well as expectations for robust year-over-year earnings growth, positioning BNY Mellon as an appealing dividend player within the financial sector.

- We'll explore how BNY Mellon's substantial dividend increase and payments modernization efforts may influence its investment narrative and future outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Bank of New York Mellon Investment Narrative Recap

To be a shareholder in Bank of New York Mellon, you likely believe in its ability to modernize global payments infrastructure and deliver steady shareholder returns through both innovation and prudent capital management. The recent dividend increase signals confidence in earnings and cost controls, but the key short-term catalyst remains the upcoming quarterly results. While enthusiasm around the dividend and blockchain efforts is high, the biggest risk is still structural fee pressure and the sustainability of recent earnings momentum, which this news event does not materially change.

Of the recent announcements, BNY Mellon's blockchain initiatives, including tokenized deposits, stand out as highly relevant. These efforts are directly connected to the firm’s pursuit of futureproofing its core custody and settlement business, a crucial catalyst as financial institutions race to meet digital client demands and defend market share during tech-driven industry shifts. Blockchain innovation could help diversify revenue streams and counteract the threat of shrinking fee income.

However, investors should also be aware that, despite blockchain advances, persistent industry fee compression and structural outflows remain...

Read the full narrative on Bank of New York Mellon (it's free!)

Bank of New York Mellon's narrative projects $21.3 billion revenue and $5.8 billion earnings by 2028. This requires 3.4% yearly revenue growth and a $1.0 billion earnings increase from $4.8 billion.

Uncover how Bank of New York Mellon's forecasts yield a $113.23 fair value, a 8% upside to its current price.

Exploring Other Perspectives

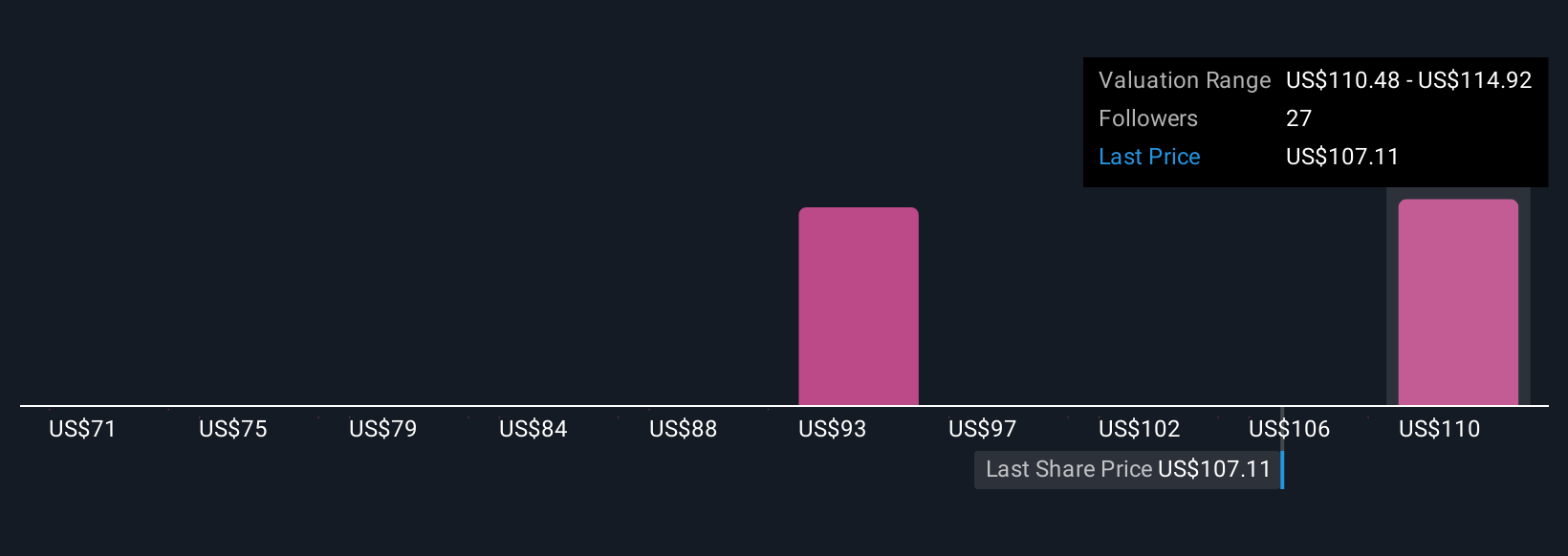

Fair value estimates for BNY Mellon from the Simply Wall St Community range from US$70.50 to US$114.92 across five unique perspectives. While many believe digital platform investments position the company for future growth, you should consider both the optimism and caution reflected in these diverse viewpoints.

Explore 5 other fair value estimates on Bank of New York Mellon - why the stock might be worth 33% less than the current price!

Build Your Own Bank of New York Mellon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bank of New York Mellon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of New York Mellon's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives