- United States

- /

- Capital Markets

- /

- NYSE:AMP

Ameriprise Financial (AMP): Is the Current Valuation Opportunity Worth Another Look?

Reviewed by Kshitija Bhandaru

Ameriprise Financial (AMP) is grabbing attention as its stock continues a steady climb, leaving many investors wondering whether now is the time to take a closer look. While there is no single triggering event dominating headlines, the recent movement might be causing some to pause and reconsider how Ameriprise fits in their portfolios. This subtle but sustained uptick is often all it takes for a company’s valuation story to get interesting.

Over the past year, Ameriprise Financial has delivered a 7.8% total return, outpacing most banks and diversified financial stocks. Even though momentum has tapered off in recent months, with modest dips over the past month and quarter, its three-year and five-year performances have been especially strong. With annual revenue and net income both growing and a track record of long-run gains, Ameriprise continues to build on its position, even if shorter-term enthusiasm has cooled a bit lately.

With the stock’s longer-term growth and some recent pullback, is Ameriprise Financial now trading at an attractive valuation, or are investors already pricing in all of its future growth potential?

Most Popular Narrative: 10.7% Undervalued

The prevailing narrative sees Ameriprise Financial as trading below its calculated fair value, with analysts projecting further upside based on future growth drivers.

Continued investment in technology and adviser platforms, including the PracticeTech system, is leading to higher adviser productivity and client satisfaction. This could potentially result in increased earnings and improved operational efficiency.

Could this be the hidden engine powering Ameriprise’s bull case? There is a secret sauce here, with bold assumptions built into future revenue and profit margins. Curious about the pivotal shifts and financial targets that set this price? Look deeper for the surprising numbers that make up the narrative’s fair value estimate.

Result: Fair Value of $558.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, elevated market volatility and potential asset outflows could disrupt Ameriprise’s growth story and present challenges even for the most optimistic projections.

Find out about the key risks to this Ameriprise Financial narrative.Another View: What Does Our DCF Model Say?

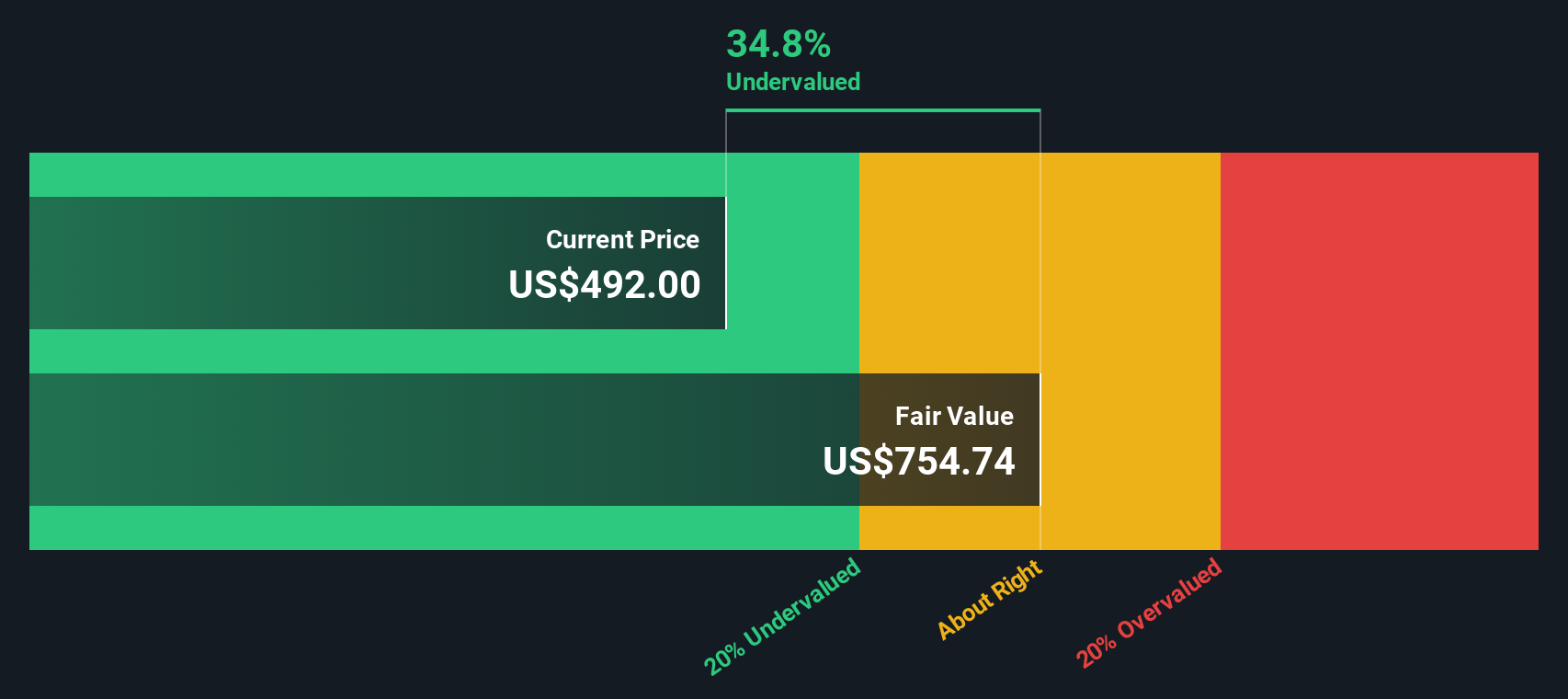

Looking through the lens of our SWS DCF model, Ameriprise, based on projected cash flows, also appears to be trading below its estimated fair value. However, does this method account for all the risks and shifts ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ameriprise Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ameriprise Financial Narrative

If your view differs from these analyses, or you prefer to chart your own path, you can dive into the data and develop a narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Ameriprise Financial.

Looking for More Smart Investment Ideas?

Why focus on just one stock when you can identify tomorrow’s leaders today? Use these powerful screens to discover strong opportunities that others might be missing.

- Find companies paying steady, robust income by checking out dividend stocks with yields > 3%.

- Explore early movers in digital currency and blockchain innovation through the latest cryptocurrency and blockchain stocks.

- Identify bargains and potential winners that the market may be overlooking with our top picks from undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMP

Ameriprise Financial

Operates as a diversified financial services company in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives