- United States

- /

- Diversified Financial

- /

- NYSE:APO

3 Stocks Estimated To Be Trading At A Discount Of Up To 25.8%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown an impressive 11% increase over the past year with earnings forecasted to grow by 15% annually. In light of these conditions, identifying stocks that are estimated to be trading at a discount can offer potential value opportunities for investors looking to capitalize on future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Roku (ROKU) | $88.99 | $174.03 | 48.9% |

| Robert Half (RHI) | $42.06 | $82.57 | 49.1% |

| Ligand Pharmaceuticals (LGND) | $121.70 | $240.64 | 49.4% |

| Insteel Industries (IIIN) | $39.60 | $77.32 | 48.8% |

| Definitive Healthcare (DH) | $3.92 | $7.82 | 49.8% |

| Carter Bankshares (CARE) | $17.99 | $35.50 | 49.3% |

| Camden National (CAC) | $42.58 | $83.14 | 48.8% |

| Atlantic Union Bankshares (AUB) | $33.14 | $65.45 | 49.4% |

| ACNB (ACNB) | $42.84 | $84.08 | 49% |

| Acadia Realty Trust (AKR) | $18.42 | $36.68 | 49.8% |

Here's a peek at a few of the choices from the screener.

Mr. Cooper Group (COOP)

Overview: Mr. Cooper Group Inc. operates as a non-bank servicer of residential mortgage loans in the United States and has a market cap of approximately $9.41 billion.

Operations: The company's revenue is primarily derived from its Servicing segment, which accounts for $1.62 billion, followed by the Originations segment at $532 million.

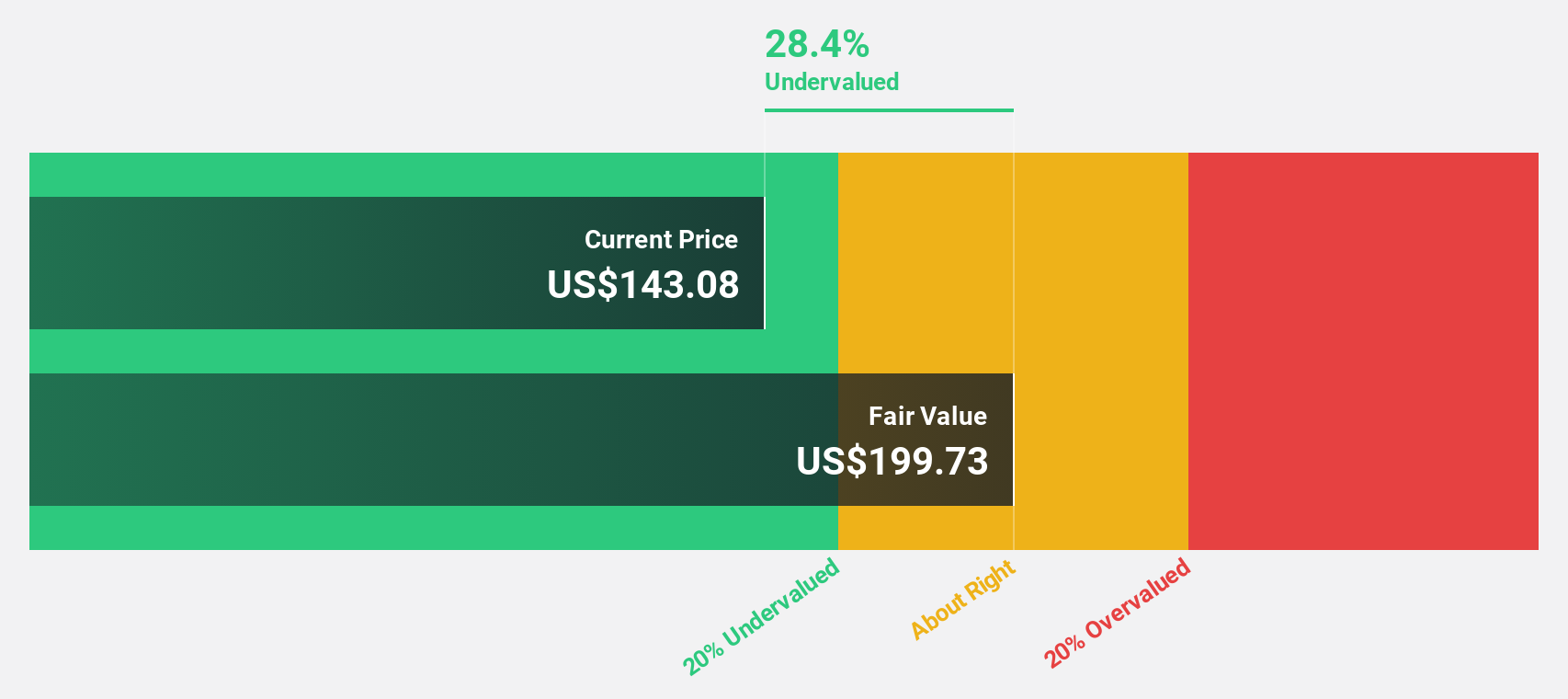

Estimated Discount To Fair Value: 25.8%

Mr. Cooper Group is trading at US$147, significantly below its estimated fair value of US$198.16, indicating potential undervaluation based on cash flows. Despite a forecasted annual earnings growth of 24.8%, revenue growth is expected to be slower at 12.4% per year, and insider selling has been significant recently. The company's recent removal from several Russell indices but addition to the Russell 1000 Value Benchmark may impact investor perception and liquidity considerations.

- Our expertly prepared growth report on Mr. Cooper Group implies its future financial outlook may be stronger than recent results.

- Take a closer look at Mr. Cooper Group's balance sheet health here in our report.

Apollo Global Management (APO)

Overview: Apollo Global Management, Inc. is a private equity firm that specializes in investments across credit, private equity, infrastructure, secondaries and real estate markets with a market cap of approximately $84.11 billion.

Operations: Apollo Global Management's revenue is primarily derived from three segments: Asset Management ($4.96 billion), Principal Investing ($1.11 billion), and Retirement Services ($18.56 billion).

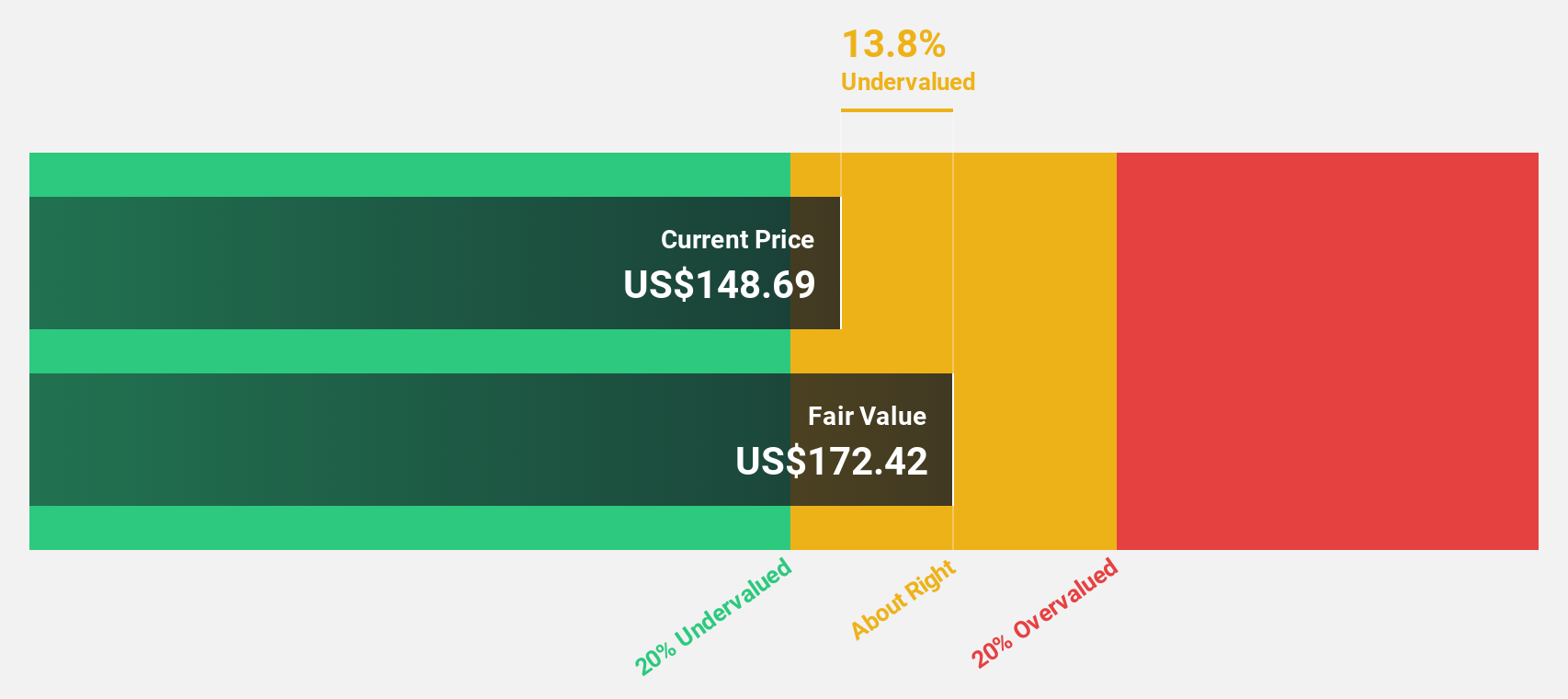

Estimated Discount To Fair Value: 14.6%

Apollo Global Management is trading at US$147.18, below its estimated fair value of US$172.43, suggesting potential undervaluation based on cash flows. Despite anticipated revenue declines over the next three years, earnings are forecast to grow significantly at 21.9% annually, outpacing the broader US market's growth rate. Recent strategic hires and business expansions could bolster operational efficiency and value creation across its portfolio, enhancing long-term profitability prospects amidst a challenging revenue environment.

- Insights from our recent growth report point to a promising forecast for Apollo Global Management's business outlook.

- Dive into the specifics of Apollo Global Management here with our thorough financial health report.

Lazard (LAZ)

Overview: Lazard, Inc. is a financial advisory and asset management firm with operations across the Americas, Europe, the Middle East, Africa, and the Asia Pacific, and it has a market cap of approximately $4.89 billion.

Operations: The company's revenue primarily comes from Financial Advisory services at $1.67 billion, followed by Asset Management at $1.18 billion, and Corporate activities contributing $85.50 million.

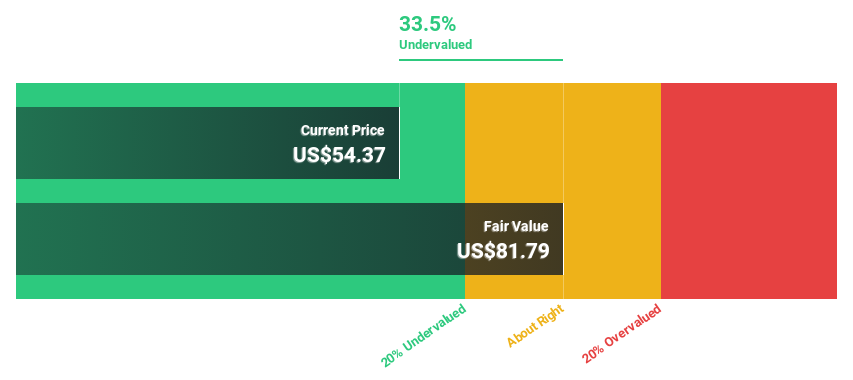

Estimated Discount To Fair Value: 25.7%

Lazard is trading at US$51.92, below its estimated fair value of US$69.89, highlighting potential undervaluation based on cash flows. Despite a high debt level and an unstable dividend track record, earnings are expected to grow 18.93% annually, surpassing the US market's growth rate of 14.8%. Recent strategic expansions in the UK and UAE could enhance Lazard’s global footprint and operational capabilities, potentially supporting future profitability despite insider selling activity over the past quarter.

- According our earnings growth report, there's an indication that Lazard might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Lazard.

Where To Now?

- Delve into our full catalog of 181 Undervalued US Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APO

Apollo Global Management

A private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives