- United States

- /

- Capital Markets

- /

- NYSE:BBDC

Barings BDC (NYSE:BBDC) Has Returned Negative 27% To Its Shareholders In The Past Five Years

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Barings BDC, Inc. (NYSE:BBDC) shareholders for doubting their decision to hold, with the stock down 57% over a half decade. Unhappily, the share price slid 2.4% in the last week.

View our latest analysis for Barings BDC

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

We know that Barings BDC has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

We note that the dividend has fallen in the last five years, so that may have contributed to the share price decline. On top of that, revenue has declined by 11% per year over the half decade; that could be a red flag for some investors.

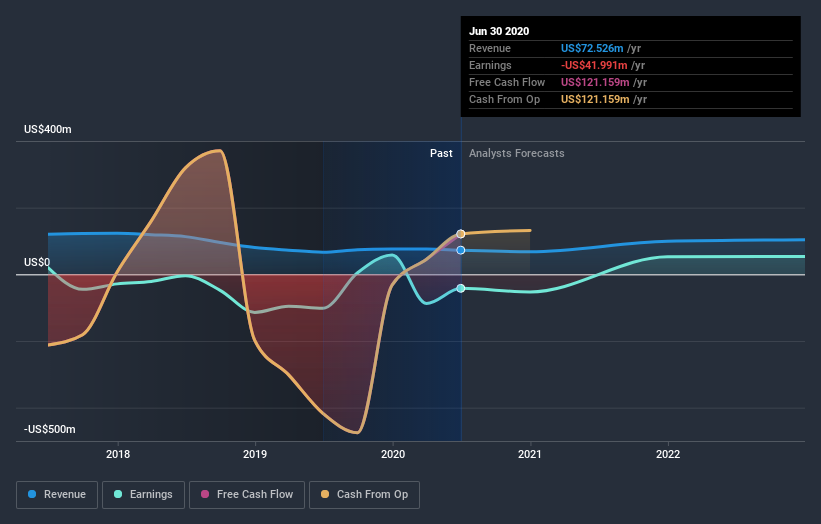

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Barings BDC

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Barings BDC the TSR over the last 5 years was -27%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in Barings BDC had a tough year, with a total loss of 13% (including dividends), against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4.9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Barings BDC (1 is significant!) that you should be aware of before investing here.

Barings BDC is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade Barings BDC, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Barings BDC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:BBDC

Barings BDC

A publicly traded, externally managed investment company that has elected to be treated as a business development company under the Investment Company Act of 1940.

Fair value low.

Similar Companies

Market Insights

Community Narratives