- United States

- /

- Capital Markets

- /

- NasdaqGS:TPG

Can TPG’s (TPG) Strong Earnings Execution Redefine Its Competitive Edge in a Shifting Industry?

Reviewed by Sasha Jovanovic

- TPG recently reported quarterly results that exceeded expectations, with both revenue and earnings coming in above market forecasts despite mixed industry trends.

- This performance sets TPG apart as peers have experienced uneven results, suggesting strong operational capabilities and effective execution on recent strategic initiatives.

- We’ll explore how TPG’s robust earnings performance influences its investment narrative and future earnings potential amid evolving industry conditions.

Find companies with promising cash flow potential yet trading below their fair value.

TPG Investment Narrative Recap

To own TPG stock, investors need confidence in the company's ability to grow fee-based revenue in a challenging private markets environment, underpinned by successful fundraising and diversified product expansion. The recent Q2 earnings beat supports this narrative, but it does not materially change the key short-term catalyst, continued fundraising momentum, nor does it reduce the biggest risk of industry-wide fundraising slowdowns as cautious client sentiment persists.

Among recent announcements, TPG’s ongoing negotiations to acquire a stake in Creative Planning stand out. If completed, this acquisition would enhance platform scale and fee generation, aligning directly with TPG’s focus on expanding and diversifying its revenue base, factors that underlie its growth catalysts.

By contrast, sustained caution among private equity clients could still pose significant challenges for future capital inflows, something investors should be aware of as...

Read the full narrative on TPG (it's free!)

TPG's outlook anticipates $2.3 billion in revenue and $827.7 million in earnings by 2028. This assumes a 16.5% annual decline in revenue and an increase in earnings of $807.5 million from the current $20.2 million.

Uncover how TPG's forecasts yield a $65.54 fair value, a 19% upside to its current price.

Exploring Other Perspectives

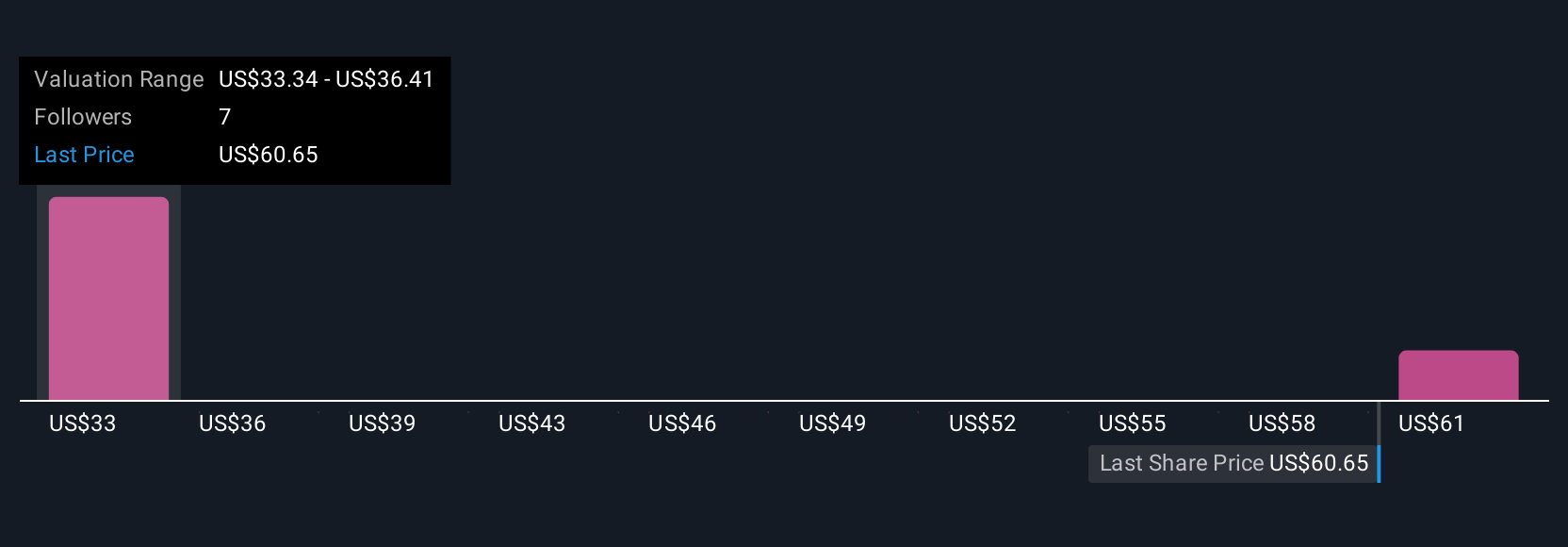

Two Simply Wall St Community fair value estimates for TPG range widely from US$33.17 to US$65.54 per share. With analysts watching fundraising momentum as a key driver, explore how your outlook compares to others.

Explore 2 other fair value estimates on TPG - why the stock might be worth as much as 19% more than the current price!

Build Your Own TPG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TPG research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TPG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TPG's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TPG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TPG

TPG

Operates as an alternative asset manager in the United States and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives