- United States

- /

- Mortgage REITs

- /

- NYSE:ABR

What Recent Fed Rate Signals Could Mean for Arbor Realty Trust’s Share Price in 2025

Reviewed by Bailey Pemberton

Trying to decide what to do with Arbor Realty Trust? You are not alone. This stock is one that investors often analyze closely, especially after the year it has had. The price at last close was $11.62, and while its one-year return sits at a disappointing -14.2%, taking a step back reveals a very different story over the long run. In the past three years, Arbor Realty Trust has gained 35.0%, and it is up 73.7% over five years. This makes short-term turbulence seem like just another swing in its ongoing performance.

There has definitely been some volatility lately. Shares have slipped -5.4% in the past week and are down -0.7% over the past month. This occurs as markets re-evaluate risk across the real estate sector, particularly with changing sentiment around interest rates and the economic growth outlook. Year-to-date, the stock is off by -15.7%, so it is clear that many investors are reassessing their approach.

The key question is whether Arbor Realty Trust is currently undervalued. Here is where things get interesting. Out of six common valuation checks, Arbor earns a value score of 4, indicating it appears undervalued in four out of six ways analysts assess a company. That is notable, but valuation is rarely straightforward, and the method used to measure “undervalued” can make all the difference. Next, let us break down the classic valuation approaches, followed by a perspective that may be even more useful for evaluating what Arbor Realty Trust is really worth.

Why Arbor Realty Trust is lagging behind its peers

Approach 1: Arbor Realty Trust Excess Returns Analysis

The Excess Returns valuation model helps investors evaluate how much value a company is creating above its cost of equity. This approach focuses on whether Arbor Realty Trust is able to deliver returns on invested capital that exceed the minimum threshold investors require for the risk they are taking. In Arbor's case, the picture is illuminating.

The company’s book value stands at $12.17 per share, with a stable earnings per share (EPS) of $1.32. These figures are grounded in the median return on equity from the past five years. The cost of equity is $0.97 per share, meaning every year Arbor needs to generate at least this much from each share just to compensate shareholders for their risk. Arbor’s average return on equity sits at 11.44%, and its calculated excess return per share is $0.36. Analysts project a stable book value of $11.55 per share for the future, providing a solid foundation for continued excess returns.

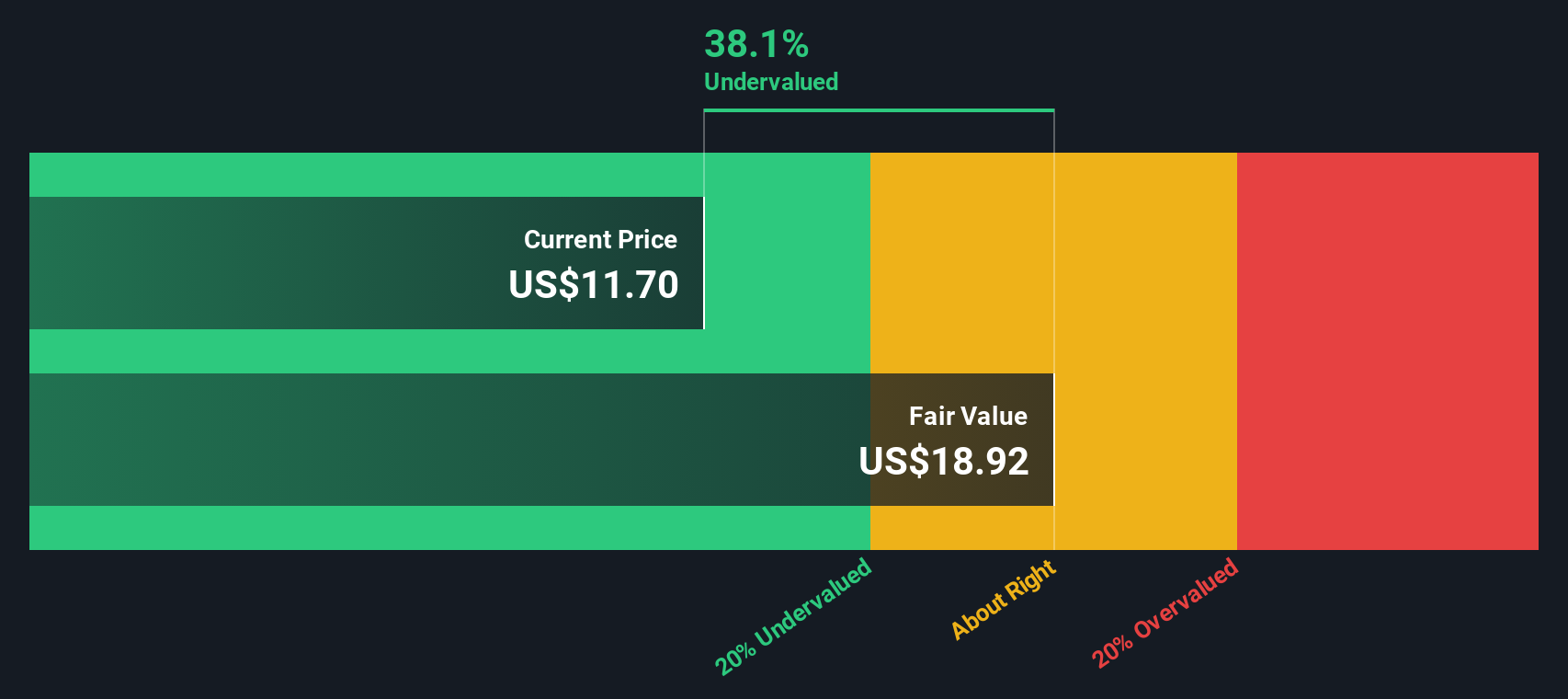

Using this method, the estimated intrinsic fair value for Arbor Realty Trust shares is $18.30, while the current market price is $11.62. This indicates the stock is trading at a notable 36.5% discount to its intrinsic value, suggesting the shares are undervalued at present.

Result: UNDERVALUED

Our Excess Returns analysis suggests Arbor Realty Trust is undervalued by 36.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Arbor Realty Trust Price vs Earnings

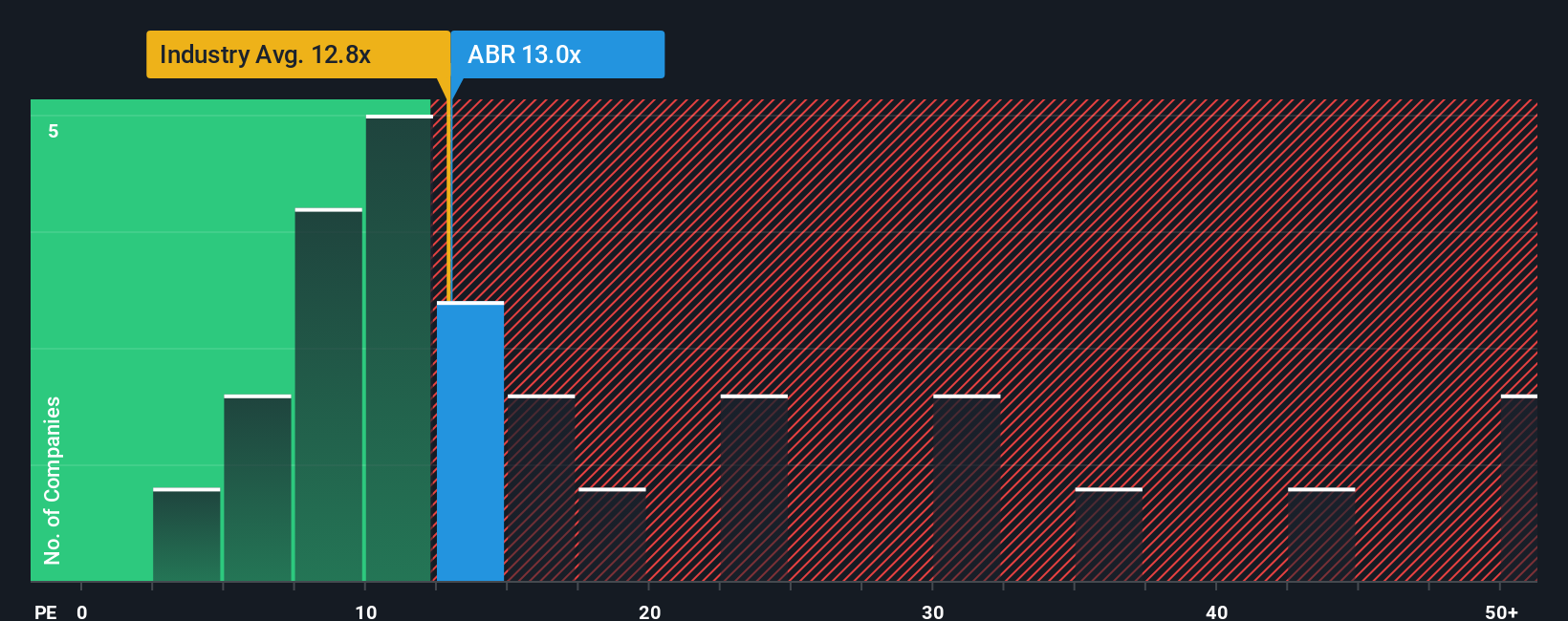

The price-to-earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like Arbor Realty Trust. It helps investors quickly assess how much they are paying for each dollar of earnings, which is particularly useful when those earnings are consistent and reliable.

What counts as a "normal" or "fair" PE ratio is shaped by multiple factors, notably the company's expected growth and the risks it faces. Higher anticipated growth and lower risk often justify a higher PE ratio, while the opposite holds true for slower-growing, riskier companies.

Arbor Realty Trust currently trades at a PE ratio of 13.0x, which is slightly above the industry average of 12.9x for Mortgage REITs but below its peer group average of 16.2x. Simply Wall St has also calculated a proprietary Fair Ratio for Arbor Realty Trust, coming in at 13.7x. This Fair Ratio is designed to reflect a more nuanced, tailored benchmark by taking into account not just peer and industry averages but also Arbor's unique growth rate, risks, profit margins, industry specifics, and market capitalization.

Comparing Arbor's current PE ratio with this Fair Ratio shows the stock is trading almost exactly where it should be. The difference between the two is less than 0.10, indicating the company's shares are neither notably overvalued nor undervalued by this measure.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arbor Realty Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives. A Narrative is simply your story about a company, in this case Arbor Realty Trust, where you combine your own assumptions about future revenue, earnings, and profit margins with what you consider to be a fair value. Narratives make investing far more powerful because they connect the company's story, your financial forecast, and its underlying valuation all in one place.

On Simply Wall St's Community page, millions of investors can easily create, share, and compare Narratives, making this approach accessible to everyone. Narratives help you decide if Arbor Realty Trust is a buy or sell by dynamically showing you when your estimated Fair Value is above or below the current market price. They automatically update anytime new news or earnings are released.

For example, some Arbor Realty Trust Narratives reflect higher optimism, with users projecting a fair value of $15.00 per share, while others take a more cautious view with a fair value down at $10.50. This illustrates how the numbers shift depending on your perspective. Narratives empower you to back up your decisions with facts, not just feelings.

Do you think there's more to the story for Arbor Realty Trust? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABR

Arbor Realty Trust

Invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives