- United States

- /

- Consumer Finance

- /

- NYSE:AXP

Exploring American Express (AXP) Valuation After Its Recent Uptick in Investor Attention

Reviewed by Simply Wall St

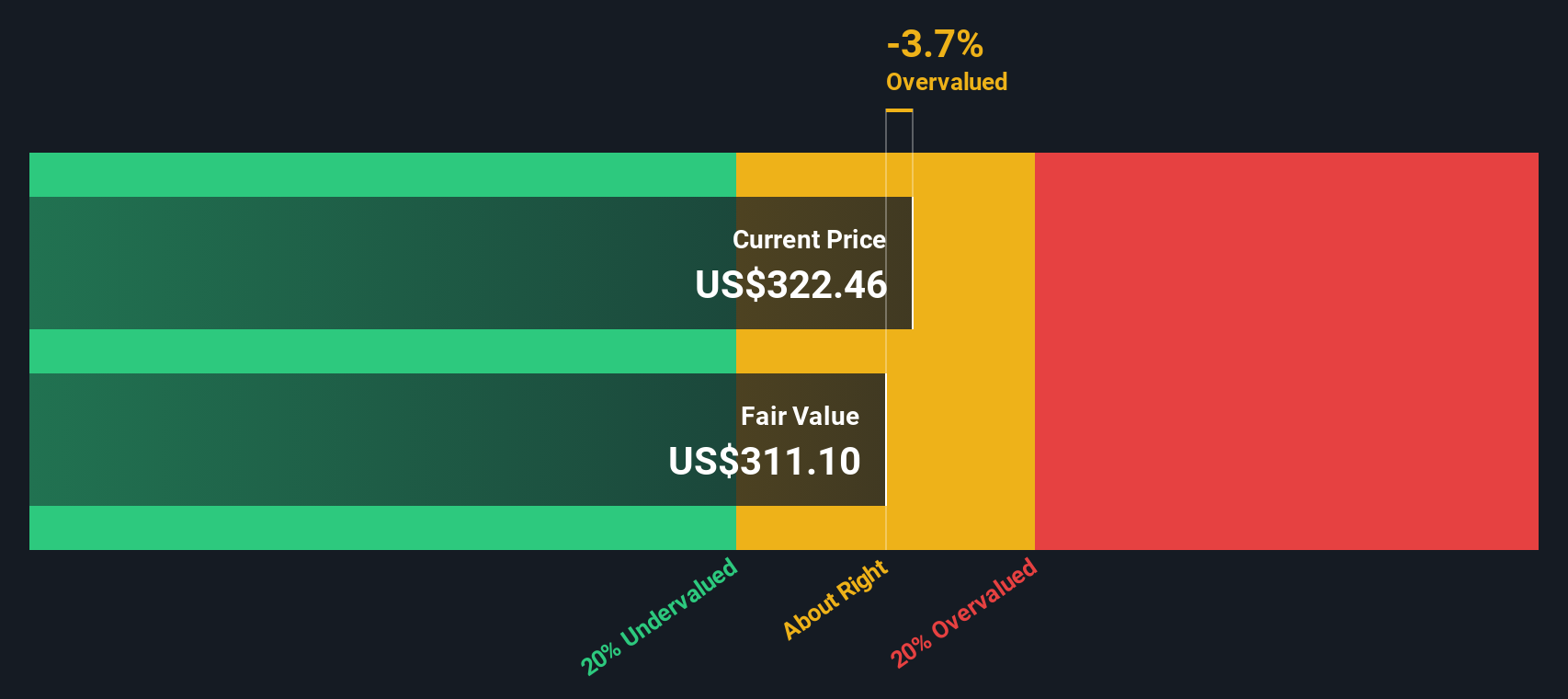

Most Popular Narrative: 4.9% Overvalued

According to the most widely discussed narrative, American Express is currently trading above its estimated fair value, placing it in the "overvalued" category by a modest margin. The narrative weighs key company initiatives and future projections to arrive at this conclusion.

Continuous enhancements to the Membership Model are fueling the earnings power of the core business and reinforcing confidence in delivering strong bottom-line growth. New Card Acquisitions: American Express has been driving strong new card acquisitions, with 3.3 million new cards in Q2 2024 and 3.4 million in Q1 2024.

Want to peek under the hood of this premium valuation? The numbers behind this narrative involve aggressive growth forecasts and ambitious profitability targets. Full details unveil the bold assumptions that support this fair value, including customer additions, product refreshes, and more. Ready to see what sets these projections apart from the status quo?

Result: Fair Value of $308.19 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges in international operations and unexpected regulatory actions could weaken the company’s growth story and lead to a market reassessment.

Find out about the key risks to this American Express narrative.Another View: SWS DCF Model Challenges the Premium

While many see American Express as overvalued, our DCF model suggests the shares trade above a calculated fair value. This challenges the premium the market is willing to pay. Which approach might have the sharper insight?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own American Express Narrative

Curious to see things from your own perspective or believe there’s more beneath the surface? You can examine the facts and shape your unique take in just a few minutes. Do it your way.

A great starting point for your American Express research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment opportunities?

Do not let promising stocks slip through your fingers. Open up your investment universe to sectors and ideas you might be overlooking with these targeted screeners.

- Start hunting for high-potential candidates by focusing on fast-growing, overlooked companies. Tap into penny stocks with strong financials for those making waves with strong fundamentals.

- Get ahead of the AI boom by zeroing in on innovative firms reshaping the healthcare landscape. Leverage healthcare AI stocks to see which names are transforming patient care.

- Take control of your search for value with a screener that highlights undervalued businesses based on real cash flows. Use undervalued stocks based on cash flows to stay ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives