- United States

- /

- Capital Markets

- /

- NasdaqGS:XP

Could Platform-Exclusive Rewards Reshape XP’s (XP) Competitive Positioning in the Gaming Sector?

Reviewed by Sasha Jovanovic

- Battlefield 6 launched yesterday across PC, PS5, and Xbox Series X/S, featuring exclusive XP earning advantages and special in-game rewards for PlayStation players who purchase premium editions or pre-order content packs.

- This platform-specific XP boost is drawing heightened player interest toward XP-related rewards, potentially influencing player platform choices and in-game engagement patterns around release.

- We'll examine how the exclusive XP incentives for PlayStation players might impact XP's investment case as competition intensifies.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

XP Investment Narrative Recap

To be a shareholder in XP, you need to believe in the ongoing expansion of Brazil’s middle class, increased digital adoption, and XP’s ability to grow share in a transitioning investment landscape. The recent Battlefield 6 news connecting exclusive PlayStation XP rewards to platform selection has little direct impact on XP’s core short-term catalysts, retail client growth and platform migration; nor does it materially alter the biggest current risk, which remains competitive fee compression and net new money challenges from institutional clients.

The most relevant recent announcement is XP’s solid Q2 2025 earnings update, reflecting growth in both revenue and net income. This underscores the company's operational execution amid competitive pressures, even as investors weigh how persistent macro trends and shifting client preferences might impact AUM growth in the quarters ahead. In contrast, investors should be mindful of how competitive fee pressures...

Read the full narrative on XP (it's free!)

XP's outlook anticipates R$25.2 billion in revenue and R$6.8 billion in earnings by 2028. This scenario assumes a 14.5% annual revenue growth rate and an earnings increase of R$1.9 billion from current earnings of R$4.9 billion.

Uncover how XP's forecasts yield a $23.50 fair value, a 45% upside to its current price.

Exploring Other Perspectives

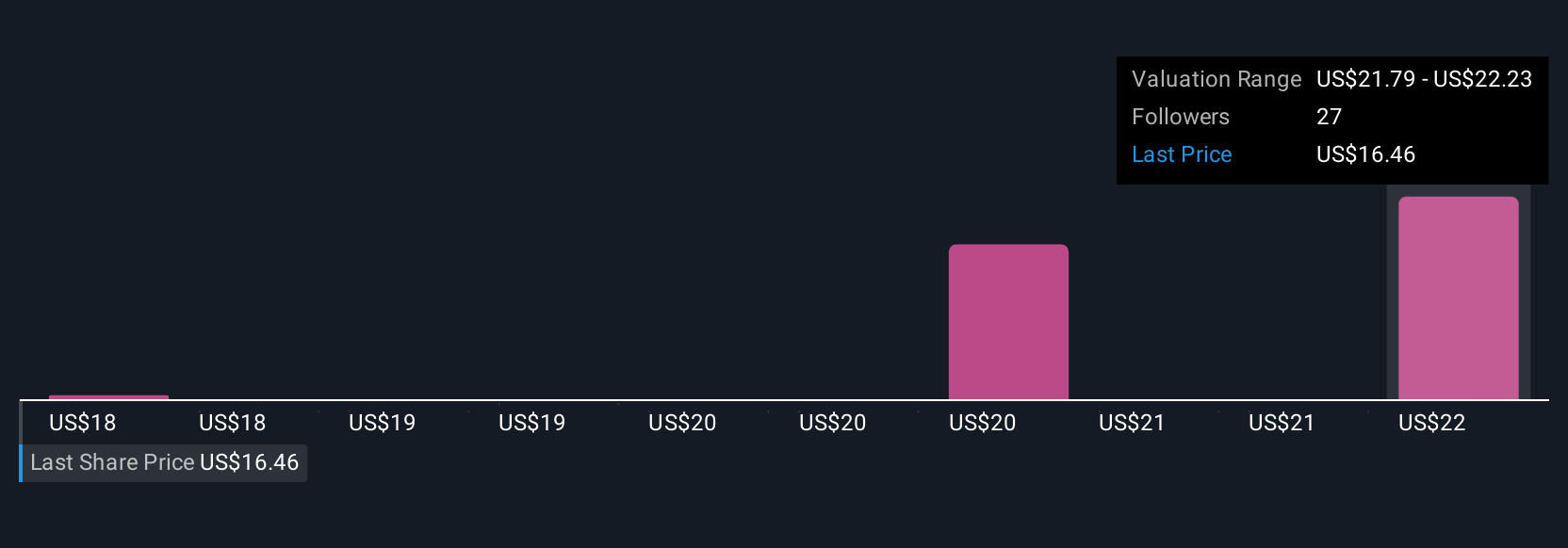

Fair value estimates from five Simply Wall St Community members range from US$17.79 to US$28.38 per share. With such wide opinions, it is vital to consider risks like margin pressure and competition when forming your outlook.

Explore 5 other fair value estimates on XP - why the stock might be worth just $17.79!

Build Your Own XP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XP research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free XP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XP's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XP

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026