- United States

- /

- Consumer Finance

- /

- NYSE:AXP

American Express (AXP) Declares US$9 Dividend on Preferred Shares for September Payout

Reviewed by Simply Wall St

American Express (AXP) announced a significant dividend declaration recently, reflecting its ongoing financial stability and commitment to shareholders. Over the last quarter, the company's stock price increased by 17%, a notable move largely in line with the broader market's upward trend on trade deal optimism and record highs in major indices. The company's reaffirmed earnings guidance and product enhancements likely bolstered investor sentiment. However, the dip in Q2 earnings from the previous year and a slightly weaker net income may have applied some counterweight to this positive momentum. Overall, AXP mirrored broader market movements, supported by key corporate actions.

Find companies with promising cash flow potential yet trading below their fair value.

The recent dividend declaration by American Express underscores its financial stability and dedication to shareholder value, a positive signal amidst the company's strategic challenges. While Q2 earnings showed a decline from the previous year, the robust dividend could indicate management's confidence in maintaining a resilient revenue stream. In the context of the company's long-term performance, American Express has delivered a total return of 243.20% over five years. This notable growth surpasses the recent one-year performance, where it underperformed the US Consumer Finance industry, which returned 29.1% over the same period.

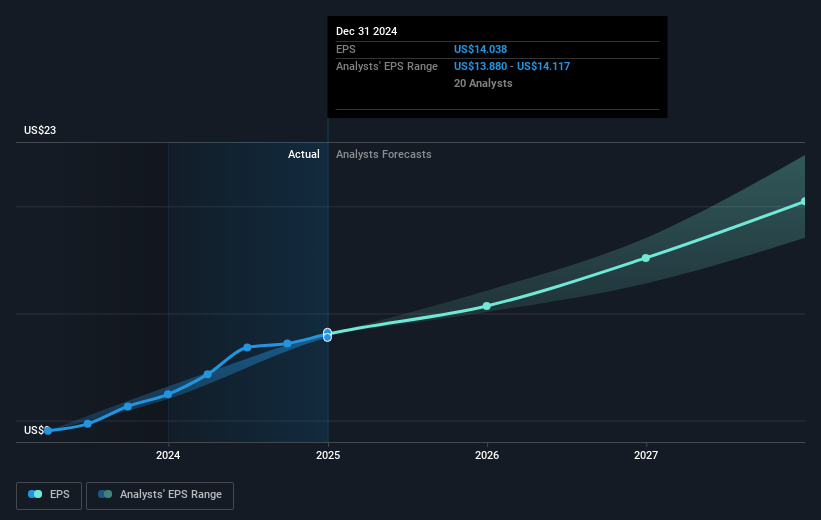

The company's recent dividend announcement and share price increase may affect revenue and earnings forecasts positively by reinforcing investor confidence. However, cautious consideration is warranted given the potential pressures from decelerated spending in key segments such as airline and entertainment. The current share price of US$304.14, approaching the consensus analyst price target of US$318.67, situates the stock close to anticipated valuation levels. This stability could reflect confidence in meeting revenue growth projections, anticipated at 9.2% per year, despite lingering macroeconomic uncertainties and potential spending contractions among small businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXP

American Express

Operates as integrated payments company in the United States, Europe, the Middle East and Africa, the Asia Pacific, Australia, New Zealand, Latin America, Canada, the Caribbean, and Internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives