- United States

- /

- Diversified Financial

- /

- NYSE:APO

Apollo Global Management (APO): Assessing Valuation Following Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Apollo Global Management (APO) has experienced a pullback over the past month, with shares edging down about 12%. That move has caught the eye of long-term investors who recall the company’s impressive multi-year performance and strong net income growth.

See our latest analysis for Apollo Global Management.

After surging to new highs earlier in the year, Apollo Global Management’s share price momentum has faded, with the stock pulling back nearly 29% year-to-date. Nonetheless, the firm’s long-term track record stands out, with a three-year total shareholder return of 163% and a five-year run of almost 230%. This makes recent price weakness feel more like a pause than the end of an era.

If you’re considering where the next big opportunity could be, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With the stock now trading at a notable discount to analyst price targets, the question arises: is this dip a genuine buying opportunity for Apollo Global Management, or is the market already factoring in the company’s future growth potential?

Most Popular Narrative: 27% Undervalued

Compared to Apollo Global Management's last close price of $118.22, the most widely followed narrative assigns a fair value of $161.86, which is substantially higher. The narrative argues this upside potential is built on major strategic shifts and anticipated earnings acceleration.

"The company's strategic focus on the global industrial renaissance, particularly in areas like energy and infrastructure, is anticipated to significantly boost origination volumes, enhancing both revenue and earnings. Apollo's expansion into retirement solutions and evolving products for guaranteed income, alongside legislative prospects, could stimulate strong growth in retirement inflows, positively impacting net margins."

Curious what powers this bold valuation? The narrative hinges on a mix of ambitious earnings growth, margin expansion, and a future profit multiple that rivals dream of. Want to uncover the specific financial leaps and strategic moves driving this target? Peek under the hood and explore the details behind these headline projections.

Result: Fair Value of $161.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution challenges or increased competition in the insurance segment could undermine Apollo’s growth story and put pressure on future earnings projections.

Find out about the key risks to this Apollo Global Management narrative.

Another View: The Market’s Multiple Sends a Mixed Signal

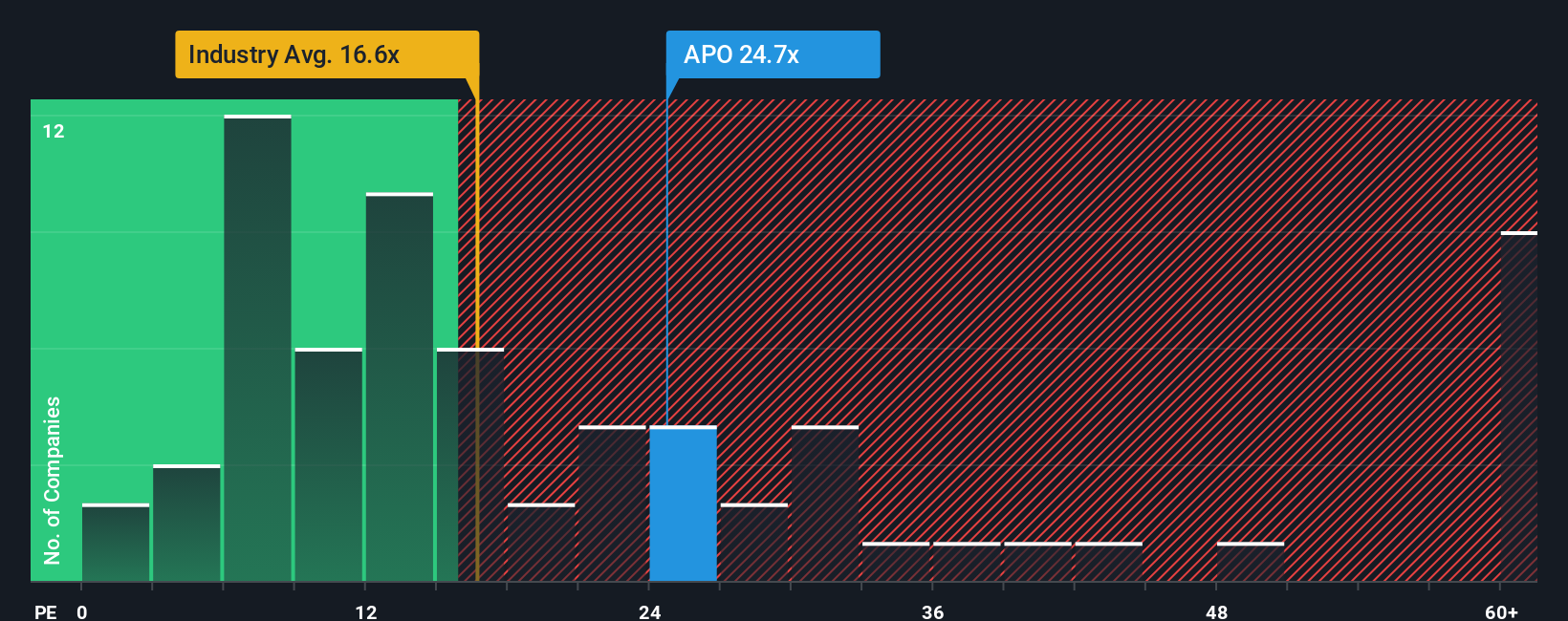

While fair value models hint that Apollo Global Management is undervalued, its current price-to-earnings ratio of 21.4 times earnings is actually higher than both the US Diversified Financials industry average of 16.1 times and the peer average of 20.5 times. However, it remains below the fair ratio of 25 times that the market could one day converge toward. This disconnect raises a question for investors: does Apollo’s current premium signal strong future growth, or is the market already pricing in all the good news?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Apollo Global Management Narrative

If you'd rather dig into the numbers on your own and shape your own outlook, you can build a narrative for Apollo Global Management in just a few minutes, Do it your way

A great starting point for your Apollo Global Management research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There’s a whole world of opportunities beyond Apollo Global Management. Make your next move confidently by tapping into these unique stock ideas handpicked for forward-thinking investors.

- Spot income potential and secure your portfolio with steady payers through these 19 dividend stocks with yields > 3%, featuring companies with healthy yields above 3%.

- Explore technological breakthroughs and unlock possibilities by checking out these 24 AI penny stocks that are transforming the future with artificial intelligence.

- Capitalize on shifting trends in digital finance by reviewing these 79 cryptocurrency and blockchain stocks, where you’ll find the most compelling blockchain and cryptocurrency players making waves right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.