- United States

- /

- Capital Markets

- /

- NYSE:ARES

Will Ares Management's (ARES) Retail Push Redefine Its Investor Base and Long-Term Strategy?

Reviewed by Sasha Jovanovic

- In recent days, Ares Management announced it is raising its 2028 fundraising and assets under management targets and developing new investment products for individuals, following regulatory changes that allow broader retail access to private markets.

- This expansion into the retail investor market, underscored by Ares’ acquisition of a significant minority stake in EP Wealth Advisors, highlights the company's intent to diversify its investor base and strengthen its wealth management capabilities.

- We’ll examine how the push into retail investor products could reshape Ares Management’s investment narrative and long-term growth outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Ares Management Investment Narrative Recap

Investing in Ares Management comes down to believing the company can outpace competition and protect fee margins while capitalizing on its push into retail wealth products and fresh growth in alternative asset classes. The latest move to raise fundraising and AUM targets is encouraging for long-term fee earnings, but in the short-term, the biggest catalyst remains management's execution on growing the retail investor base, while the main risk continues to be fee pressure from rising competition. The impact of recent news strengthens the growth narrative but does not materially change the risk from potential fee compression.

Ares' acquisition of a minority stake in EP Wealth Advisors is the most relevant announcement to the retail-focused expansion, positioning Ares to offer a broader suite of private market products to both institutional and retail clients. This deepening wealth channel helps address the near-term opportunity in democratized alternatives, which is central to both growth catalysts and future revenue stability.

On the flip side, investors should keep in mind how fee competition is intensifying among alternative asset managers, which could threaten...

Read the full narrative on Ares Management (it's free!)

Ares Management's narrative projects $7.1 billion revenue and $2.2 billion earnings by 2028. This requires 13.7% yearly revenue growth and an earnings increase of $1.83 billion from current earnings of $369.5 million.

Uncover how Ares Management's forecasts yield a $191.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

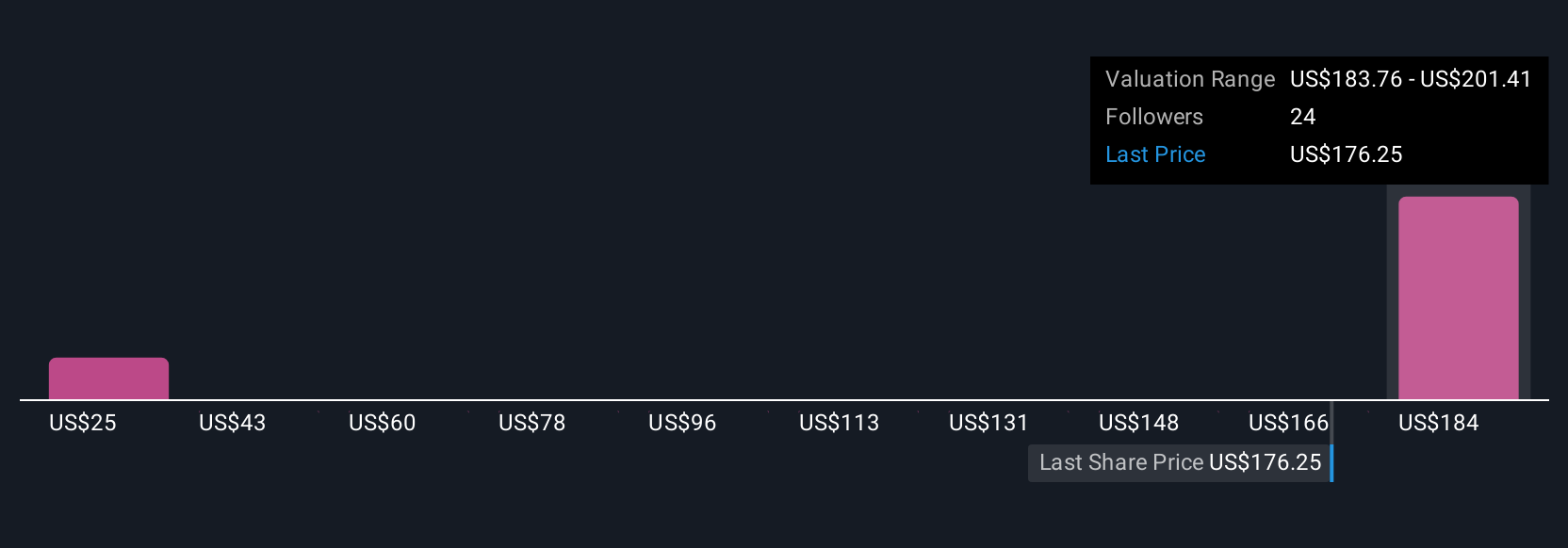

Simply Wall St Community forecasts for Ares Management’s fair value range from US$24.45 to US$201.41, reflecting just three contrasting opinions. Margins and future revenues could be influenced by industry-wide fee pressure, so take some time to compare these views.

Explore 3 other fair value estimates on Ares Management - why the stock might be worth less than half the current price!

Build Your Own Ares Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ares Management research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ares Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ares Management's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives