- United States

- /

- Consumer Finance

- /

- NasdaqGS:TREE

Growth Investors: Industry Analysts Just Upgraded Their LendingTree, Inc. (NASDAQ:TREE) Revenue Forecasts By 19%

LendingTree, Inc. (NASDAQ:TREE) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The consensus estimated revenue numbers rose, with their view now clearly much more bullish on the company's business prospects.

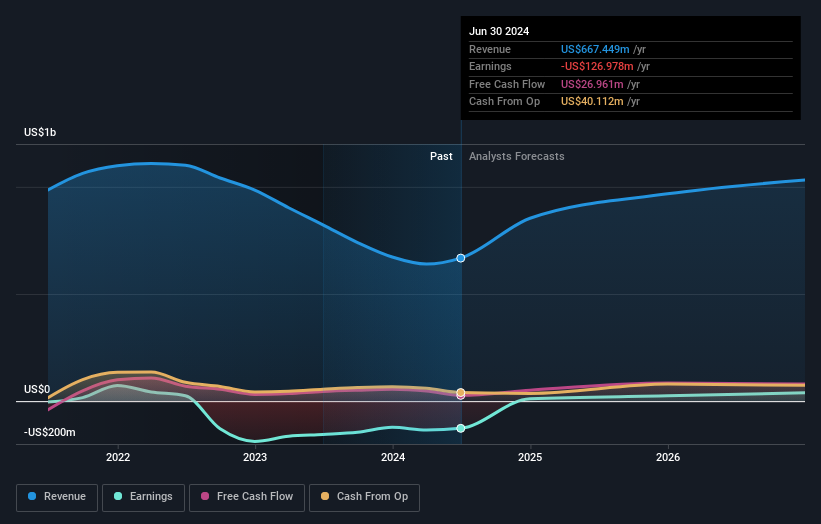

Following the upgrade, the most recent consensus for LendingTree from its eight analysts is for revenues of US$853m in 2024 which, if met, would be a major 28% increase on its sales over the past 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of US$0.59 per share this year. Prior to this update, the analysts had been forecasting revenues of US$717m and earnings per share (EPS) of US$0.57 in 2024. The forecasts seem more optimistic now, with a nice gain to revenue and a slight bump in earnings per share estimates.

Check out our latest analysis for LendingTree

With these upgrades, we're not surprised to see that the analysts have lifted their price target 18% to US$62.88 per share.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. For example, we noticed that LendingTree's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 63% growth to the end of 2024 on an annualised basis. That is well above its historical decline of 7.2% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 12% annually. So it looks like LendingTree is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. There was also a nice increase in the price target, with analysts apparently feeling that the intrinsic value of the business is improving. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at LendingTree.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple LendingTree analysts - going out to 2026, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TREE

LendingTree

Through its subsidiary, operates online consumer platform in the United States.

Reasonable growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026