- United States

- /

- Capital Markets

- /

- NasdaqGS:TIGR

Assessing UP Fintech Holding’s (NasdaqGS:TIGR) Valuation After Strong Quarterly Earnings Growth

Reviewed by Simply Wall St

UP Fintech Holding (NasdaqGS:TIGR) is grabbing headlines right now, and for good reason. Its latest earnings report landed with several eye-catching figures. The company just posted a sharp rise in both revenue and net income versus the same period last year, the kind of comeback that tends to prompt investors to take a closer look. When a business delivers profits and growth at this pace, it forces everyone on the sidelines to rethink how the future might unfold.

The upbeat earnings release arrives after a stretch of strong momentum for the stock. Over the past year, shares have soared by over 235%, with gains accelerating further in the past 3 months. This burst of growth is not just a one-off. The latest quarterly numbers add to a solid trend of revenue and profit expansion and follow recent boardroom changes as well. The takeaway? Momentum appears to be building, not fading, as new financial results set expectations even higher.

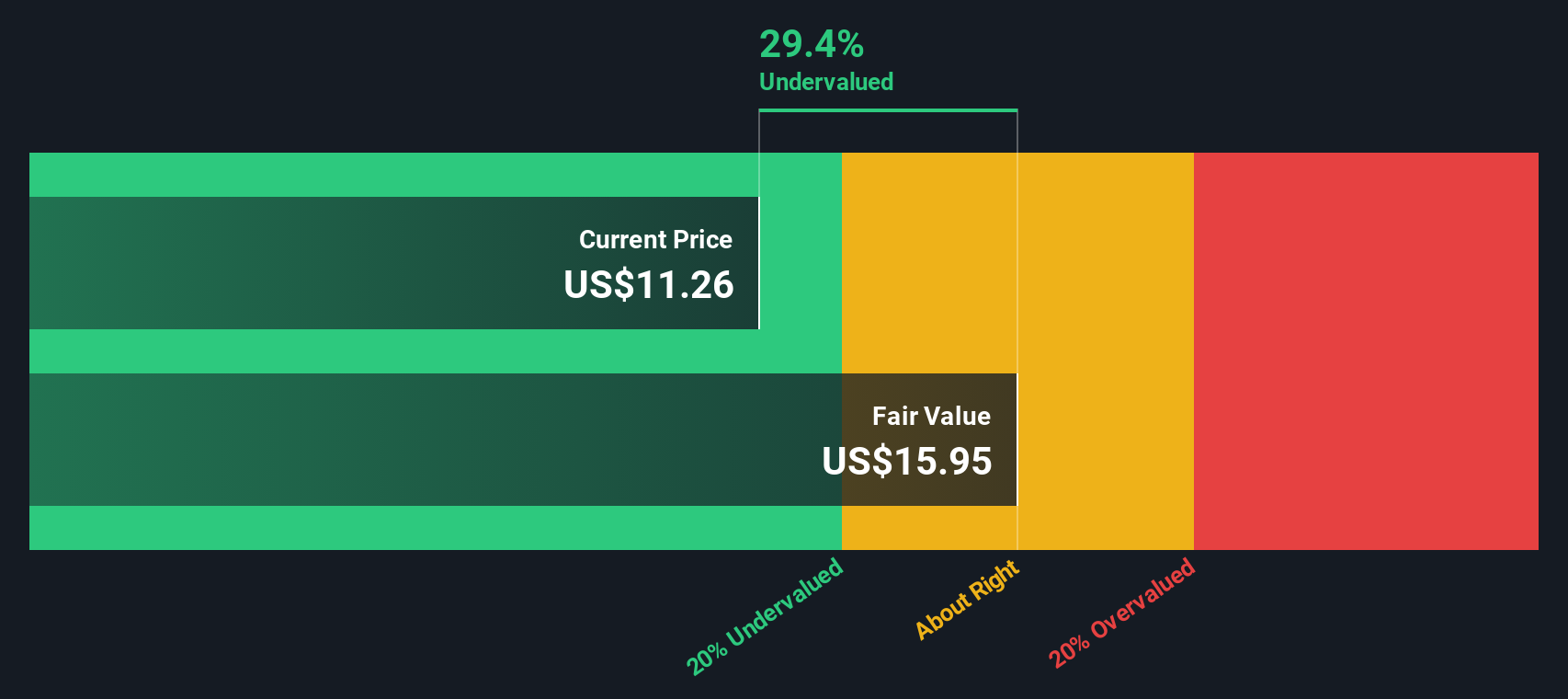

After such a remarkable run, is the market too optimistic, or could UP Fintech Holding still be trading at a discount to its true worth?

Most Popular Narrative: 6.2% Undervalued

The most widely followed narrative suggests that UP Fintech Holding is currently undervalued by a modest margin, based on forward-looking growth and profitability assumptions.

Strategic expansion into high-potential markets, notably Hong Kong, and product lines such as wealth management, investment banking, and digital assets is opening substantial new revenue channels. If these trends continue, this approach can mitigate cyclicality and further stabilize or grow both revenue and net margins over time.

Is there a secret formula fueling this fair value call? The narrative balances bold projections for future growth with a discounted valuation method. Want to know which specific assumptions about business momentum, forward earnings, and future margins led analysts to mark UP Fintech as underestimated? The details behind these forecasts might surprise you.

Result: Fair Value of $13.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained surges in revenue and client inflows, or new profit margin highs, could quickly shift sentiment and challenge today's cautious narrative.

Find out about the key risks to this UP Fintech Holding narrative.Another View: SWS DCF Model

Looking from a different angle, our SWS DCF model also points to UP Fintech Holding being undervalued. This approach weighs future cash flows and discounts them, providing a distinct perspective compared to the earlier narrative. Could both methods be reading the market right, or is there a disconnect waiting to surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UP Fintech Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UP Fintech Holding Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily build your own UP Fintech view in just a few minutes. Do it your way

A great starting point for your UP Fintech Holding research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Opportunity favors the prepared. Don't limit your portfolio to just one story. Why not hunt down stocks with untapped potential and get ready for your next move?

- Uncover companies leading breakthroughs in artificial intelligence when you scan for competitive edge with AI penny stocks right now.

- Grow your passive income by targeting shares offering healthy yields using our game-changing dividend stocks with yields > 3%.

- Capitalize on future tech by spotting tomorrow's leaders in advanced computing through our exclusive quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:TIGR

UP Fintech Holding

Provides online brokerage services focusing on Chinese investors in New Zealand, the Cayman Island, Singapore, the United States, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives