- United States

- /

- Consumer Finance

- /

- NYSE:AXP

Assessing American Express (AXP) Valuation After a Strong 12-Month Share Price Run

Reviewed by Kshitija Bhandaru

American Express (AXP) shares edged higher today, continuing a strong run this year as the stock is up 24% over the past 12 months. Investors are watching closely to see if its recent momentum will sustain.

See our latest analysis for American Express.

This year’s momentum for American Express has been impressive, with investors attracted by consistent business growth and a current share price of $330.48. While returns have been especially strong over the past year, with the 1-year total shareholder return sitting at nearly 24%, the long-term picture is just as compelling, marked by steady gains and renewed optimism around the stock.

If you're weighing your next move after American Express's run, this could be an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With American Express trading just above analyst targets and posting steady fundamentals, investors are left to wonder if upside potential remains or if the market is already factoring in all of its future growth.

Most Popular Narrative: 2.6% Overvalued

Despite the buzz around American Express, the narrative consensus puts its fair value slightly below the current market price. This raises questions about the stock’s upward potential at these levels.

The company's ongoing focus on premium cardmembers and product refreshes, especially the upcoming U.S. Platinum Card relaunch, positions American Express to benefit from consumers' growing demand for personalized experiences and value-added rewards. This trend is likely to boost net card fee growth and retention, which supports long-term revenue and fee income expansion.

Think you know why some analysts still see room for growth, even as the stock trades above consensus targets? There is a critical set of underlying assumptions about who is spending, what they are buying, and where profits go from here. Only in the full narrative do these numbers come to light. See what drives the case for the current price—it may be bolder than you expect.

Result: Fair Value of $322.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from other premium card issuers and shifting consumer payment preferences could present challenges to American Express's optimistic growth outlook.

Find out about the key risks to this American Express narrative.

Another View: What Do the Multiples Say?

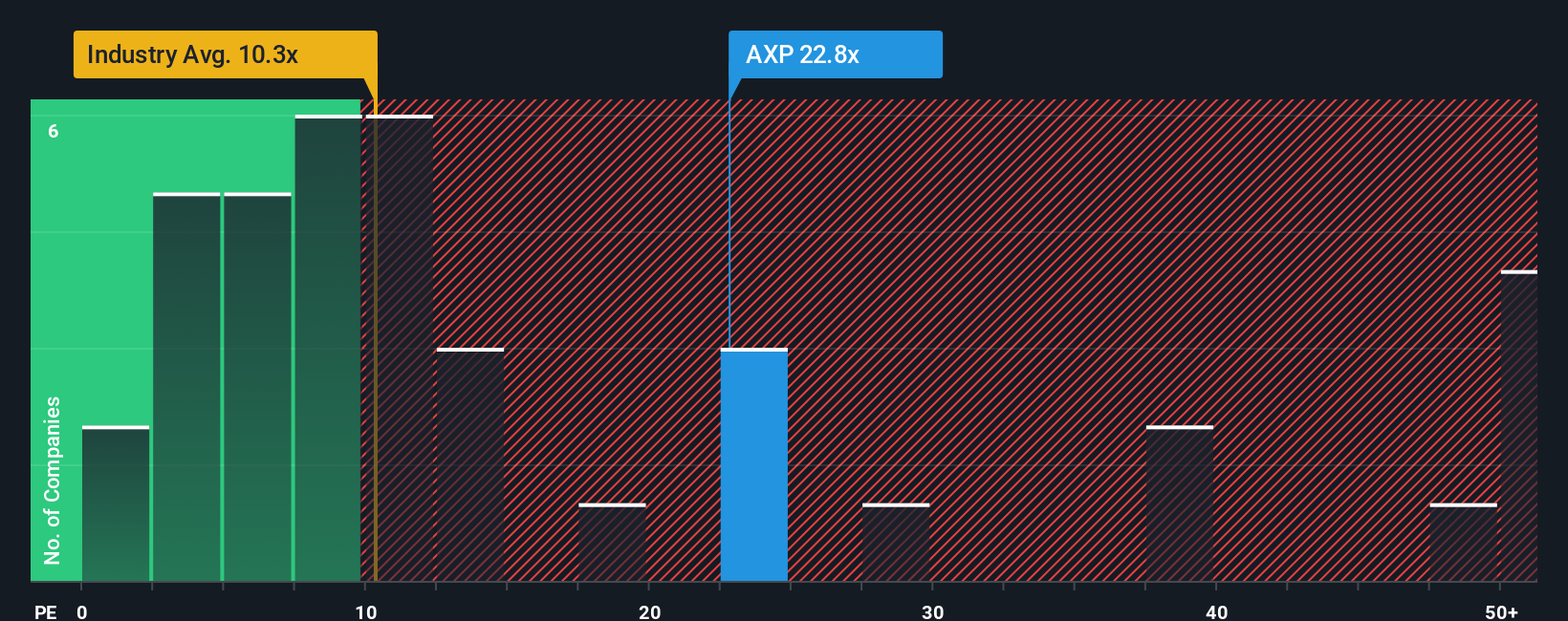

Taking a different perspective, American Express’s current price-to-earnings ratio is 23x. This figure is much higher than the US Consumer Finance industry average of 10.1x and also above its fair ratio of 21.3x. This premium suggests the market is already pricing in strong future growth, increasing the risk if results fall short. Could the optimism be overdone, or is there more upside to come?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Express Narrative

If the narrative above doesn't quite fit your view or you want to analyze the figures for yourself, you can create your own perspective in just a few minutes: Do it your way

A great starting point for your American Express research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means acting early. Don’t limit your portfolio to just one winner when other opportunities are taking shape right now.

- Boost your income potential by tapping into these 19 dividend stocks with yields > 3% that offer attractive yields above 3% and solid fundamentals for stability.

- Catalyze your strategy and track industry-disrupting innovation by checking out these 23 AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Capture hidden bargains before the crowd by evaluating these 914 undervalued stocks based on cash flows identified as strong picks based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives