- United States

- /

- Diversified Financial

- /

- NYSE:APO

Apollo Global Management (NYSE:APO) Taps Shimpei Kanzaki as Head of Japan Global Wealth Amid 11% Price Dip

Reviewed by Simply Wall St

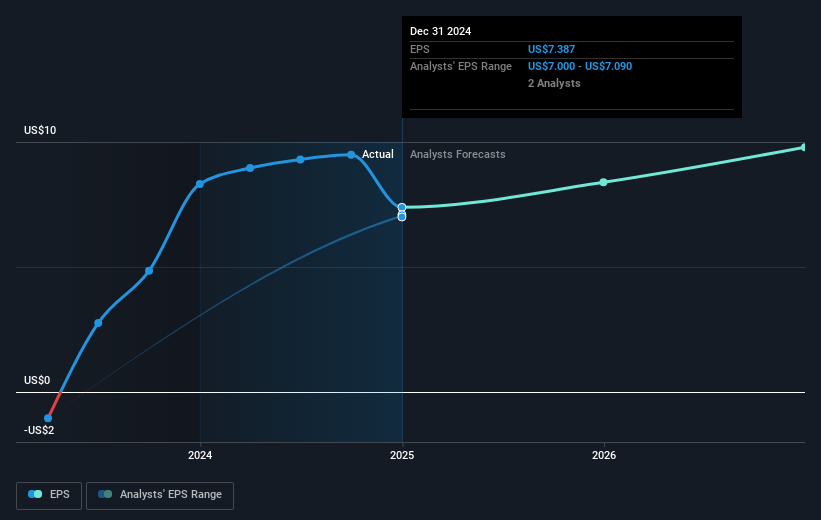

Apollo Global Management (NYSE:APO) recently experienced a leadership change with the appointment of Shimpei Kanzaki as Managing Director and Head of Japan Global Wealth, and the departure of Louis-Jacques Tanguy. Meanwhile, the firm is actively involved in M&A discussions for Reckitt Benckiser's homecare brands and a potential acquisition of Family Dollar. Despite these activities, Apollo's stock price declined by 11% over the past week, while the broader market indices like the S&P 500 and Nasdaq also recorded declines of 3% and 3.5%, respectively. This suggests that Apollo's price movement might also have been influenced by the general downturn in the market, rather than just company-specific events. Additionally, the market's persistent challenges due to economic uncertainties and fluctuating investor sentiment might have further contributed to Apollo's recent performance.

Unlock comprehensive insights into our analysis of Apollo Global Management stock here.

The past five years have been significant for Apollo Global Management, with the company's total shareholder return reaching 321.07%, including both share price appreciation and dividends. This impressive growth can be partly attributed to strategic actions such as share repurchases, which saw 10.67 million shares repurchased recently. The company's expansion activities, including the purchase of Family Dollar and bidding for Reckitt Benckiser's homecare brands, highlight its aggressive M&A strategy.

Moreover, collaborations like the partnership with InvestCloud to launch the PMA Network have facilitated integrated management solutions, potentially enhancing investor appeal. Despite current market pressures and revenue declines, Apollo's previous earnings growth and dividend payouts may continue to support long-term returns. Notably, performance exceeded both the US market and the Diversified Financials industry over the past year, suggesting resilience amidst broader economic fluctuations.

- Get the full picture of Apollo Global Management's valuation metrics and investment prospects—click to explore.

- Assess the downside scenarios for Apollo Global Management with our risk evaluation.

- Invested in Apollo Global Management? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Fair value with acceptable track record.