- United States

- /

- Capital Markets

- /

- NasdaqGS:VCTR

Victory Capital Holdings (VCTR): Assessing Valuation After AUM Growth and Enhanced Financial Flexibility

Reviewed by Kshitija Bhandaru

Victory Capital Holdings (VCTR) has made headlines after announcing an increase in assets under management for September 2025, along with extending and lowering the cost of its credit facility and term loans. These moves are giving the company more financial flexibility, even as some concerns about net outflows linger.

See our latest analysis for Victory Capital Holdings.

Over the past year, Victory Capital Holdings’ stock price has delivered a solid 17.7% total shareholder return. Momentum has been building after a recent 2.3% rise in assets under management and improved balance sheet flexibility. Despite earlier net outflows, investors appear encouraged by management’s efforts to position the company for long-term growth and stability.

If you want to spot more companies with compelling growth trends and strong insider backing, now is a great time to discover fast growing stocks with high insider ownership

With shares trading near their analyst price target after strong recent gains and lingering concerns over asset outflows, investors now face a critical question: Is Victory Capital still undervalued, or is the market already counting on further growth?

Most Popular Narrative: 10.8% Undervalued

With analysts setting a consensus fair value of $76.43, Victory Capital’s last close of $68.16 sits notably below the collective narrative target. This gap, supported by recent strategic moves and operational changes, continues to fuel discussion and speculation about future upside potential.

The global partnership and integration with Amundi and the acquisition of Pioneer Investments allow Victory Capital to access an extensive international distribution network across Europe and Asia. This significantly expands their addressable client base beyond the U.S., positioning the company for higher long-term asset inflows and revenue growth.

What secret growth formulas are baked into this narrative’s call for a higher price? Behind the target is an ambitious vision of scaling earnings and margins in a fiercely competitive market. The details could surprise you. Dive in to see what sets this narrative apart from the pack.

Result: Fair Value of $76.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent net outflows and integration risks from rapid acquisitions could challenge Victory Capital's ambitious growth narrative if not carefully managed.

Find out about the key risks to this Victory Capital Holdings narrative.

Another View: Multiples Tell a Cautionary Story

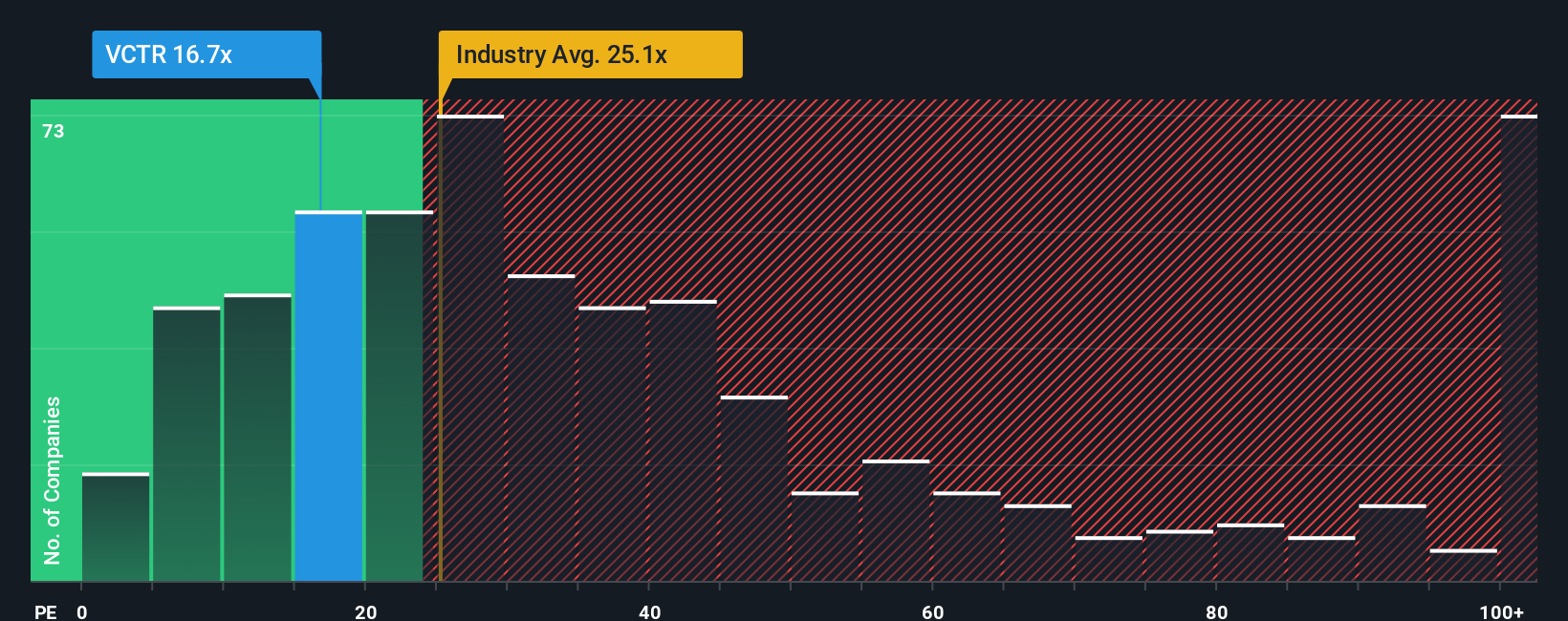

While the analyst consensus points to upside potential, the market is also weighing Victory Capital’s valuation against peers. Its current price-to-earnings ratio of 17.2x is higher than similar companies (13x), but still below the US industry average (25.8x). The fair ratio the market could move toward is 23.3x. This suggests room for re-rating, but it also signals valuation risk if growth expectations stall. Does this gap offer an opportunity, or should investors be wary?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Victory Capital Holdings Narrative

If you see things differently or want to dig even deeper, you can craft your own evidence-based thesis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Victory Capital Holdings.

Looking for more investment ideas?

Smart investors stand out by spotting early opportunities before the crowd moves in. Don’t sit on the sidelines when you could be shaping your own winning portfolio.

- Catch the next surge in AI innovation by searching these 25 AI penny stocks, and uncover companies at the forefront of artificial intelligence breakthroughs.

- Zero in on future blockchain leaders as you review these 79 cryptocurrency and blockchain stocks, powering everything from secure payments to game-changing digital platforms.

- Start building resilient income streams with these 18 dividend stocks with yields > 3%, featuring firms offering yields greater than 3% and robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VCTR

Victory Capital Holdings

Operates as an asset management company in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives