- United States

- /

- Capital Markets

- /

- NasdaqGS:TPG

TPG (NasdaqGS:TPG) Eyes Siemens Gamesa Acquisition As Stock Falls 14% Last Week

Reviewed by Simply Wall St

TPG (NasdaqGS:TPG) is leading a consortium planning to acquire Siemens Gamesa Renewable Power, a move set against a turbulent market backdrop. The company's share price fell 14% last week, coinciding with a broader market downturn where both the S&P 500 and Nasdaq dropped over 9% amid global trade concerns and new tariffs. While TPG's major acquisition efforts and financing strategies, such as the IPO exploration of its cybersecurity firm Delinea, may position it for growth, the immediate market environment has overshadowed these initiatives. The price shift reflects a composite effect of macroeconomic volatility and company-specific developments.

Every company has risks, and we've spotted 1 warning sign for TPG you should know about.

The recent announcement of TPG's consortium bid to acquire Siemens Gamesa Renewable Power may influence the company's strategic narrative, positioning it for potential growth in renewable energy investments despite a challenging market environment. With TPG's share price currently at US$47.72, setting it about 30.4% lower than the consensus price target of US$67.69, there appears to be significant upward potential in analyst forecasts. However, the broader economic conditions and the anticipated impact on TPG's capital markets outlook cannot be ignored. These elements might add complexity to revenue expectations and earnings forecasts. As TPG's expansion into areas like private wealth and infrastructure could diversify income streams, the success of these strategies might mitigate potential integration challenges from the Angelo Gordon acquisition.

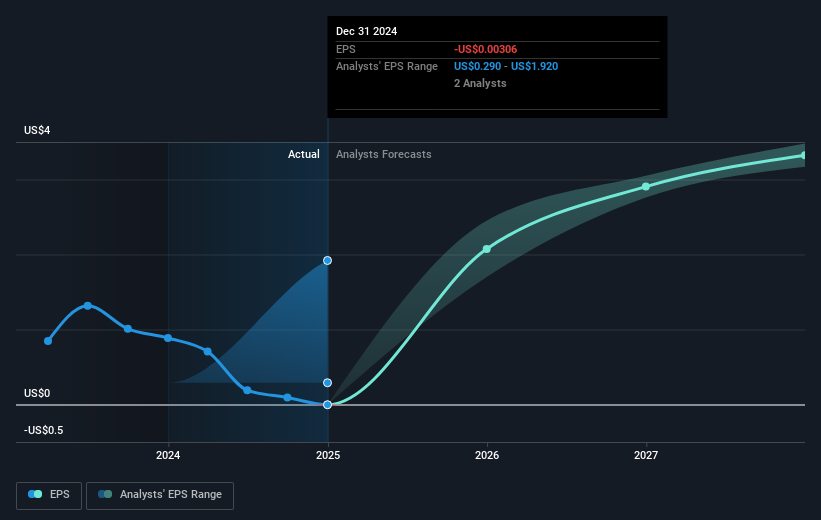

Over the last three years, TPG's total return, including share price appreciation and dividends, reached 62.27%, offering investors a significant return on their investment. This is in contrast to its performance over the past year where TPG underperformed the US market and the Capital Markets industry, showing declines relative to respective benchmarks. Such longer-term performance suggests that while immediate conditions are not favorable, the company has historically delivered favorable returns over extended periods. Analysts expect a decrease in revenue by 11.2% per year over the next three years, yet also forecast TPG to reach profitability, contrasting with its current negative earnings. The current market volatility and price fluctuations, therefore, need careful consideration for investors evaluating the stock's future potential, especially given the substantial consensus for a positive correction towards the analyst price target.

Click here to discover the nuances of TPG with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TPG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TPG

TPG

Operates as an alternative asset manager in the United States and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives