- United States

- /

- Consumer Finance

- /

- NasdaqGS:SOFI

Has SoFi’s 93% 2025 Rally Already Priced In Its Expanding Fintech Ecosystem?

Reviewed by Bailey Pemberton

- Wondering if SoFi Technologies is still a smart buy after its huge run, or if the easy money has already been made? You are not alone, and that is exactly what we are going to unpack here.

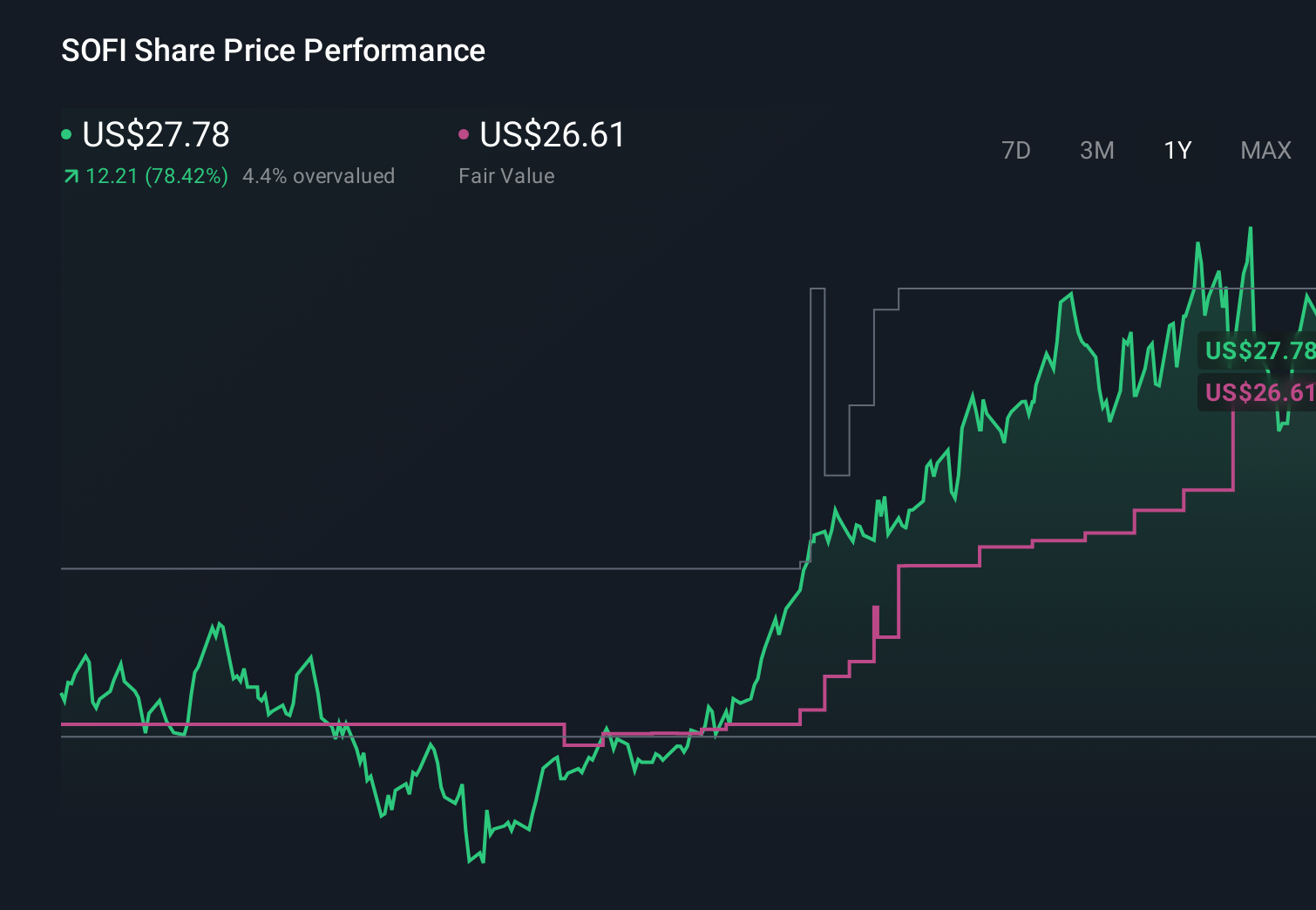

- The stock has cooled slightly this week, but it is still up 1.9% over the last month and 92.8% year to date, with a 77.5% gain over the last year and an eye catching 490.9% over three years.

- Recent headlines have focused on SoFi expanding its product ecosystem, strengthening its banking platform, and steadily adding new members. These developments help explain why investors have been willing to re rate the stock. At the same time, regulators and the broader fintech landscape remain in flux, which keeps both risk and opportunity firmly on the table.

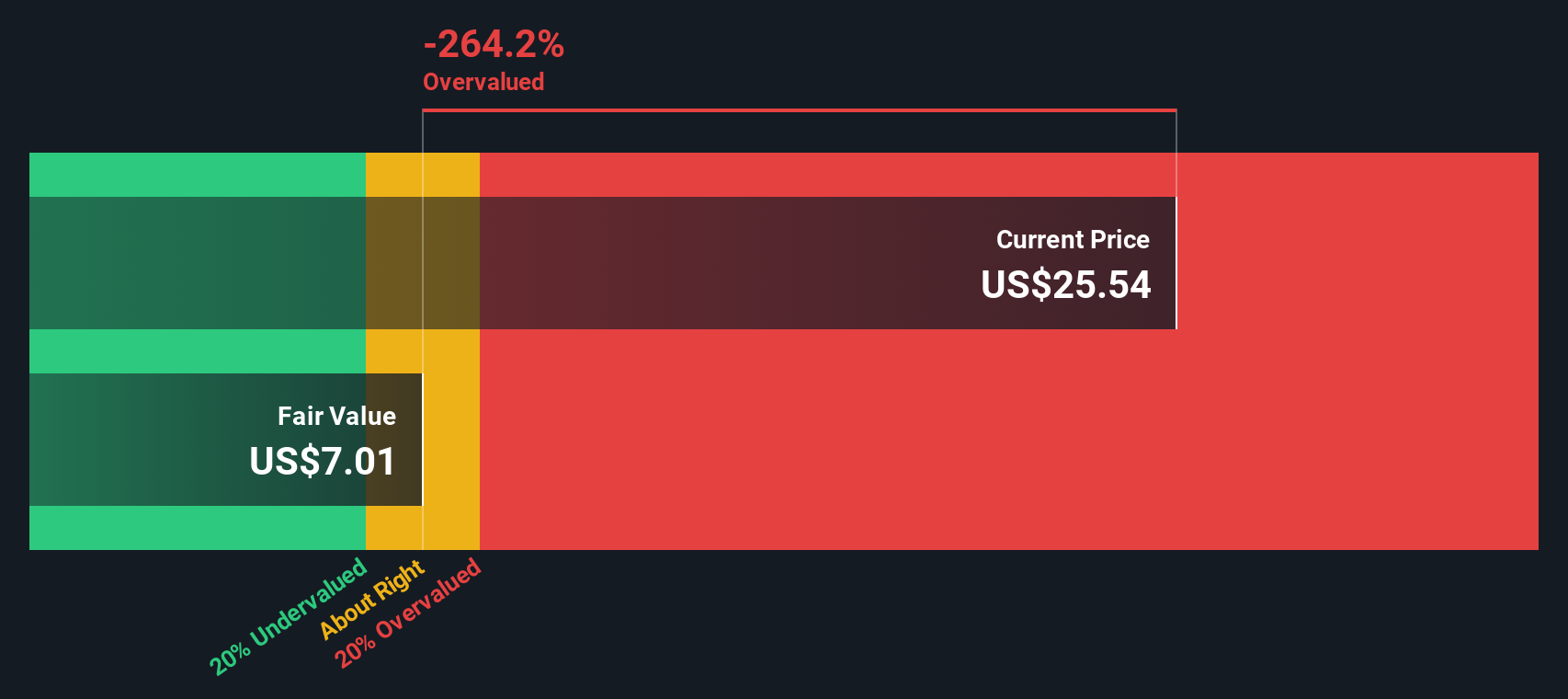

- Despite the excitement, SoFi scores just 0 out of 6 on our undervaluation checks, suggesting the market may already be pricing in a lot of good news. Next, we will walk through the different ways to value SoFi, and then finish with a more holistic way to think about what the stock is really worth in the long run.

SoFi Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: SoFi Technologies Excess Returns Analysis

The Excess Returns model asks a straightforward question: does SoFi generate returns on its equity that are higher than what investors require, and can it sustain that gap over time? That gap, or excess return, is what ultimately drives long-term value creation.

For SoFi, the starting point is a Book Value of $7.29 per share and a Stable EPS estimate of $0.70 per share, based on weighted future return on equity forecasts from five analysts. Against a Cost of Equity of $0.63 per share, this implies an Excess Return of $0.07 per share. That is underpinned by an average projected Return on Equity of 8.96% and a Stable Book Value of $7.80 per share, informed by seven analysts’ book value estimates.

Plugging these inputs into the Excess Returns framework yields an intrinsic value of about $9.32 per share. With the model indicating the stock is roughly 192.4% overvalued relative to the current market price, it suggests investors are paying well ahead of the company’s long-run earnings power.

Result: OVERVALUED

Our Excess Returns analysis suggests SoFi Technologies may be overvalued by 192.4%. Discover 914 undervalued stocks or create your own screener to find better value opportunities.

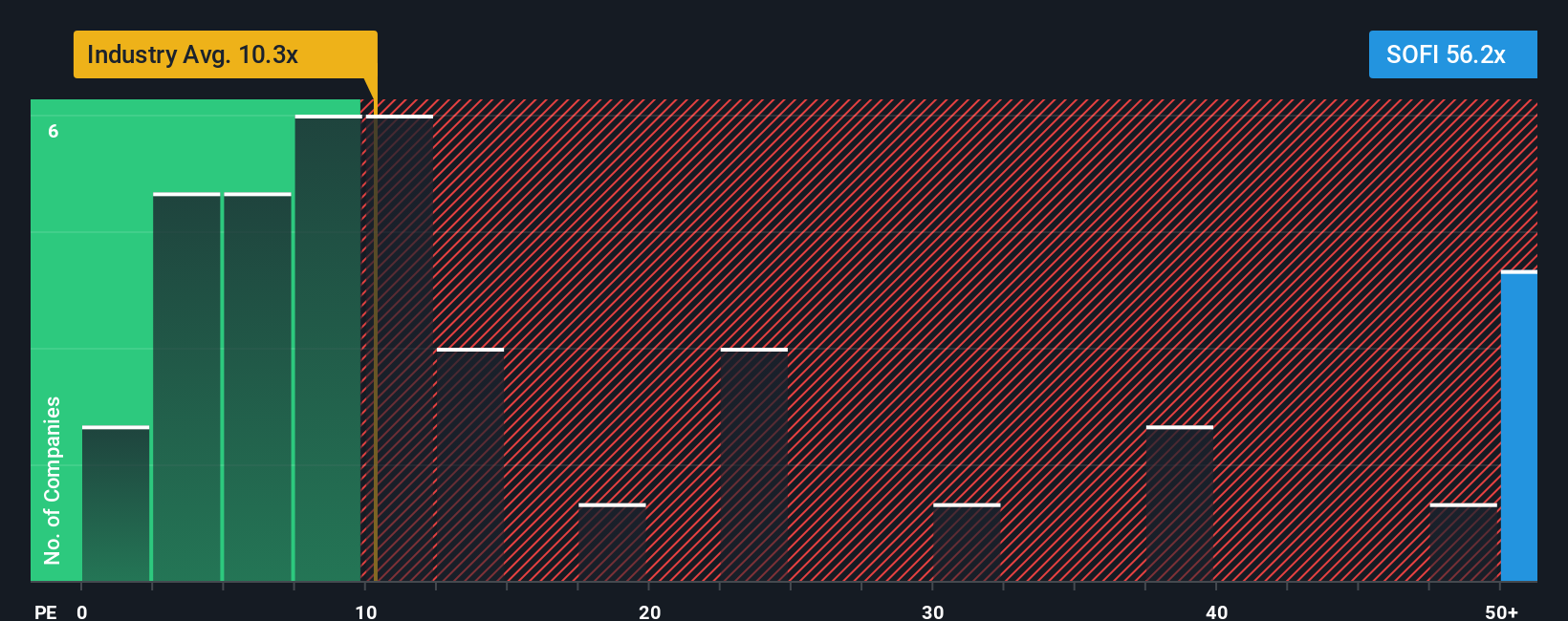

Approach 2: SoFi Technologies Price vs Earnings

For companies that are moving into consistent profitability, the price to earnings ratio is often the most intuitive way to judge valuation, because it ties the share price directly to the profits that ultimately support it. A higher PE can be justified when investors expect faster earnings growth or see the business as relatively low risk, while slower growth or higher uncertainty usually calls for a lower, more conservative multiple.

SoFi currently trades on a PE of about 53.6x, which is well above the Consumer Finance industry average of roughly 10.0x and also richer than the 16.4x average for its peer group. To move beyond simple comparisons, Simply Wall St calculates a proprietary Fair Ratio of 26.2x for SoFi. This is the PE you might expect given its specific mix of earnings growth prospects, business risks, profit margins, industry positioning and market cap. Because this Fair Ratio is tailored to SoFi’s profile, it provides a more nuanced anchor than broad industry or peer averages. Set against today’s 53.6x, the shares look meaningfully overvalued on a PE basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1465 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SoFi Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of SoFi’s story with concrete forecasts for its future revenue, earnings and margins, and then translate that into a fair value. A Narrative on Simply Wall St is your personal investment storyline for a company, where you spell out what you think will drive its growth, how profitable it can become, and what that implies the stock should be worth, instead of just accepting a single PE or DCF outcome. Narratives live inside the Community page on Simply Wall St, used by millions of investors, and they make it easy to decide when to buy or sell by constantly comparing your Narrative Fair Value to the latest share price. They also update dynamically as new earnings, news and estimates are released, so your view stays current without you rebuilding a model from scratch each time. For example, one SoFi Narrative on the platform might assume a fair value near $14 with more modest growth and margins, while another might see closer to $27 with faster adoption and stronger profitability, reflecting how different but structured perspectives can coexist around the same stock.

Do you think there's more to the story for SoFi Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOFI

SoFi Technologies

Provides various financial services in the United States, Latin America, Canada, and Hong Kong.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion