- United States

- /

- Capital Markets

- /

- NYSE:AAMI

Acadian Asset Management (AAMI): Reviewing Valuation Following Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Acadian Asset Management (NYSE:AAMI) shares have tracked lower this month, even as the broader market has seen pockets of strength. The stock has now declined nearly 9% over the past month and this has stirred valuation conversations.

See our latest analysis for Acadian Asset Management.

Acadian Asset Management’s share price momentum has turned sharply negative in recent weeks, giving back nearly 9% in just a month. However, the bigger picture is still striking. The shares have notched a 71% share price return since January and a 70% total shareholder return over twelve months, suggesting that strong gains have simply paused after an exceptional run.

If you’re keeping an eye on what else is on the move this year, broaden your investing horizons and discover fast growing stocks with high insider ownership

This recent dip in Acadian Asset Management raises a key question for investors: does the current price represent an attractive entry point, or has the market already factored in all expected growth ahead?

Price-to-Earnings of 17.7x: Is it justified?

Acadian Asset Management’s price-to-earnings ratio stands at 17.7x, placing the stock above its sector peers and raising questions about whether this premium is warranted. At the last close of $44.22, the valuation looks expensive compared to similar companies in the space.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings. It is a widely used yardstick, especially relevant for capital markets companies like Acadian Asset Management, as it directly reflects earnings power and growth expectations.

Currently, Acadian Asset Management trades at a P/E multiple that is materially higher than the peer average of 13.6x, signaling the market may be pricing in stronger future growth or a premium for quality. However, it is notably below the broader US market average of 18.5x, which helps to balance the relative expensiveness. Compared to the US Capital Markets industry average of 24.9x, Acadian actually appears attractively valued within its sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.7x (OVERVALUED)

However, weaker revenue growth or a failure to meet analyst price targets could trigger further downside and challenge the stock’s premium valuation.

Find out about the key risks to this Acadian Asset Management narrative.

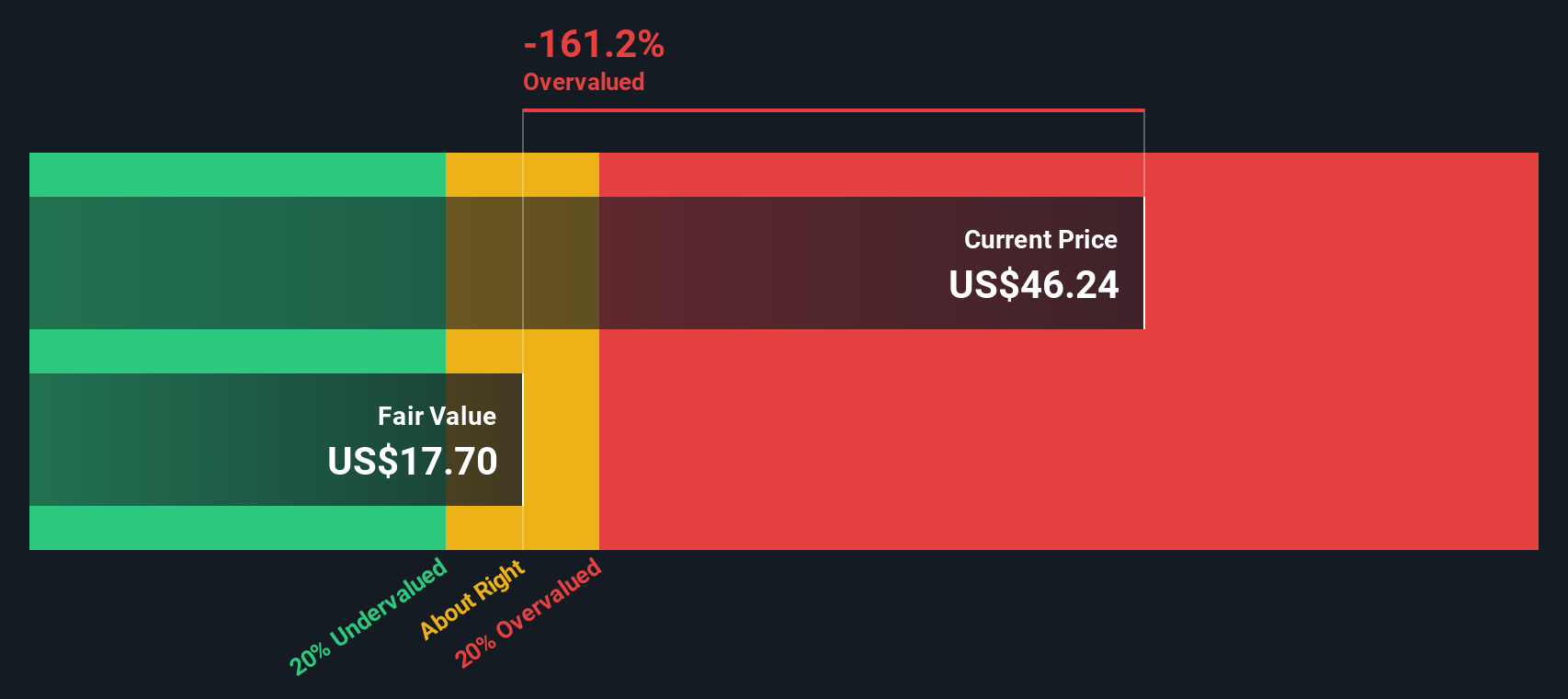

Another View: Discounted Cash Flow Tells a Different Story

Taking a different perspective, our DCF model points to an estimated fair value for Acadian Asset Management at $17.78, which is much lower than its current share price of $44.22. This suggests the stock could be overvalued if future cash flows do not live up to market expectations. So, which approach will prove right in the end?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acadian Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acadian Asset Management Narrative

If you see things differently or want to explore the numbers for yourself, you can build your own Acadian Asset Management narrative in a matter of minutes, Do it your way.

A great starting point for your Acadian Asset Management research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t stop at just one opportunity. Tap into fresh angles across the market with these uniquely curated investment themes. Missing out could mean leaving real potential on the table.

- Turbocharge your watchlist by targeting companies with strong financials and healthy yields, starting with these 19 dividend stocks with yields > 3%.

- Position your portfolio for tomorrow’s breakthroughs by targeting firms at the forefront of quantum computing, thanks to these 26 quantum computing stocks.

- Get ahead of hot trends by seeking out financially robust businesses revolutionizing healthcare with artificial intelligence, via these 33 healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AAMI

Acadian Asset Management

BrightSphere Investment Group Inc. is a publically owned asset management holding company.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives