- United States

- /

- Mortgage REITs

- /

- NYSE:ARR

ARMOUR Residential REIT (NYSE:ARR) Records 14% Share Price Decline Over Past Week

Reviewed by Simply Wall St

ARMOUR Residential REIT (NYSE:ARR) confirmed the monthly cash dividend rate for its Series C Preferred Stock and provided guidance on its April 2025 cash dividend for Common Stock, demonstrating a commitment to maintaining consistent shareholder returns. Despite these affirmations, the company's share price declined by 14% over the past week, aligning with broader market turbulence, as major indexes experienced significant volatility due to recent economic and political uncertainties. The outlined dividend schedule provided shareholder assurance but may have been insufficient to counteract the prevailing negative sentiment impacting the overall market.

We've spotted 2 weaknesses for ARMOUR Residential REIT you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

ARMOUR Residential REIT's (NYSE:ARR) total return, including share price and dividends, decreased by 12.45% over the past year. This underperformance contrasts with the broader US market, which saw a 4.7% increase during the same period. Additionally, the company lagged behind the US Mortgage REITs industry, which experienced a 7.5% decline. This comparative analysis highlights ARR's challenges in maintaining competitive performance amid broader economic and market conditions.

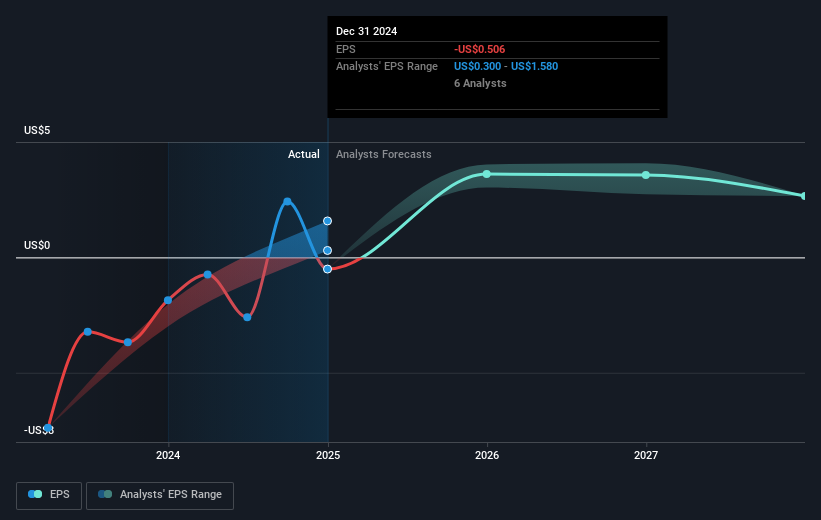

The announced dividend affirmations and future guidance reflect efforts to sustain shareholder returns; however, they have not shielded the company from market volatility, which contributed to its share price decline. Current revenue forecasts predict a growth of 70.9% per year, signaling potential improvements despite recent setbacks in share value. Analysts' consensus price target suggests a 41.3% potential upside, indicating confidence in the stock's recovery prospects. Nevertheless, the price target, while optimistic, remains subject to broader economic influences and the company's ongoing financial performance.

Assess ARMOUR Residential REIT's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARR

ARMOUR Residential REIT

Invests in residential mortgage-backed securities (MBS) in the United States.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives