- United States

- /

- Diversified Financial

- /

- NYSE:AGM

Federal Agricultural Mortgage (AGM): Valuation Check After New $313.5m Securitization and 2026 Product Plans

Reviewed by Simply Wall St

Federal Agricultural Mortgage (AGM) just wrapped up a $313.5 million securitization of 343 agricultural mortgage loans, featuring a $290 million guaranteed senior tranche, a move that shines a light on its evolving funding strategy.

See our latest analysis for Federal Agricultural Mortgage.

The latest securitization follows a strong run of corporate moves and earlier gains tied to upbeat earnings. Yet the share price return is still down year to date, even after a robust 1 month share price return of 11.9 percent, while long term investors remain comfortably ahead thanks to a 5 year total shareholder return of 175.8 percent. This suggests momentum has cooled but the long range story is still firmly intact.

If this kind of balance between income stability and long term growth appeals to you, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover the next wave of potential compounders.

With earnings still growing, a recent securitization under its belt, and the stock trading below analyst targets, is Federal Agricultural Mortgage quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 21.7% Undervalued

With the narrative fair value sitting well above the last close of $176.92, the implied upside hinges on steady growth and resilient margins.

Accelerating capital needs in agriculture and rural infrastructure, driven by farm consolidation and increased mechanization, are creating a larger addressable market for Farmer Mac's core and new product offerings, underpinning long-term loan growth and greater net interest income.

Curious how moderate growth assumptions and only slightly lower margins can still support a much higher future earnings multiple than today? See what the narrative is baking in and which forward projections really power that fair value call.

Result: Fair Value of $226 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained credit losses in newer segments or adverse changes to Farmer Mac's GSE status could quickly challenge the market's current undervaluation thesis.

Find out about the key risks to this Federal Agricultural Mortgage narrative.

Another View: Market Ratios Tell a Different Story

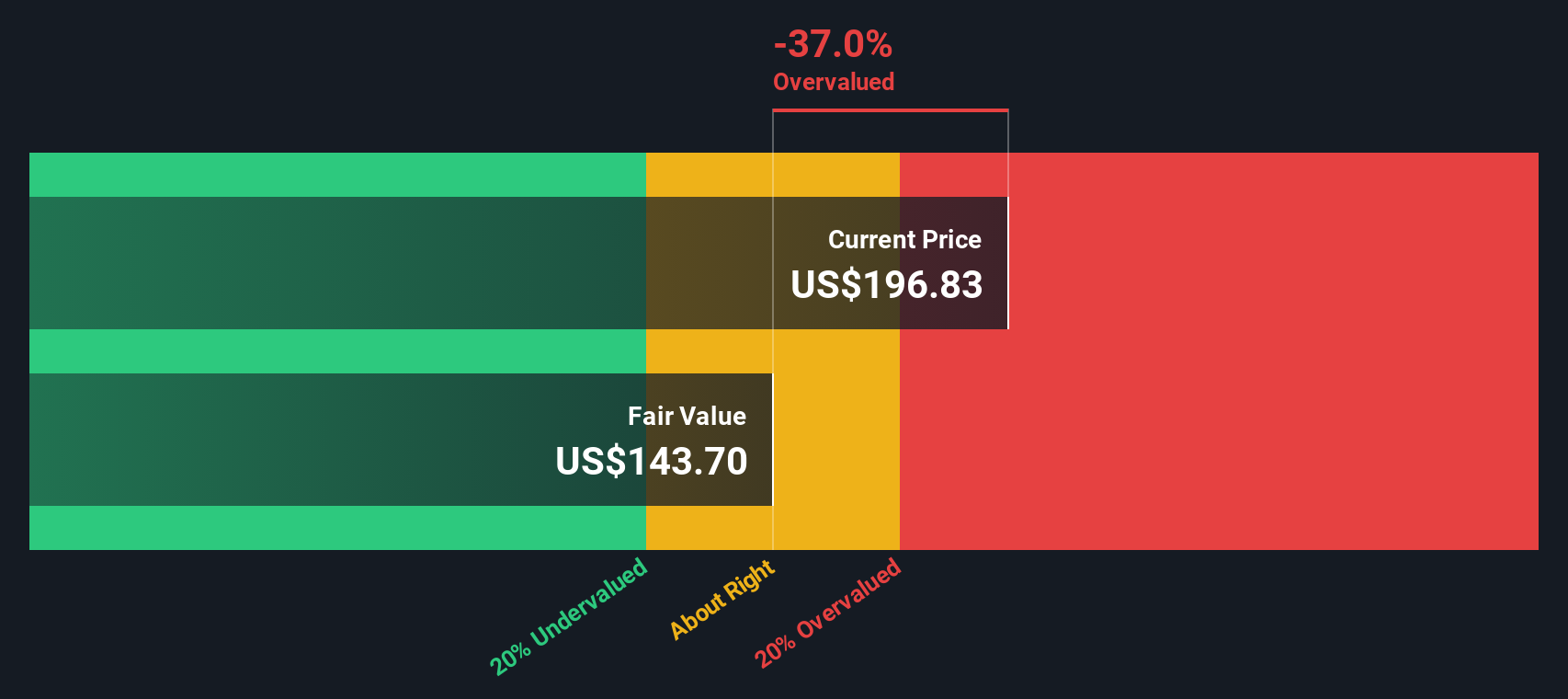

Our SWS DCF model points to a fair value of about $135.90, below the current $176.92 share price. This frames Federal Agricultural Mortgage as overvalued on cash flow terms and sharply at odds with the 21.7 percent upside implied by the narrative fair value.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Federal Agricultural Mortgage for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Federal Agricultural Mortgage Narrative

If you see the story differently or want to stress test your own assumptions using the same data, you can build a fresh view yourself in under three minutes: Do it your way.

A great starting point for your Federal Agricultural Mortgage research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next steps with targeted ideas from our screener so you are not relying on just one opportunity.

- Capture potential multi-bagger upside by scanning these 3571 penny stocks with strong financials featuring smaller companies with the financial strength to support serious long term growth.

- Position yourself at the intersection of medicine and algorithms by reviewing these 30 healthcare AI stocks that could reshape diagnostics, treatment planning, and hospital productivity.

- Strengthen your portfolio’s income engine by targeting these 14 dividend stocks with yields > 3% that combine attractive yields with the potential for capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AGM

Federal Agricultural Mortgage

Provides a secondary market for various loans made to borrowers in the United States.

Established dividend payer and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026