- United States

- /

- Consumer Finance

- /

- NasdaqGS:UPST

Is Upstart Holdings Poised for a Rebound After Its 24% Drop This Month?

Reviewed by Bailey Pemberton

- Wondering if Upstart Holdings is at a bargain, overpriced, or primed for a rebound? You are not alone. Many investors are questioning what the real value story is for this stock right now.

- The company’s share price has seen swings lately, up just 0.3% over the past week but down 24.2% in the last month. This brings its year-to-date performance to a steep -36.3% and -43.4% over the last year, despite still being up more than 100% over three years.

- Recent headlines have spotlighted regulatory shifts in lending technology and increasing competition in the AI-driven loan approval space. These are key factors fueling those sharp moves. News around partnerships with emerging fintechs and a changing macro backdrop are adding both uncertainty and opportunity into the mix.

- When it comes to valuation, Upstart Holdings scores just 1 out of 6 on our undervaluation checks, so a deeper dive is definitely needed. Let's break down the usual valuation methods and explore a smarter approach at the end.

Upstart Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Upstart Holdings Excess Returns Analysis

The Excess Returns valuation model estimates a company’s intrinsic value based on how much return it is generating above its cost of equity. It focuses on whether the company is making more from its invested capital than it would by simply matching market returns. This approach is particularly useful for evaluating businesses where consistent profitability and efficient capital allocation drive value creation.

For Upstart Holdings, the numbers stack up as follows:

- Book Value: $7.65 per share

- Stable Earnings per Share (EPS): $2.89 per share

(Source: Weighted future Return on Equity estimates from 5 analysts.) - Cost of Equity: $1.00 per share

- Excess Return: $1.89 per share

- Average Return on Equity: 26.20%

- Stable Book Value: $11.05 per share

(Source: Weighted future Book Value estimates from 2 analysts.)

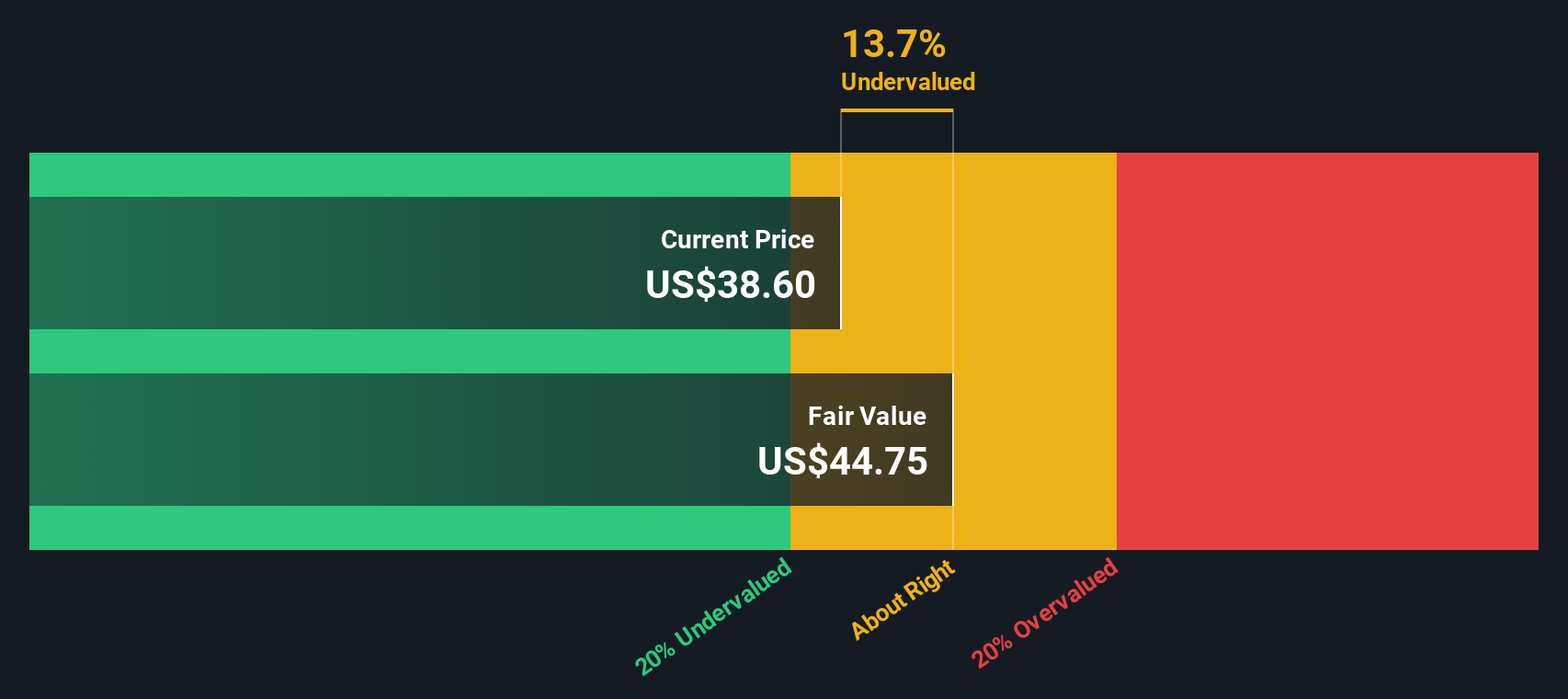

This model implies an intrinsic value of $43.53 per share, suggesting the stock is currently trading 11.1% below its fair value. This suggests Upstart Holdings appears undervalued compared to what its above-average returns could justify, especially if these returns hold steady.

Result: UNDERVALUED

Our Excess Returns analysis suggests Upstart Holdings is undervalued by 11.1%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Upstart Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a useful yardstick for valuing profitable companies because it connects a company's share price directly to how much it earns. It helps investors gauge whether a stock is trading at a premium or discount relative to its earnings power. In most markets, rapidly growing companies or those with lower risk generally command a higher PE ratio, while slower-growth or riskier firms tend to have lower ratios.

Upstart Holdings currently trades at a lofty PE ratio of 117x. For context, the average PE for the Consumer Finance industry stands at just 10x, and its peers average around 7.6x. On the surface, this means Upstart's valuation is significantly higher than others in its space, likely reflecting investor expectations for superior growth or profitability in the future.

Rather than leaning solely on these broad benchmarks, Simply Wall St’s proprietary Fair Ratio digs deeper. It considers the company’s growth rate, industry dynamics, profit margins, size, and potential risks to provide a more tailored sense of what a reasonable PE should be for Upstart specifically. For this company, the Fair Ratio comes in at 43.5x, which is much higher than the industry average, but still well below Upstart’s actual multiple.

Comparing the Fair Ratio of 43.5x and Upstart’s real PE of 117x suggests the stock is currently overvalued based on this approach. While the company may still have long-term potential, its share price could be running ahead of the fundamentals right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Upstart Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your investment “story.” It is how you connect your perspective on a company’s future to the actual numbers, including your estimates of fair value, revenue, earnings, and margins.

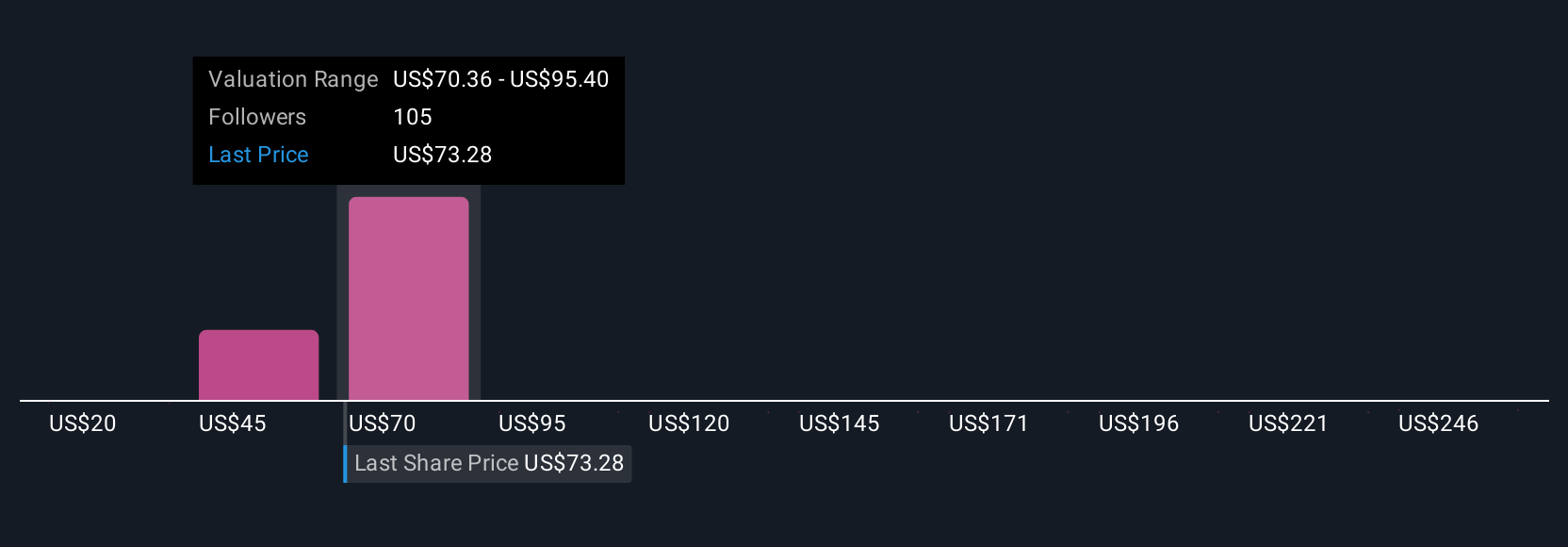

Narratives go beyond the numbers by linking what you know or believe about a company with the financial models behind a stock’s price. On Simply Wall St’s platform Community page, millions of investors use Narratives to quickly see not just the numbers but also the “why” behind them, making investment decisions more accessible and personal.

Narratives help you decide whether to buy or sell by comparing your Fair Value to the current Price, and they update in real time as new news or earnings come in. For example, some investors see Upstart Holdings surging to $105 thanks to new product growth and improved automation, while others foresee risks that bring targets as low as $20.

By using a Narrative, you can test how changing your own assumptions about growth, margins, or industry conditions would affect your valuation story, turning uncertainty into actionable insight.

Do you think there's more to the story for Upstart Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPST

Upstart Holdings

Operates a cloud-based artificial intelligence (AI) lending platform in the United States.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives