- United States

- /

- Diversified Financial

- /

- NYSE:APO

Apollo Global Management (NYSE:APO) Secures US$975 Million in New Debt Financing

Reviewed by Simply Wall St

Apollo Global Management (NYSE:APO) recently secured a significant $975 million debt funding, which includes support from firms like Brookfield and Blackstone. This financial bolstering may have firmed investor confidence, contributing to the 10% price increase over the past month. Meanwhile, ongoing interest in M&A activities, such as the potential acquisition of TenneT Germany, could also have supported positive sentiment. While the market's overall movement was relatively flat, the company's strategic financial efforts and broader market recovery likely influenced this upward trajectory, aligning its performance more closely with the optimism surrounding future growth prospects in the broader economy.

The recent US$975 million debt funding by Apollo Global Management, involving collaboration with major firms like Brookfield and Blackstone, could bolster the company's long-term growth narrative. Their ongoing interest in strategic mergers and acquisitions, such as a potential bid for TenneT Germany, supports their focus on industrial and retirement sectors, which may positively influence future revenue and earnings. This financial move, coupled with Apollo's S&P 500 inclusion, aligns with their aim to expand market exposure and could catalyze growth in public markets.

Over the past five years, Apollo's total shareholder returns soared 232.31%, indicating substantial shareholder value. This performance reflects enhanced investor confidence and effective business maneuvers beyond recent short-term fluctuations. In comparison, over the last year, Apollo outperformed the US market with a greater return, although it matched the US Diversified Financial industry returns, highlighting strong relative performance within the sector.

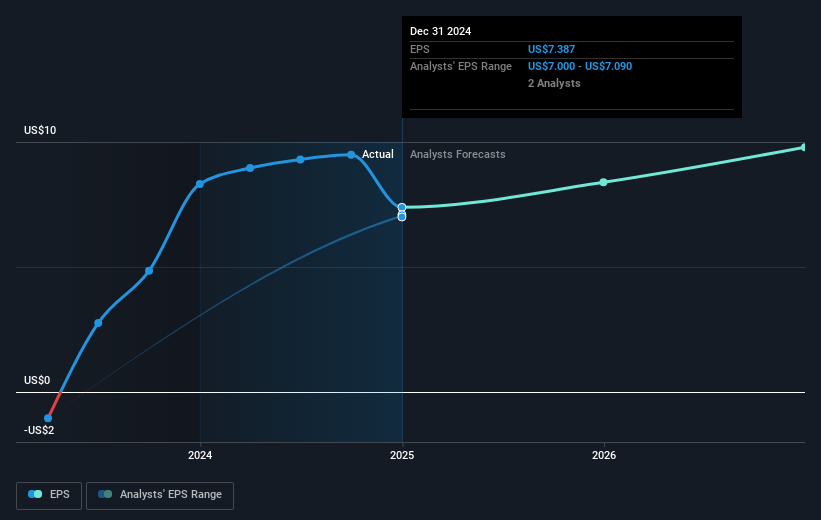

The news underscores Apollo's potential to enhance revenue streams, potentially affecting analyst forecasts, which anticipate revenue decreases but significant margin improvements. Despite these forecasts, the price target set by analysts at US$156.76 is 11.1% higher than the current share price of US$137.55. This suggests room for upward movement, provided the company meets or exceeds earnings expectations. However, shareholders should weigh this optimism against projected declines in revenue as they make their investment decisions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Apollo Global Management, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives