- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

Fed Rate Cut Hopes Might Change the Case for Investing in Ally Financial (ALLY)

Reviewed by Sasha Jovanovic

- Ally Financial recently experienced a series of noteworthy events, including its CEO and Chief Risk Officer participating in major industry conferences and a rise in investor optimism following comments from a Federal Reserve official suggesting possible interest rate cuts.

- An interesting insight is that interest rate expectations are especially material for Ally Financial because lower rates are often linked with increased loan demand and a potential reduction in borrower defaults.

- We'll explore how optimism around a Federal Reserve rate cut announcement may influence Ally Financial's investment narrative and risk outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Ally Financial Investment Narrative Recap

To be an Ally Financial shareholder, you need to believe in the strength and ongoing relevance of its all-digital platform and prime auto lending franchise, even amid sector changes. Recent speculation regarding a potential Federal Reserve rate cut has lifted market sentiment on short-term loan demand, but it does not alter Ally’s core risks: concentrated auto lending exposure and uncertainties around borrower credit quality remain front and center.

Ally’s CEO presenting at the upcoming Goldman Sachs US Financial Services Conference is particularly relevant given investor focus on interest rate catalysts. This event offers management a platform to address evolving financial conditions and provide further insights on how potential rate shifts may impact auto lending volumes and credit performance going into 2026.

Yet, in contrast, investors should be aware of how increased competition in auto lending threatens Ally’s margins if origination yields face pressure from...

Read the full narrative on Ally Financial (it's free!)

Ally Financial's narrative projects $9.6 billion revenue and $1.8 billion earnings by 2028. This requires 12.0% yearly revenue growth and a $1.5 billion increase in earnings from $324.0 million currently.

Uncover how Ally Financial's forecasts yield a $48.06 fair value, a 25% upside to its current price.

Exploring Other Perspectives

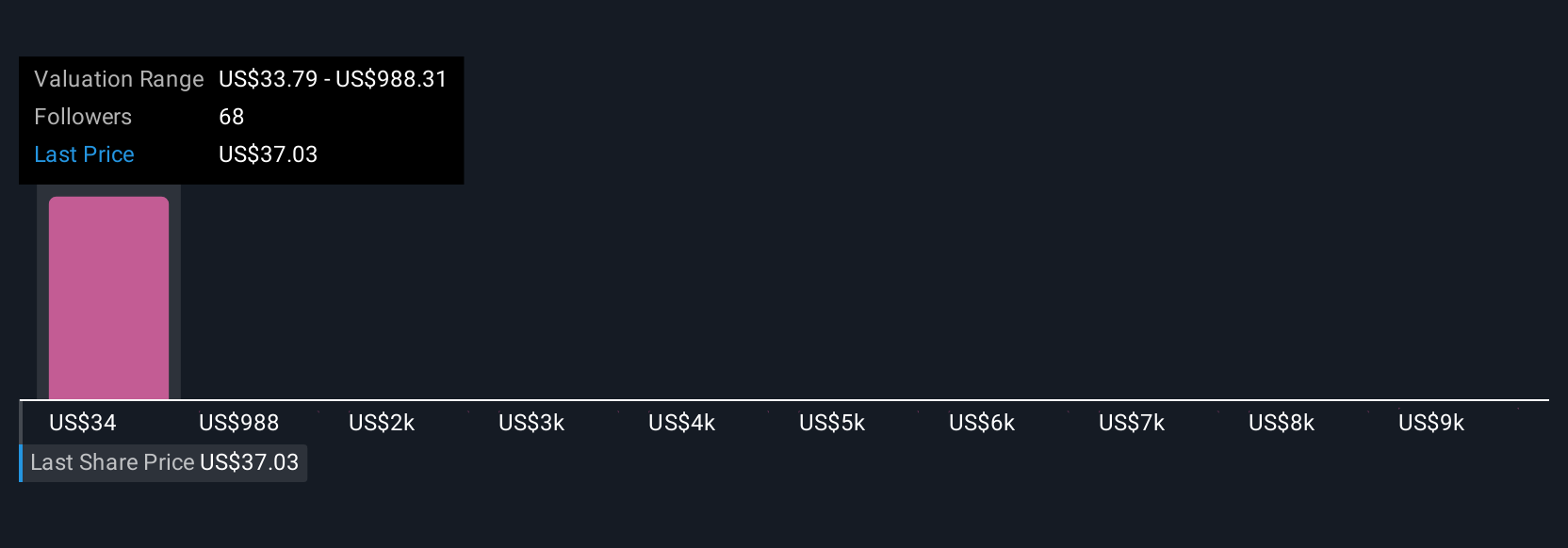

Nine members of the Simply Wall St Community see Ally’s fair value spread from US$36.04 to US$56.49. While expectations differ, the risk of compressed origination yields if larger banks and fintechs expand auto lending could influence results beyond expectations. Explore the range of views shaping this discussion.

Explore 9 other fair value estimates on Ally Financial - why the stock might be worth as much as 47% more than the current price!

Build Your Own Ally Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ally Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ally Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ally Financial's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives