- United States

- /

- Capital Markets

- /

- NYSE:AMG

With EPS Growth And More, Affiliated Managers Group (NYSE:AMG) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Affiliated Managers Group (NYSE:AMG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Affiliated Managers Group

Affiliated Managers Group's Improving Profits

In the last three years Affiliated Managers Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Affiliated Managers Group's EPS has risen over the last 12 months, growing from US$11.83 to US$14.51. There's little doubt shareholders would be happy with that 23% gain.

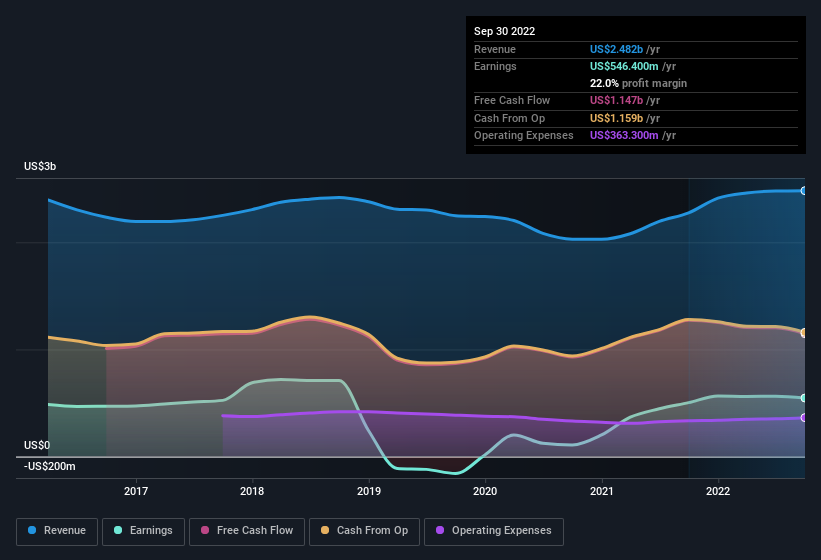

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Affiliated Managers Group shareholders can take confidence from the fact that EBIT margins are up from 33% to 37%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Affiliated Managers Group's forecast profits?

Are Affiliated Managers Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that Affiliated Managers Group insiders spent a whopping US$1.0m on stock in just one year, without so much as a single sale. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. Zooming in, we can see that the biggest insider purchase was by Independent Director Tracy Palandjian for US$509k worth of shares, at about US$138 per share.

Along with the insider buying, another encouraging sign for Affiliated Managers Group is that insiders, as a group, have a considerable shareholding. Given insiders own a significant chunk of shares, currently valued at US$68m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

Does Affiliated Managers Group Deserve A Spot On Your Watchlist?

As previously touched on, Affiliated Managers Group is a growing business, which is encouraging. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. What about risks? Every company has them, and we've spotted 2 warning signs for Affiliated Managers Group (of which 1 makes us a bit uncomfortable!) you should know about.

Keen growth investors love to see insider buying. Thankfully, Affiliated Managers Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMG

Affiliated Managers Group

Through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives