- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (AXP) Earnings Growth Slows, Challenging Bull Case for Profit Momentum

Reviewed by Simply Wall St

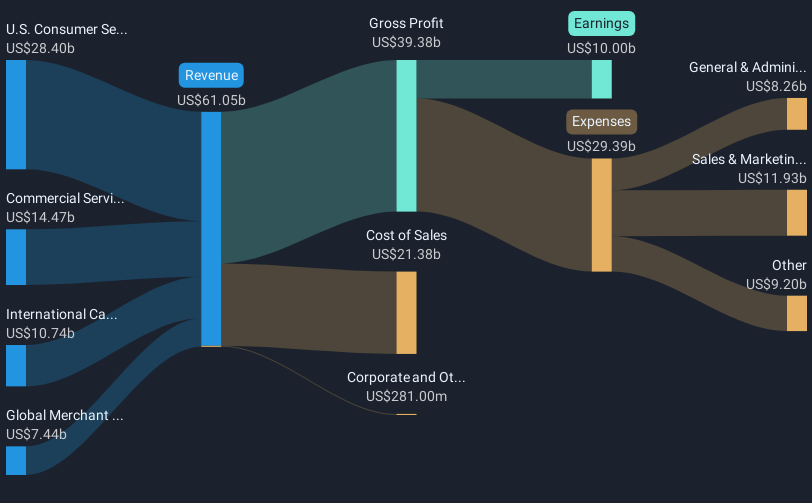

American Express (AXP) posted earnings growth of 3.2% for the latest year, a slowdown from its five-year average of 16.4% annually. Net profit margins dipped to 15.8%, down from 16.7% the prior year, and the company’s expected revenue growth of 9.2% per year lags behind the broader US market’s 10.1% forecast. With steady profit and revenue growth forecasts remaining in place, investors now face a moderation in momentum and margins as the company trades at a Price-to-Earnings Ratio of 24.1x, above its industry average but below its peers.

See our full analysis for American Express.Next, we will see how these results stack up against the most widely discussed narratives and expectations among investors, and where the latest figures might shift the story.

See what the community is saying about American Express

Premium Card Fees Surge Despite Slower Growth

- Net card fee growth jumped 20% this year, even as overall revenue growth slowed to 9.2% annually, underlining the strength of American Express’s premium offerings beyond just top-line expansion.

- Bullish investors argue this premium segment momentum, fueled by ongoing card refreshes and higher-value benefits, reinforces long-term earnings durability despite moderation in profit growth.

- Sustained acquisition of Millennial and Gen Z customers, who prefer travel and experience rewards, helps drive up card fee revenue and supports higher future margins.

- Ongoing tech investments, including AI-driven analytics, are credited for boosting retention and operational efficiency, which could widen net margins above current levels if successful.

Rising Rewards Expenses Pressure Margins

- Annual rewards expenses increased by 16%, outpacing revenue growth and contributing to the decline in net profit margins from 16.7% to 15.8%, which underscores the impact of attracting and retaining premium customers.

- Bears highlight that heightened rewards spending and macro headwinds could weigh on profitability and make it tougher to deliver upside for shareholders.

- Elevated customer acquisition costs, essential for premium card retention, drive structurally higher expenses that may compress net margins if not offset by further revenue acceleration.

- Potential pullback in Millennial and Gen Z spending or broader economic pressure could make it harder for American Express to sustain current revenue and earnings growth rates.

Valuation Trapped Between Peers and DCF Estimate

- American Express currently trades at 24.1x earnings, in the middle ground between a much higher peer average of 29.7x and a much lower industry average of 9.8x, with market price ($346.62) sitting 10.7% above its DCF fair value of $313.26 but just 2.4% above the consensus analyst target ($338.24).

- Analysts' consensus narrative notes that despite robust card fee growth and international expansion, American Express appears fairly valued on average, making strong future outperformance less certain.

- The small gap between the current share price and consensus target means the market may already be pricing in most near-term positives, leaving less margin for error in execution or sustained premium segment performance.

- Dependence on mature US market growth and increasing competition from digital-first players may cap multiple expansion absent further upside in core profitability metrics.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for American Express on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your angle and build a narrative in just a few minutes by using Do it your way

A great starting point for your American Express research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite robust card fee growth, American Express faces margin pressure as rising rewards expenses and intense competition could cap future profitability and expansion.

If you want steadier, more reliable earnings growth, focus your search on companies consistently delivering through all cycles by using stable growth stocks screener (2084 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives