- United States

- /

- Capital Markets

- /

- NYSE:BK

A Look at BNY Mellon's Valuation Following Digital Asset and Blockchain Expansion

Reviewed by Kshitija Bhandaru

Bank of New York Mellon (NYSE:BK) is making headlines after announcing a pilot program for tokenized deposits and stepping in as Ripple USD’s primary custodian. Both initiatives are aimed at advancing its digital asset infrastructure.

See our latest analysis for Bank of New York Mellon.

The bank’s latest foray into blockchain arrives just as U.S. financials rally ahead of a busy earnings season. Bank of New York Mellon's share price is up 37% year-to-date, with a remarkable 42% total return over the past year. Longer-term holders have seen momentum build, with total shareholder returns exceeding 188% across three years as the stock rides both sector optimism and BNY’s push for digital innovation.

If you're curious where to find the next growth story in financials or beyond, expand your search and discover fast growing stocks with high insider ownership.

With shares up strongly and recent innovation headlines drawing fresh attention, the real question is whether Bank of New York Mellon remains undervalued or if the market has already factored in its future growth prospects. Could this be a smart entry point for investors?

Most Popular Narrative: 6% Undervalued

Bank of New York Mellon's widely-followed narrative sets a fair value above the last close of $106.30, reflecting optimism around its digital transformation and future efficiency gains. Analyst expectations are converging around continuous earnings growth, drawing attention to key catalysts on the horizon.

Accelerated investment in digital platforms (including digital asset custody, AI integration, and the NEXEN ecosystem), coupled with strong early adoption, positions BNY Mellon for improved operating leverage and net margin expansion over the coming years, as scalable technology reduces costs and increases cross-selling opportunities.

Just how ambitious are these projections? The narrative hints at bold assumptions on growth, future margins, and valuation multiples. These details could surprise even seasoned investors. Unpack what’s really fueling that upside target and see which numbers are driving this view.

Result: Fair Value of $113.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, BNY Mellon's growth narrative faces real headwinds if client outflows persist or if digital platform efficiencies take longer than expected to materialize.

Find out about the key risks to this Bank of New York Mellon narrative.

Another View: DCF Model Adds Context

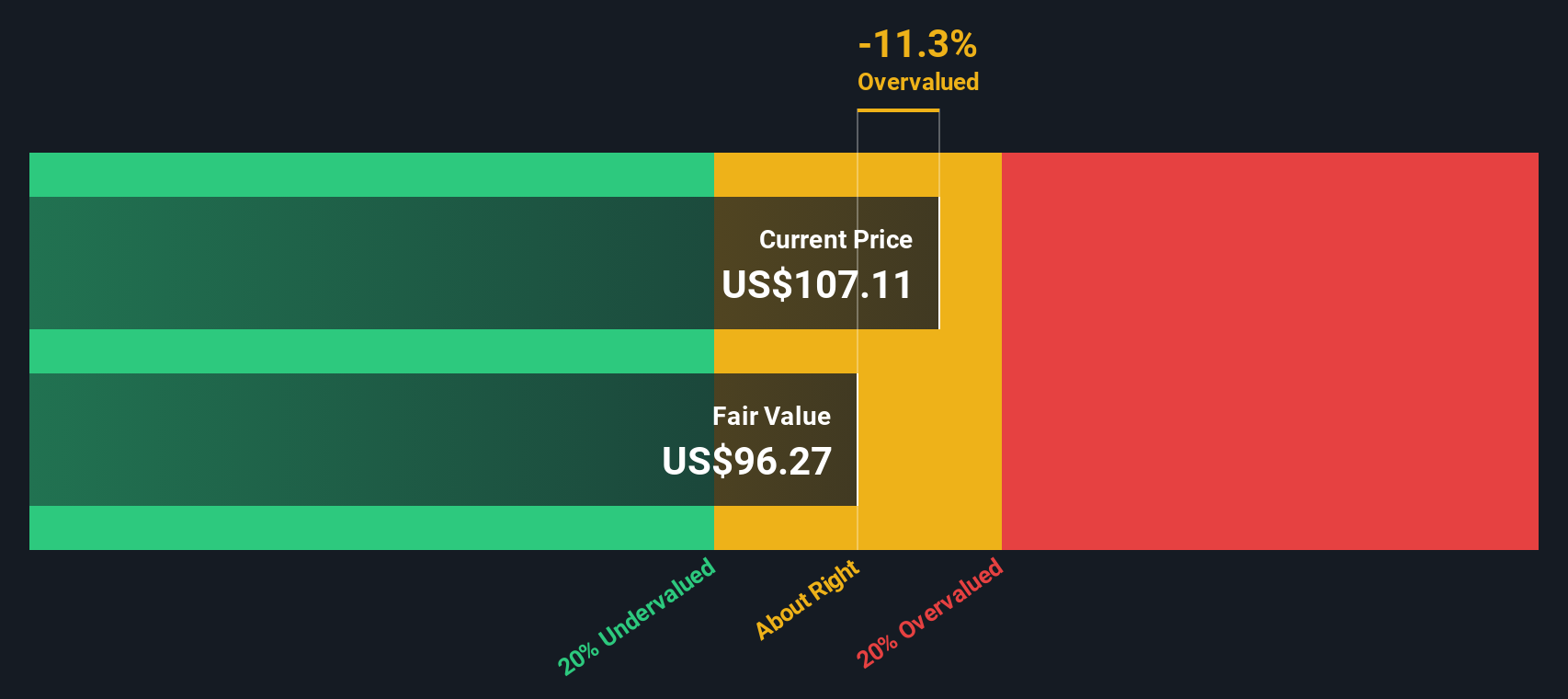

While many analysts eye multiples, our DCF model takes a different approach by projecting Bank of New York Mellon's future cash flows instead of focusing only on current earnings. The result is that the SWS DCF model estimates a fair value below the latest close, suggesting the shares may not be as undervalued as some believe. Does this challenge the bullish narrative or does it highlight the gap between long-term forecasts and market enthusiasm?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of New York Mellon for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of New York Mellon Narrative

If you have your own perspective or want a hands-on approach, dive into the data and shape your own story in just a few minutes. Do it your way.

A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your investment horizon and seize timely opportunities across other fast-moving markets. Don't let the next big winner pass you by. Move with confidence toward your financial goals.

- Unlock dividend income potential as you tap into these 18 dividend stocks with yields > 3% featuring stocks with robust yields and sustainable payouts.

- Ride the AI trend by evaluating these 25 AI penny stocks, where rapidly growing companies are shaping tomorrow’s tech landscape.

- Capitalize on discounted opportunities with these 893 undervalued stocks based on cash flows to pinpoint stocks trading below intrinsic value before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BK

Bank of New York Mellon

Provides a range of financial products and services in the United States and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives