- United States

- /

- Capital Markets

- /

- NYSE:AMP

What Recent Market Volatility Means For Ameriprise Financial’s True Worth in 2025

Reviewed by Bailey Pemberton

Thinking about Ameriprise Financial stock right now? You are not alone. With a recent close at $479.43, plenty of investors are weighing whether to buy, sell, or simply hold tight. Over the past week and month, shares have dipped by 2.6%, and so far in 2024, the stock is down 9.5%. That might cause some hesitation. However, stepping back a bit reveals a very different story. Ameriprise has soared 94.1% in the last three years and delivered an eye-popping 205.4% over five years. Clearly, this is a stock that can move and reward patient shareholders.

Recent shifts in the broader market have influenced Ameriprise’s performance. Shifting investor preferences between defensive financials and high-growth sectors have introduced some short-term volatility, but these moves do not always reflect the company’s underlying value. And while Ameriprise has seen its share of choppy periods, it continues to earn solid marks where it matters: valuation. On a scale where each positive signal for undervaluation adds to its credentials, Ameriprise currently has a score of 5 out of 6. This is definitely a strong showing for anyone concerned about overpaying.

So how do these numbers all add up, and what really makes Ameriprise attractive from a value perspective? In the next section, we will break down the core valuation methods used by analysts. Then, stick around for a smarter way to make sense of what this stock is really worth.

Why Ameriprise Financial is lagging behind its peers

Approach 1: Ameriprise Financial Excess Returns Analysis

The Excess Returns model estimates a company’s value based on how much it can earn above the cost of the capital it invests. This approach is especially useful for financial firms like Ameriprise, as it highlights how effectively management deploys its equity to generate profits. Here are the key numbers for Ameriprise Financial:

- Book Value: $64.42 per share

- Stable Earnings Per Share (EPS): $40.93 per share

(Source: Weighted future Return on Equity estimates from 6 analysts.) - Cost of Equity: $6.84 per share

- Excess Return: $34.09 per share

- Average Return on Equity: 49.64%

- Stable Book Value: $82.46 per share

(Source: Weighted future Book Value estimates from 7 analysts.)

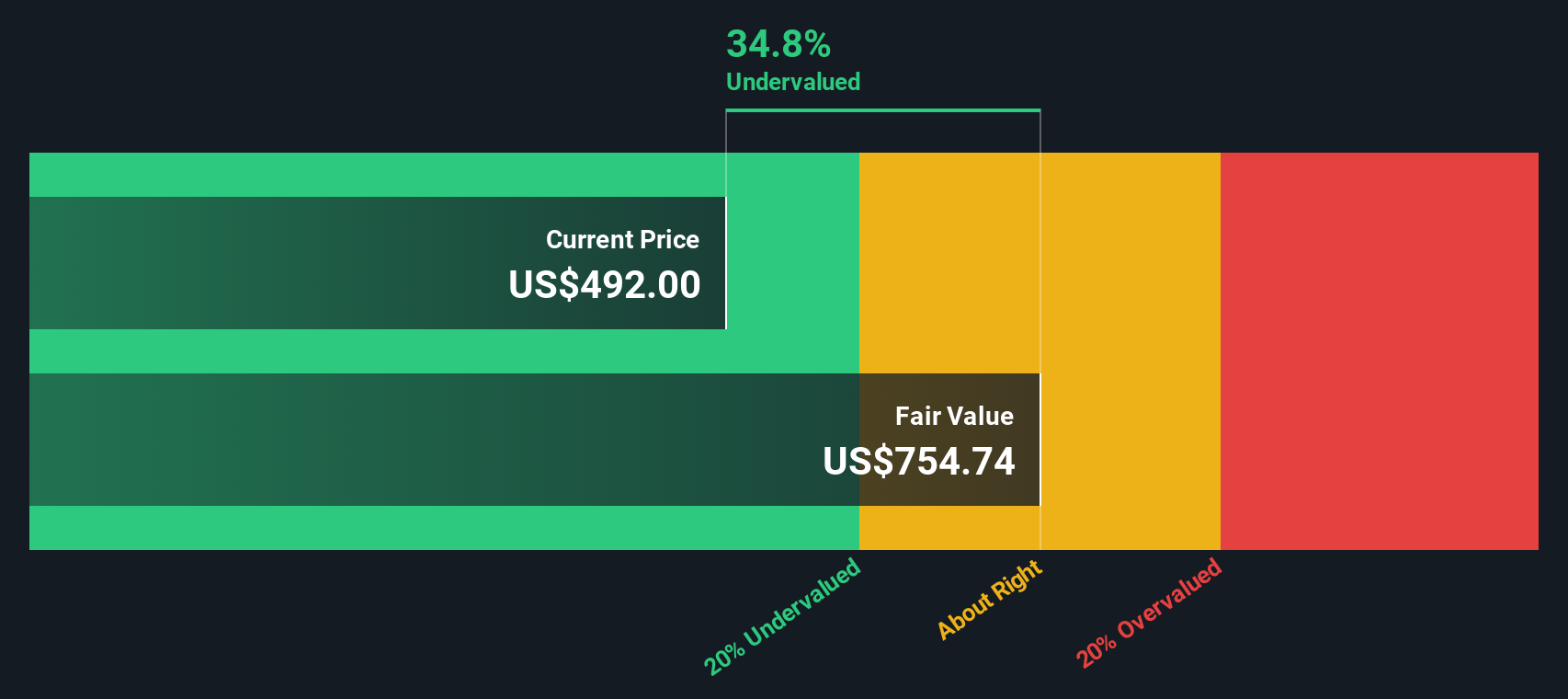

With an estimated intrinsic value of $736.43 per share, the Excess Returns model finds Ameriprise trading at a substantial 34.9% discount from its current price of $479.43. This suggests the company’s ability to consistently deliver returns above its cost of equity may not be fully reflected in today’s share price.

Result: UNDERVALUED

Our Excess Returns analysis suggests Ameriprise Financial is undervalued by 34.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ameriprise Financial Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic valuation tool for profitable companies like Ameriprise Financial because it ties the company's market value directly to its current earnings. For investors, it is a straightforward way to measure whether a stock is priced fairly, given how much profit it generates.

When considering what a “normal” or “fair” PE ratio looks like, growth prospects and perceived risks play a major role. Companies with higher expected earnings growth or lower risk profiles typically command higher PE ratios. Conversely, more uncertain or slower-growth companies often see their PE ratios settle below the market average.

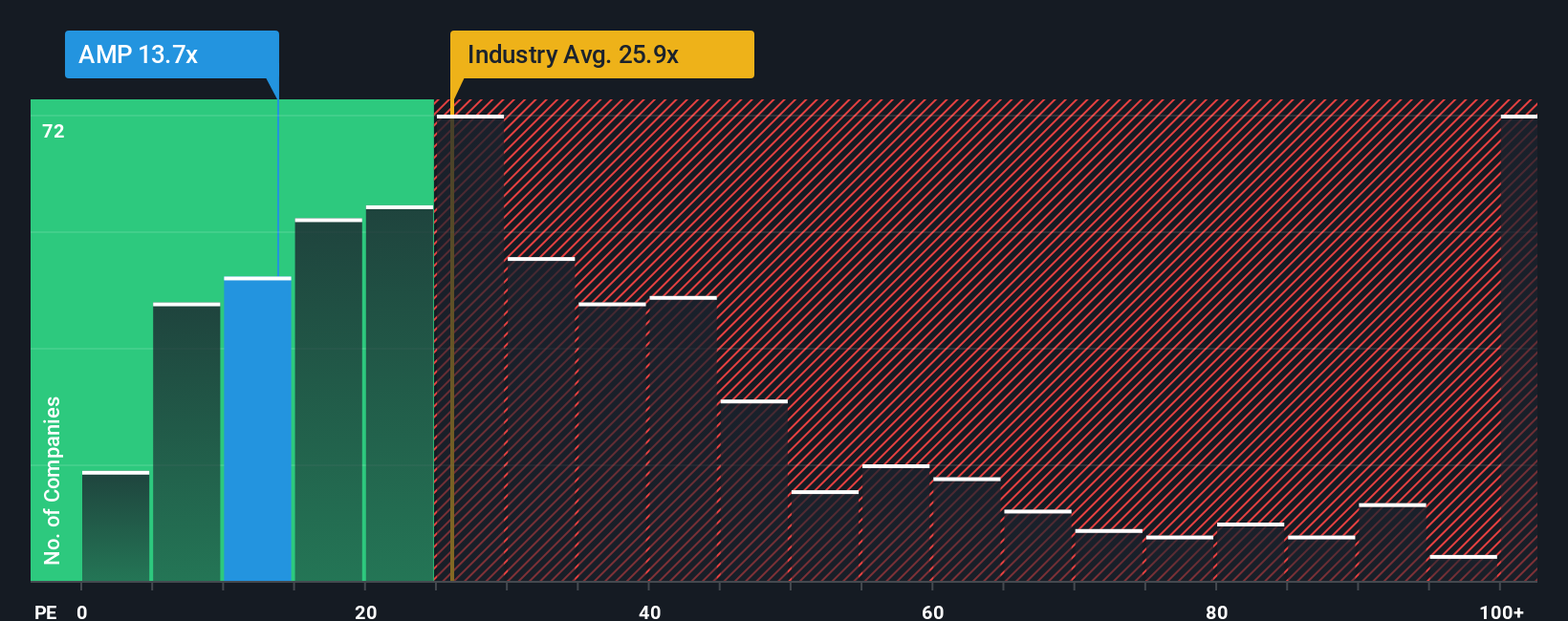

Ameriprise Financial currently trades at a PE ratio of 14x, which is well below both the industry average of 25.6x and the peer average of 31.3x. At first glance, this may suggest the stock is undervalued relative to its peers. However, Simply Wall St’s proprietary “Fair Ratio” for Ameriprise is 17.3x. This Fair Ratio is more insightful than simple industry averages because it adjusts for Ameriprise’s unique growth outlook, risk profile, profit margins, industry category, and market cap. These factors can significantly skew the relevance of standard peer comparisons.

Comparing the Fair Ratio of 17.3x with Ameriprise’s actual PE of 14x, the stock looks undervalued based on a comprehensive assessment of its prospects and risks.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ameriprise Financial Narrative

Earlier, we mentioned an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal, story-driven perspective on a company, connecting your expectations about Ameriprise Financial's future revenue, earnings, and profit margins to a financial forecast and ultimately to a fair value. Narratives help you go beyond the numbers by explaining why you believe the company is worth more or less, linking its strategy, industry dynamics, and business drivers directly to your estimates and assumptions.

On Simply Wall St’s Community page, millions of investors can easily access and create Narratives for Ameriprise Financial and thousands of other stocks, making it a powerful yet accessible decision-making tool. By building or browsing Narratives, you get to see how your fair value compares to the current market price, helping clarify whether it may be time to buy or sell. Plus, since Narratives update automatically as fresh news or new quarterly results come in, your view always stays relevant.

For Ameriprise Financial, some investors focus on technology and banking expansion fueling growth and see a fair value as high as $650, while others worry about competition or earnings volatility, estimating a fair value as low as $434. The best part? You can test out your own assumptions, compare to the community, and make sense of what matters most to you, making your investment decision both smarter and more personal.

Do you think there's more to the story for Ameriprise Financial? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMP

Ameriprise Financial

Operates as a diversified financial services company in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives