- United States

- /

- Consumer Finance

- /

- NYSE:ALLY

Ally Financial (ALLY) Valuation After Analyst Upgrades and New $2 Billion Share Buyback Plan

Reviewed by Simply Wall St

Ally Financial (ALLY) just paired a fresh round of analyst upgrades with a new 2 billion dollar share repurchase plan, a combination that usually indicates management and Wall Street see potential upside.

See our latest analysis for Ally Financial.

Those upgrades and the fresh buyback plan come on top of a strong run, with Ally’s share price up sharply this year and a hefty three year total shareholder return that signals momentum is still building.

If this kind of re rating has your attention, it could be worth exploring other fast movers, including fast growing stocks with high insider ownership.

With shares already up strongly and trading only modestly below consensus targets, the key question now is whether Ally’s accelerating earnings and buybacks still leave upside on the table, or if the market has already priced in that growth.

Most Popular Narrative: 6.5% Undervalued

With Ally Financial’s fair value estimate sitting above the latest 45.44 dollar close, the prevailing narrative leans toward measured upside driven by improving fundamentals.

Ongoing balance sheet remixing into higher yielding auto and corporate finance loans, as well as optimized deposit pricing, are increasing net interest margin beyond recent headwinds (e.g., card sale, mortgage runoff). This points to a path for above peer NIM and sustained earnings improvement.

Curious how rising margins, faster earnings growth and a richer future multiple all fit together, the most followed narrative connects them in a way the current share price does not fully reflect. To see exactly which growth, margin and valuation assumptions are doing the heavy lifting in that fair value math, dig into the full narrative to unpack the numbers behind this upside case.

Result: Fair Value of $48.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper economic slowdown or renewed stress in auto credit and consumer finance regulation could quickly challenge the improving margin and valuation narrative.

Find out about the key risks to this Ally Financial narrative.

Another Angle on Value

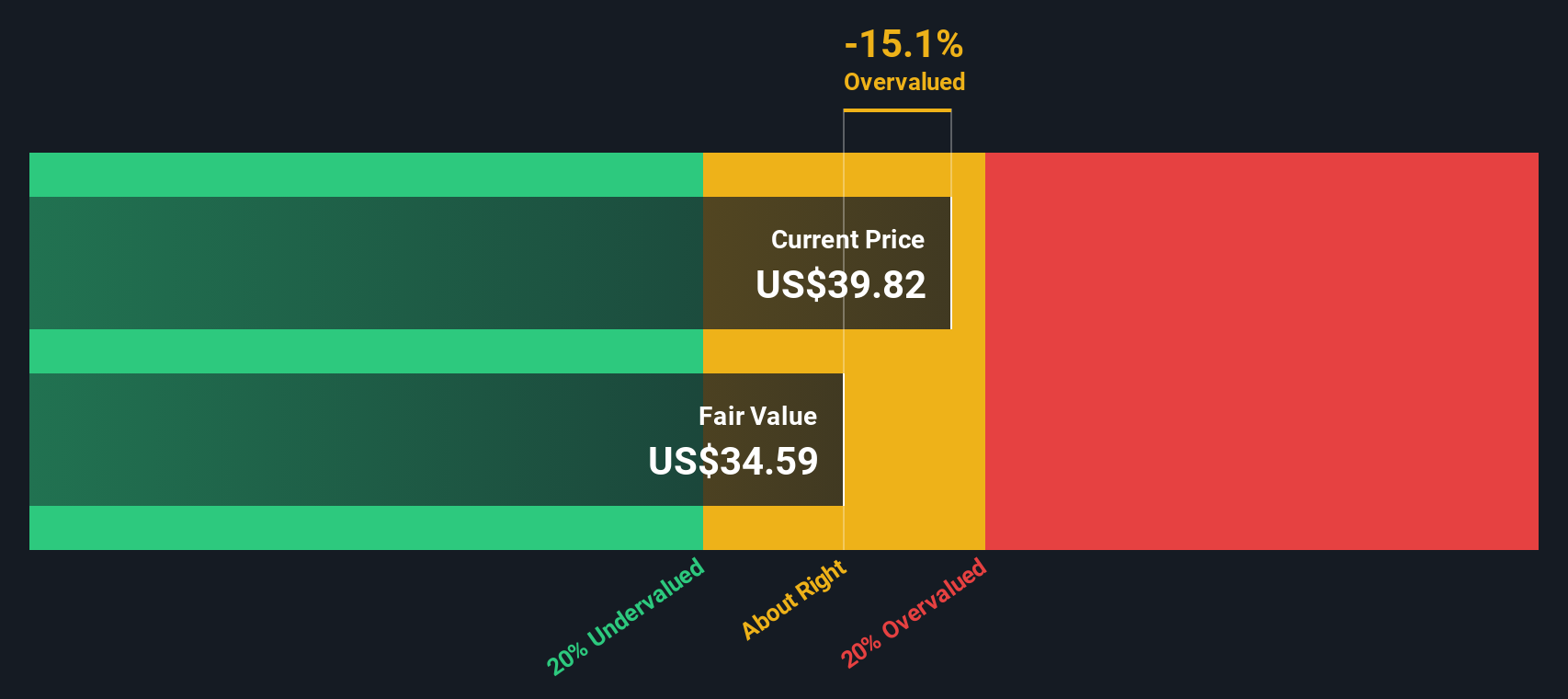

Our SWS DCF model paints a more cautious picture, suggesting Ally’s shares are trading above an estimated fair value of 40.74 dollars, which would imply the stock is overvalued on that basis. If the cash flow assumptions prove too rosy, how much downside could that leave?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ally Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ally Financial Narrative

If you see the story differently or want to follow your own numbers, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Ally Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more actionable investment ideas?

Before you move on, consider reviewing a few fresh opportunities from the Simply Wall Street Screener so you are not leaving potential winners on the table.

- Explore rapid small cap momentum by targeting these 3624 penny stocks with strong financials that already show strong balance sheets and improving fundamentals.

- Focus on these 24 AI penny stocks that are involved in intelligent software and automation.

- Filter for these 13 dividend stocks with yields > 3% that aim to provide consistent cash returns through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALLY

Ally Financial

A digital financial-services company, provides various digital financial products and services in the United States, Canada, and Bermuda.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion