- United States

- /

- Capital Markets

- /

- NasdaqGS:TW

Rich Repetto Joins Tradeweb Markets (NasdaqGS:TW) Board Enhancing Audit and Risk Expertise

Reviewed by Simply Wall St

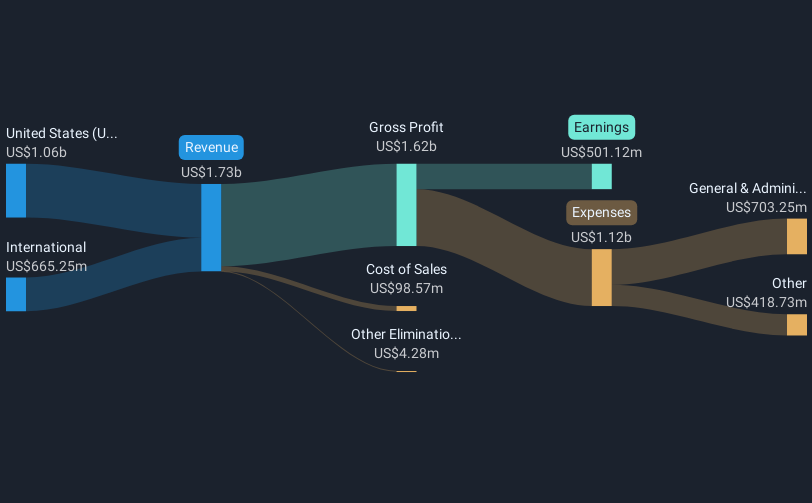

Tradeweb Markets (NasdaqGS:TW) recently appointed Rich Repetto to its Board of Directors, coinciding with a 5% share price increase over the last month. This leadership change may have impacted investor confidence, suggesting enhanced governance and strategic oversight. The company's Q4 and full-year 2024 earnings were positive, with notable increases in revenue and net income, likely underpinning the stock's movement. Market conditions were turbulent, with the Dow and S&P 500 experiencing significant declines due to economic concerns and tariff impacts, yet Tradeweb’s shares rose, indicating robust institutional and investor backing despite broader market strains. The company's collaboration with Coremont to integrate fixed income execution workflows could signal potential growth opportunities. Moreover, the increased quarterly dividend and ongoing share buyback program further reinforced investor confidence, potentially contributing to Tradeweb’s recent price improvement against a backdrop of challenging market conditions.

Unlock comprehensive insights into our analysis of Tradeweb Markets stock here.

Over the last five years, Tradeweb Markets Inc. has achieved a total shareholder return of 213.90%. This growth reflects the company's strong performance relative to broader market trends. Although in the past year, Tradeweb has outperformed the US market by achieving a return above the market's 14% increase, the firm's significant earnings growth has been a critical driver in the longer term. Tradeweb's earnings have grown significantly over the past five years at an annual rate of 26.6%, which is well above the Capital Markets industry average of 17.2%.

Key developments that have supported Tradeweb's robust performance include a successful implementation of strategic collaborations, such as the integration with Coremont's platform to enhance trading services for asset managers announced in February 2025. Additionally, the regular share buyback program, with 1,351,843 shares repurchased for US$120.1 million since December 2022, and an increased quarterly dividend, underscore the company's commitment to returning value to shareholders. These initiatives, alongside strong revenue growth, have been integral to Tradeweb's impressive long-term returns.

- Get the full picture of Tradeweb Markets' valuation metrics and investment prospects—click to explore.

- Understand the uncertainties surrounding Tradeweb Markets' market positioning with our detailed risk analysis report.

- Have a stake in Tradeweb Markets? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tradeweb Markets might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TW

Tradeweb Markets

Tradeweb Markets Inc., together with its subsidiaries, builds and operates electronic marketplaces worldwide.

Flawless balance sheet with solid track record.