- United States

- /

- Capital Markets

- /

- NasdaqGS:VINP

Vinci Partners Investments And Two Other Key Dividend Stocks To Consider

Reviewed by Simply Wall St

As markets exhibit mixed signals with the U.S. and Europe showing varied responses to economic indicators, investors remain vigilant, particularly focusing on inflation data and central bank policies. In this environment, dividend stocks like Vinci Partners Investments offer a potential avenue for steady returns amidst market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.65% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.02% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.04% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.02% | ★★★★★★ |

| Citizens Financial Group (NYSE:CFG) | 4.75% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.70% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.80% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 6.14% | ★★★★★☆ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.47% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 4.86% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Vinci Partners Investments (NasdaqGS:VINP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vinci Partners Investments Ltd., a Brazil-based asset management firm, has a market capitalization of approximately $592.62 million.

Operations: Vinci Partners Investments Ltd. generates revenue through its Private Markets segment with R$262.78 million, Corporate Advisory at R$42.91 million, and Investment Products and Solutions contributing R$70.98 million.

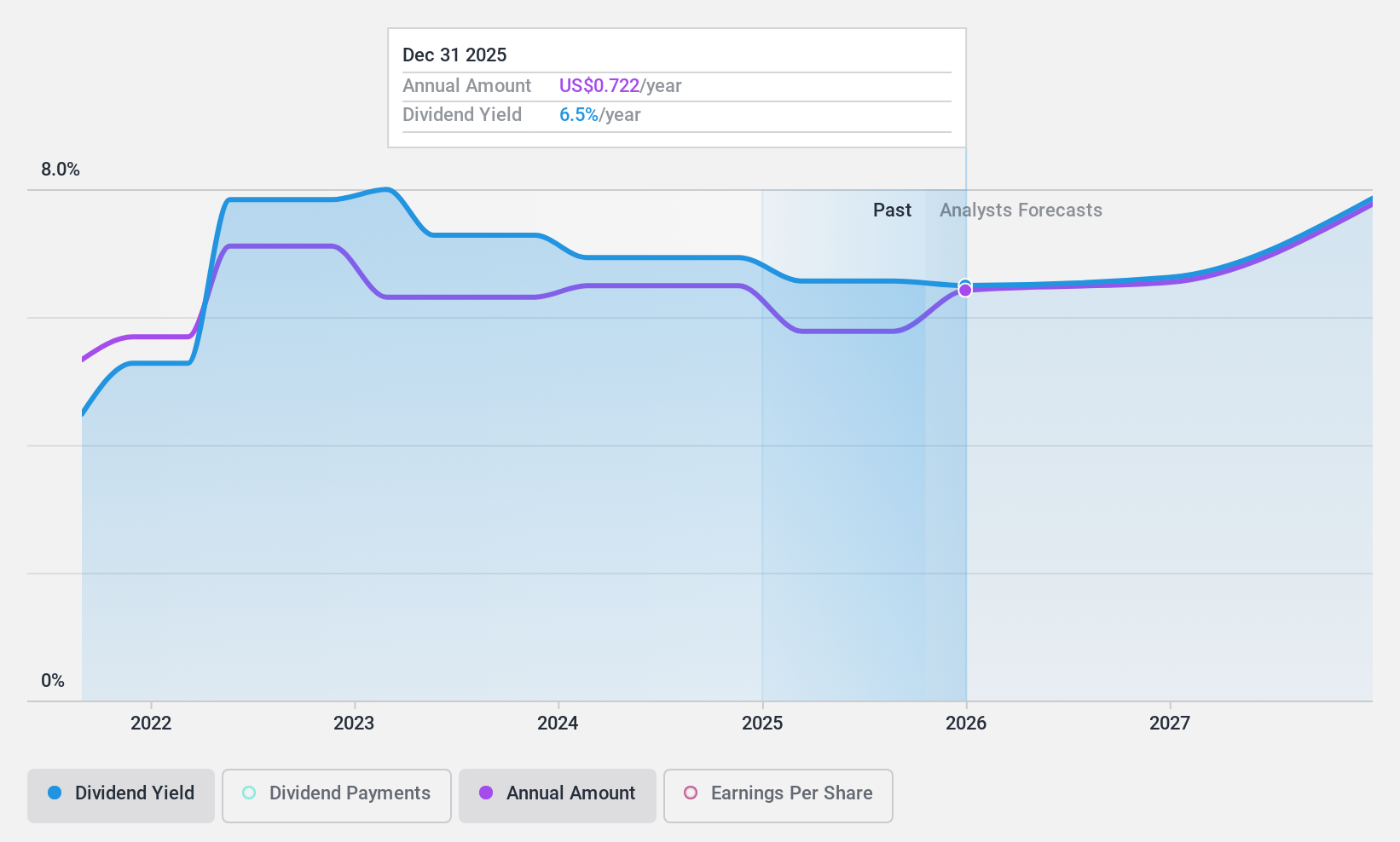

Dividend Yield: 6.2%

Vinci Partners Investments Ltd. recently reported a significant increase in Q1 earnings with net income rising to BRL 46.16 million from BRL 32.74 million year-over-year, enhancing its financial stability. Despite this, the firm reduced its quarterly dividend to US$0.17 per share, reflecting a cautious approach given its payout ratio of 83.4%. The dividends appear sustainable supported by both earnings and cash flows (cash payout ratio at 61.7%). However, Vinci's dividend history is relatively short at three years, which may raise concerns about long-term reliability despite a high current yield of 6.25%, placing it in the top quartile of US market dividend payers.

- Get an in-depth perspective on Vinci Partners Investments' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Vinci Partners Investments shares in the market.

Radian Group (NYSE:RDN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Radian Group Inc., operating in the United States, focuses on the mortgage and real estate services sectors with a market capitalization of approximately $4.71 billion.

Operations: Radian Group Inc. generates its revenue primarily from the mortgage insurance segment, which accounted for approximately $1.12 billion.

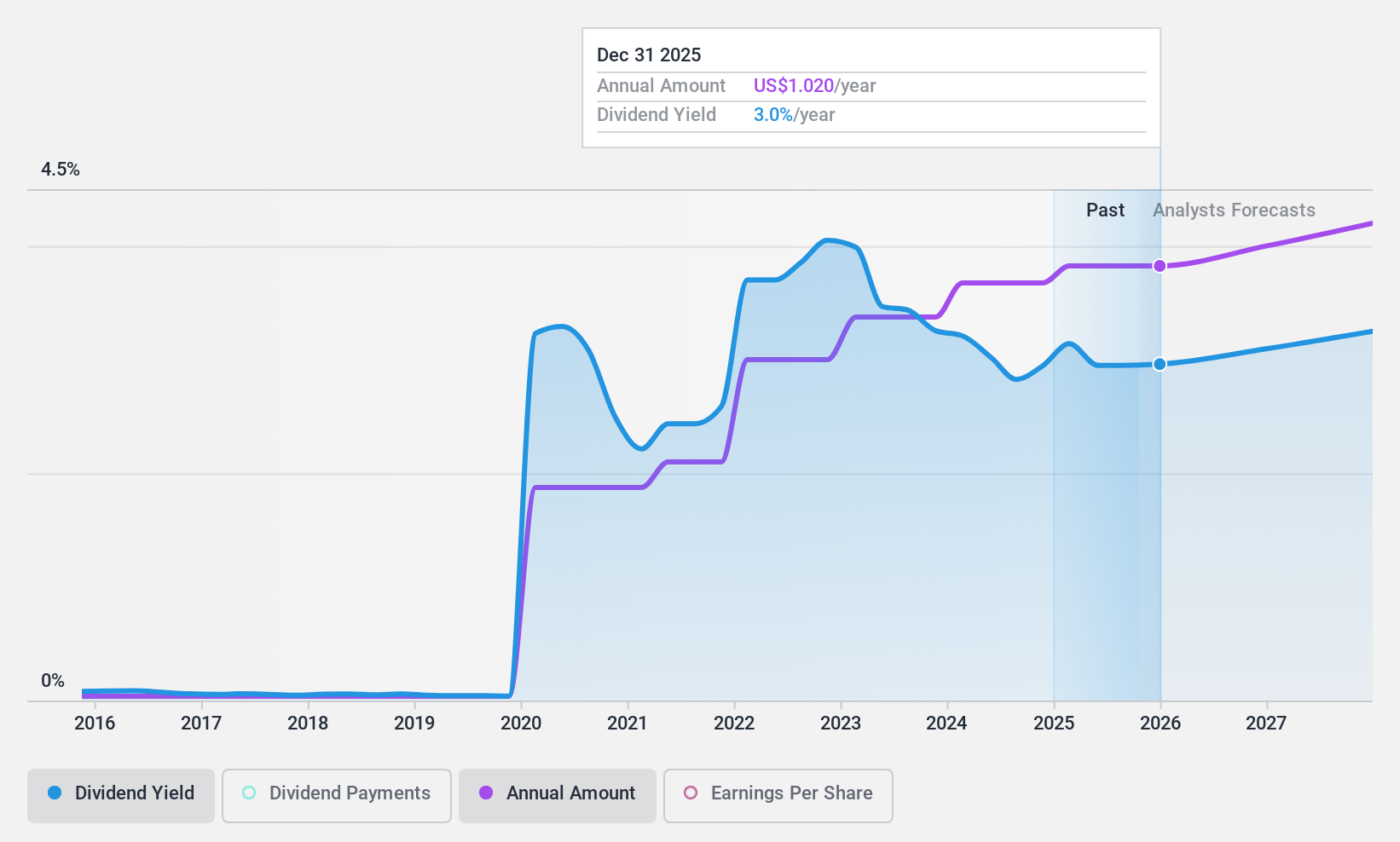

Dividend Yield: 3.1%

Radian Group Inc. maintains a low payout ratio at 24.2%, ensuring dividends are well covered by earnings, alongside a cash payout ratio of 32.7%. Dividends have shown stability and growth over the past decade, though its current yield of 3.13% falls below the top US dividend payers' average. Recent activities include affirming quarterly dividends and significant share repurchases, indicating confidence in financial health despite forecasts of declining earnings over the next three years.

- Delve into the full analysis dividend report here for a deeper understanding of Radian Group.

- Our expertly prepared valuation report Radian Group implies its share price may be lower than expected.

Teekay Tankers (NYSE:TNK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teekay Tankers Ltd. operates globally, offering crude oil and other marine transportation services with a market capitalization of approximately $2.48 billion.

Operations: Teekay Tankers Ltd. generates its revenue primarily from tanker services, totaling approximately $1.31 billion.

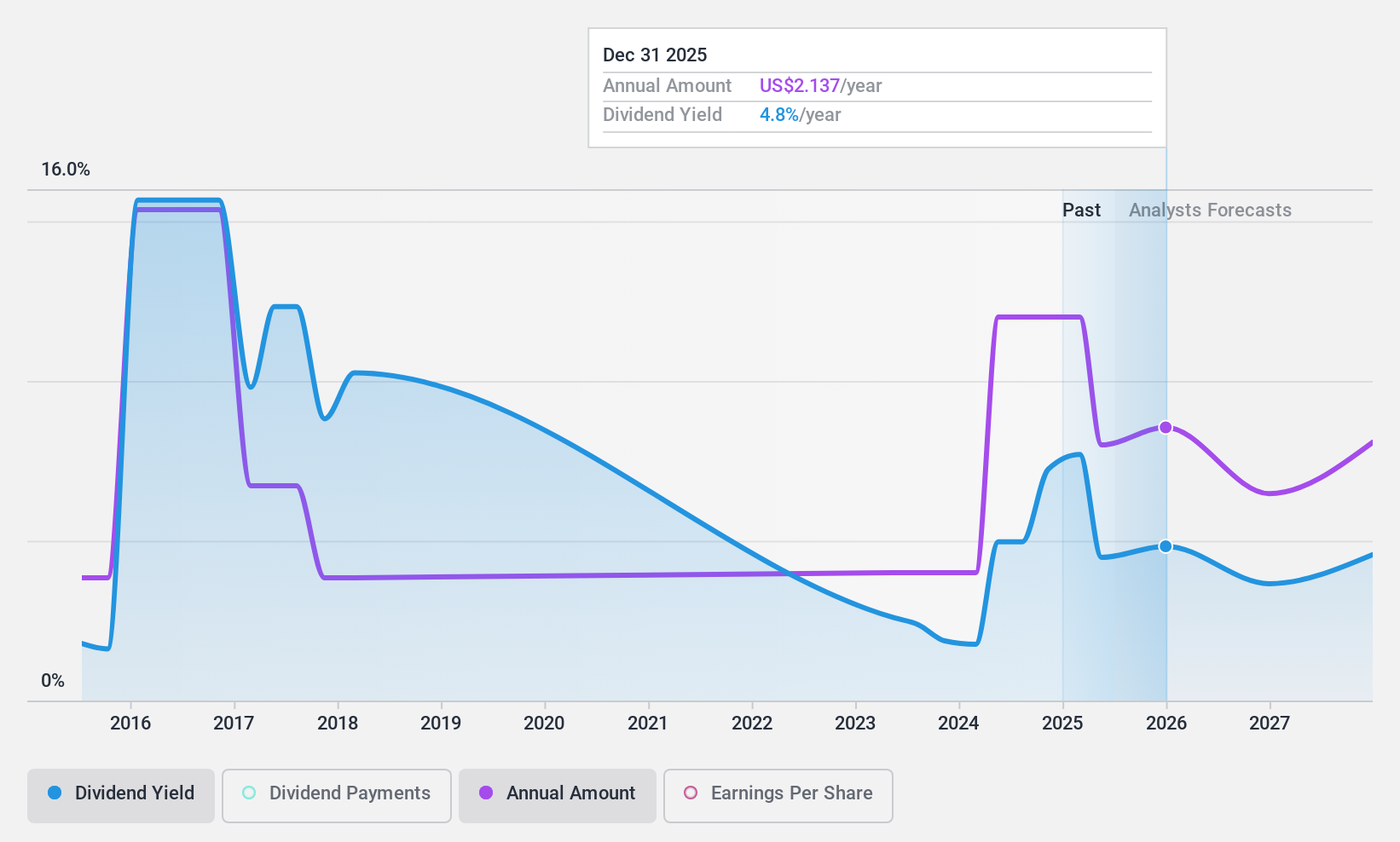

Dividend Yield: 4.1%

Teekay Tankers Ltd. offers a dividend yield of 4.14%, which is slightly below the top quartile of US dividend stocks. Despite a history of inconsistent dividends, recent financials show strong coverage with a low payout ratio of 7% and cash payout ratio of 17.8%. Earnings have grown by 18.6% over the past year, although they are projected to decrease annually by 7% in the next three years. Recently, Teekay declared both regular and special dividends, underscoring its current liquidity despite earnings volatility.

- Navigate through the intricacies of Teekay Tankers with our comprehensive dividend report here.

- The analysis detailed in our Teekay Tankers valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Unlock our comprehensive list of 205 Top Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VINP

Vinci Compass Investments

Operates as an asset management firm in Brazil.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives