- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

Is There Still Upside in SoFi After Its 104% Surge and New Service Launches?

Reviewed by Bailey Pemberton

- Wondering if SoFi Technologies is a deal in today’s market? You’re not alone, especially with so much buzz about its long-term potential and how “expensive” or “undervalued” it really is.

- After soaring a staggering 104.1% over the past year, SoFi’s stock has caught a lot of attention, and even its 96.9% year-to-date run shows just how quickly perception can shift.

- Recent headlines about SoFi breaking into new services, partnerships with major names, and changes in the fintech landscape have fueled discussion about what is driving these outsized moves. Industry chatter on customer growth and fintech competition is amplifying the focus on where SoFi fits in among digital finance leaders.

- Despite all the excitement, SoFi earns a valuation score of 0 out of 6 on our checklist, meaning it isn’t undervalued by any of the usual metrics. Let’s unpack what goes into that score by looking at the classic valuation methods. We will then introduce a fresh approach at the end that may change how you look at SoFi’s true worth.

SoFi Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SoFi Technologies Excess Returns Analysis

The Excess Returns valuation model estimates a company's intrinsic worth based on how much value it can generate above its cost of equity. It focuses on comparing return on invested capital with growth projections and offers insight into whether the company is delivering shareholder value above what investors require for risk.

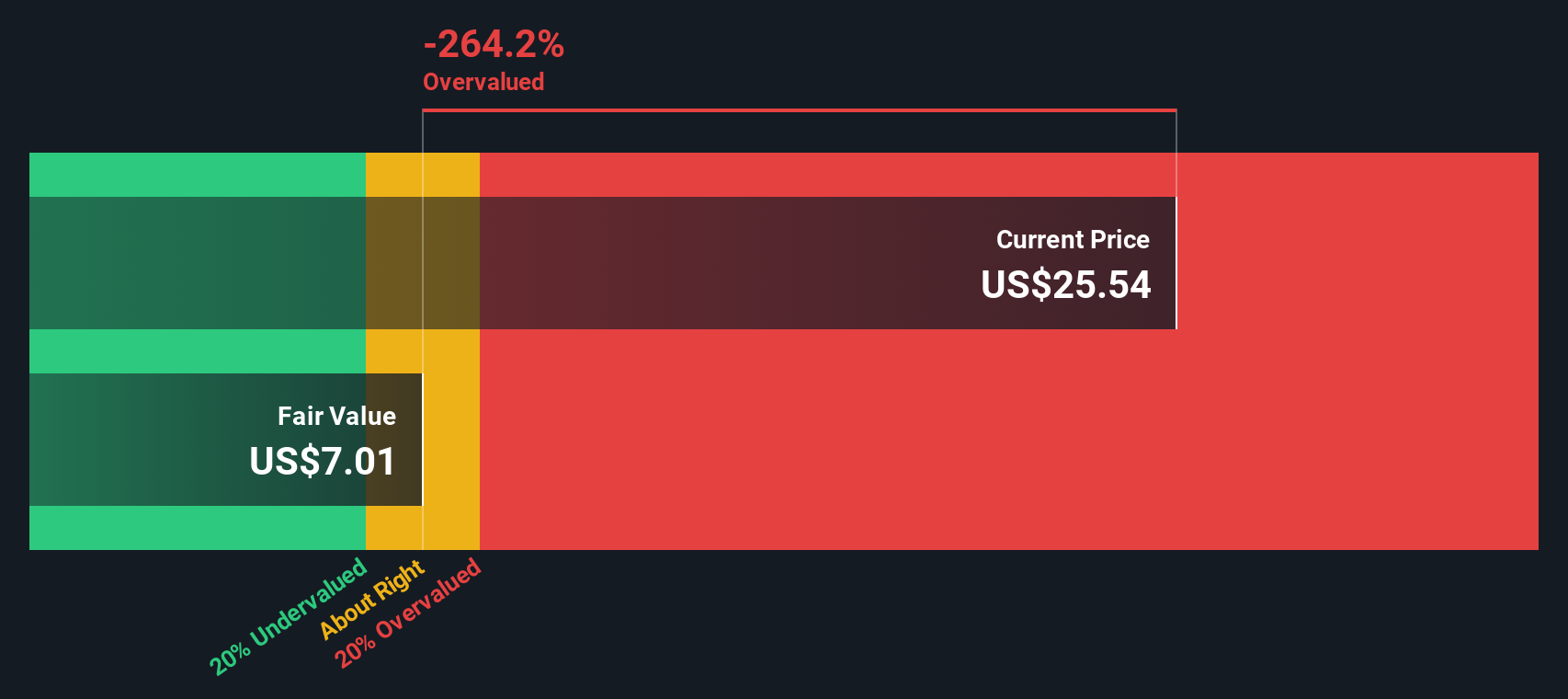

For SoFi Technologies, analysts forecast a future Book Value of $7.29 per share and a Stable Book Value rising to $7.68 per share, based on weighted estimates from seven analysts. The Stable EPS is projected at $0.69 per share, according to the consensus of five analysts drawing from future Return on Equity estimates. The model identifies SoFi’s Cost of Equity at $0.61 per share, producing an Excess Return of $0.08 per share. This results in an average Return on Equity of 8.97%, which is marginally ahead of the cost required by investors.

Despite these positive signals, the intrinsic value per share computed by the Excess Returns method comes in significantly below SoFi’s current market price. The model indicates the stock is around 199.7% overvalued at current prices, suggesting the market is pricing in growth or profitability beyond what the fundamentals currently support.

Result: OVERVALUED

Our Excess Returns analysis suggests SoFi Technologies may be overvalued by 199.7%. Discover 897 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: SoFi Technologies Price vs Earnings

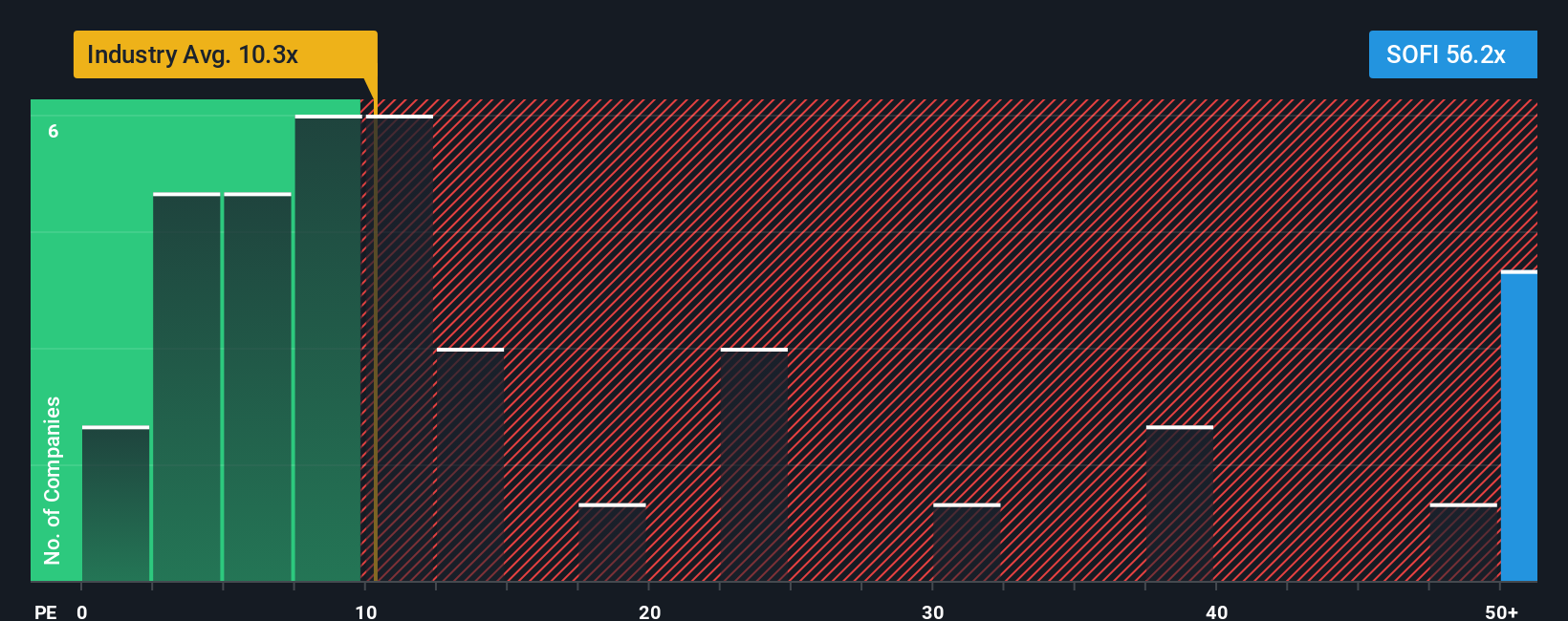

The Price-to-Earnings (PE) ratio is a time-tested metric when evaluating companies that have achieved profitability, as it links a company’s stock price to its per-share earnings. For businesses like SoFi Technologies that are now generating positive earnings, the PE ratio can provide a good sense of whether the stock is trading at a fair price relative to its earning power.

Of course, not all PE ratios should be considered equal. Expectations for future earnings growth, the company’s risk profile, and broader industry trends can all influence what might be considered “normal.” Fast-growing or lower-risk companies usually command higher PE multiples, while mature or riskier ones tend to have lower figures.

Right now, SoFi Technologies trades at a PE ratio of 52.4x, which is notably higher than both the industry average of 9.9x and the peer average of 28.5x. However, to better capture company-specific factors, Simply Wall St calculates a proprietary “Fair Ratio.” For SoFi, this is 25.2x. This Fair Ratio is more comprehensive than industry or peer comparisons because it considers SoFi’s expected earnings growth, underlying risks, profit margins, and market capitalization, giving a more tailored benchmark for valuation.

Comparing SoFi’s current PE ratio of 52.4x to its Fair Ratio of 25.2x suggests that the stock is priced well above what the fundamentals alone would warrant based on its profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoFi Technologies Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives, a simple, powerful approach that connects your personal view of SoFi Technologies to a clear, data-driven financial forecast and fair value.

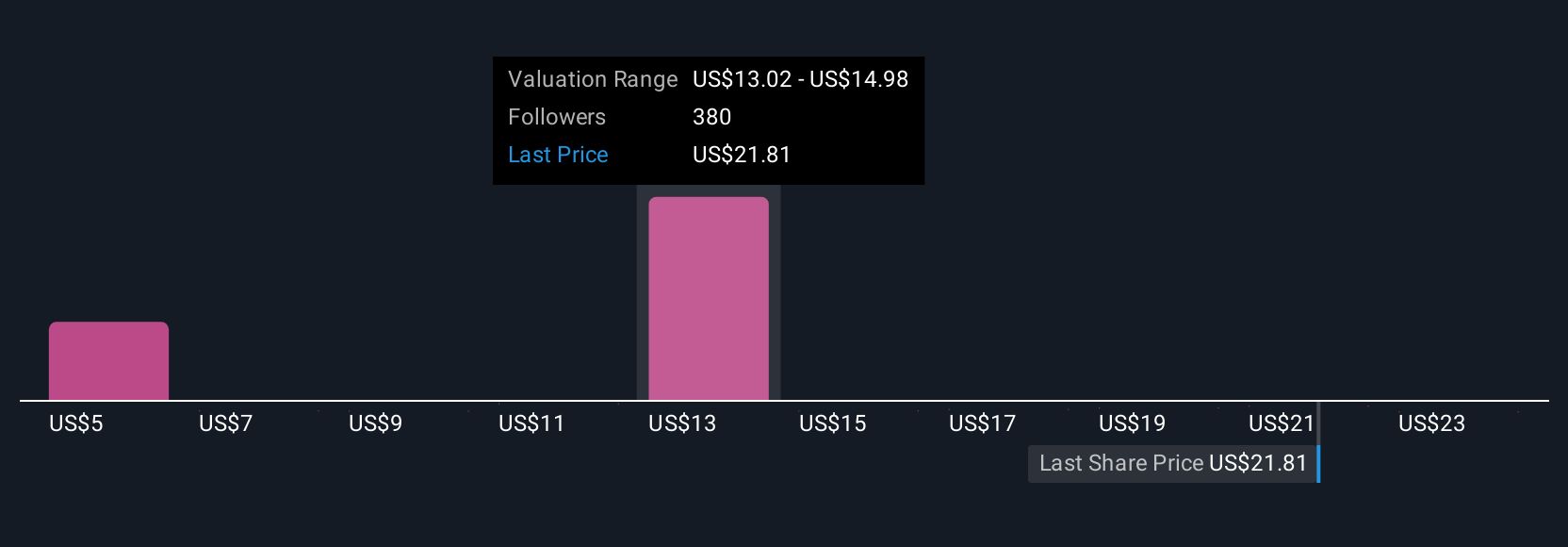

Think of a Narrative as your investment story: you set your fair value, revenue and margin estimates, then use those numbers to quickly see whether SoFi’s current price matches your expectations. This puts the numbers into context and bridges the gap between hard data and your own perspective on the company’s future, offering clarity and confidence rather than relying on generic metrics or analyst opinions alone.

Narratives are available on Simply Wall St’s Community page and are used by millions of investors who want to upgrade their decision making without complicated spreadsheets or research. They dynamically update in real time when new news or earnings come out, keeping your forecasts and fair value fresh.

For example, while one investor’s Narrative sees SoFi’s fair value at $30.00 based on bullish assumptions, another may estimate just $6.00 if they're more cautious about growth. This shows how Narratives turn your unique outlook into a personalized valuation for smarter investment decisions.

Do you think there's more to the story for SoFi Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives