- United States

- /

- Capital Markets

- /

- NYSE:ARES

Will Anup Agarwal’s Appointment Shift Ares Management's (ARES) Insurance Asset Management Growth Narrative?

Reviewed by Simply Wall St

- In September 2025, Ares Management Corporation announced that Anup Agarwal joined as Partner and Head and Chief Investment Officer of Ares Insurance Solutions, bringing over 25 years of investment leadership and experience managing large insurance portfolios.

- This leadership change is set to impact Ares' insurance asset management capabilities, with Agarwal expected to play a central role in growing third-party insurance asset management and origination alongside newly appointed and transitioning executives.

- With Agarwal's extensive expertise in insurance asset management, we’ll explore how this addition could influence Ares’ long-term growth narrative and earnings outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Ares Management Investment Narrative Recap

To believe in Ares Management, you need confidence that institutional and retail demand for alternatives will continue to accelerate fee-based revenue growth, even with mounting competition and evolving regulation. The appointment of Anup Agarwal as Partner and Chief Investment Officer of Ares Insurance Solutions introduces seasoned insurance asset management expertise, but does not materially impact the immediate risk of fee pressure and margin compression, which remains the most significant short-term concern for shareholders today.

Among recent announcements, the July 2025 launch of Ares' Core Infrastructure Fund in Australia speaks to Ares’ continued focus on expanding asset classes and international fundraising. This wider reach aligns directly with the firm's stated catalyst of attracting new capital, deepening global partnerships, and growing perpetually-funded strategies, all of which are crucial in offsetting the risk of fluctuating retail sentiment and cyclical redemptions.

Yet, against Ares' global expansion efforts, investors should also be mindful of the potential for growing fee pressure in the asset management industry...

Read the full narrative on Ares Management (it's free!)

Ares Management's outlook foresees $7.1 billion in revenue and $2.2 billion in earnings by 2028. This scenario assumes 13.7% annual revenue growth and a $1.8 billion increase in earnings from the current $369.5 million.

Uncover how Ares Management's forecasts yield a $193.69 fair value, a 9% upside to its current price.

Exploring Other Perspectives

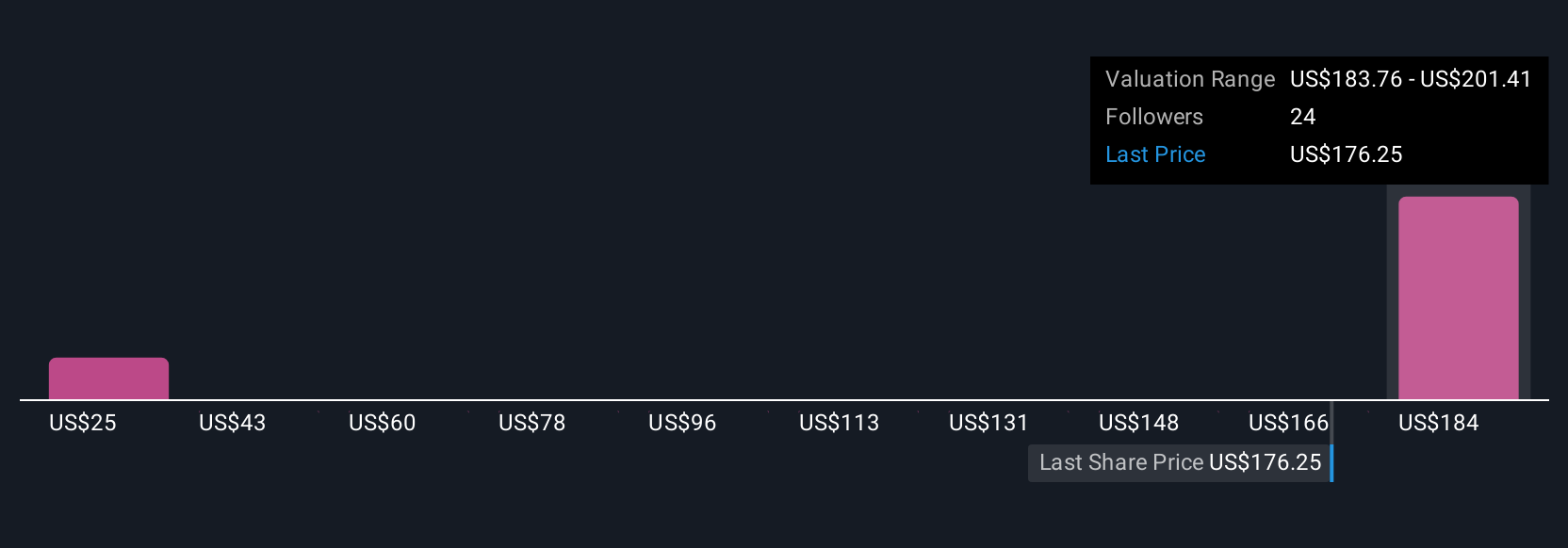

Simply Wall St Community members supplied three fair value estimates for Ares ranging from just US$24.94 to US$201.41 per share. As you compare these mixed opinions, remember that rising competition and possible fee reductions could weigh on future margins, inviting a variety of perspectives about where Ares' performance is heading.

Explore 3 other fair value estimates on Ares Management - why the stock might be worth as much as 14% more than the current price!

Build Your Own Ares Management Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ares Management research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Ares Management research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ares Management's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ARES

Ares Management

Operates as an alternative asset manager in the United States, Europe, and Asia.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives