- United States

- /

- Consumer Finance

- /

- NasdaqGS:SLM

Sallie Mae (SLM): Assessing Valuation as Earnings Rebound and Dividends Signal Stability

Reviewed by Simply Wall St

Sallie Mae (SLM) has just affirmed its fourth-quarter dividends for both common and preferred shareholders. Investors are also focusing on the company’s upcoming earnings report, where a rebound in revenue is expected. This combination is putting the spotlight on SLM’s stability and future outlook.

See our latest analysis for SLM.

After a sharp rally last week, SLM’s share price has lost some steam in recent months. However, investors are still sitting on a strong 22.5% total shareholder return over the past year. Momentum may be cooler since the spring. Still, steady dividends and anticipated revenue recovery are keeping investor sentiment buoyant.

If you’re eyeing where the next breakout could come from, now’s a timely moment to expand your search and discover fast growing stocks with high insider ownership

With analyst price targets well above the current share price and a rebound in revenue forecast, the question now is whether SLM remains undervalued or if the market has already priced in its next chapter of growth.

Most Popular Narrative: 24% Undervalued

SLM’s narrative fair value outpaces the latest close, suggesting significant upside based on forward-looking financials and policy-driven market expansion. Analysts see the discount rate as only slightly higher, keeping future projections robust and in focus.

The recently enacted federal student loan reforms, which cap borrowing under Parent PLUS and eliminate Grad PLUS, are expected to shift $4.5 to $5 billion in annual loan volume from the federal to the private market. This directly expands SLM's addressable market and is poised to drive higher revenue growth beginning in 2027 as the impact phases in.

Curious what’s fueling this ambitious valuation? The blueprint hinges on bold profit growth, surging revenues, and a future earnings multiple that turns heads. Unlock the full narrative to see which forecasts are driving SLM’s deep value calculation.

Result: Fair Value of $35.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher delinquency rates or a tougher jobs market for graduates could challenge SLM’s growth story as policy changes take effect.

Find out about the key risks to this SLM narrative.

Another View: What Do Multiples Say?

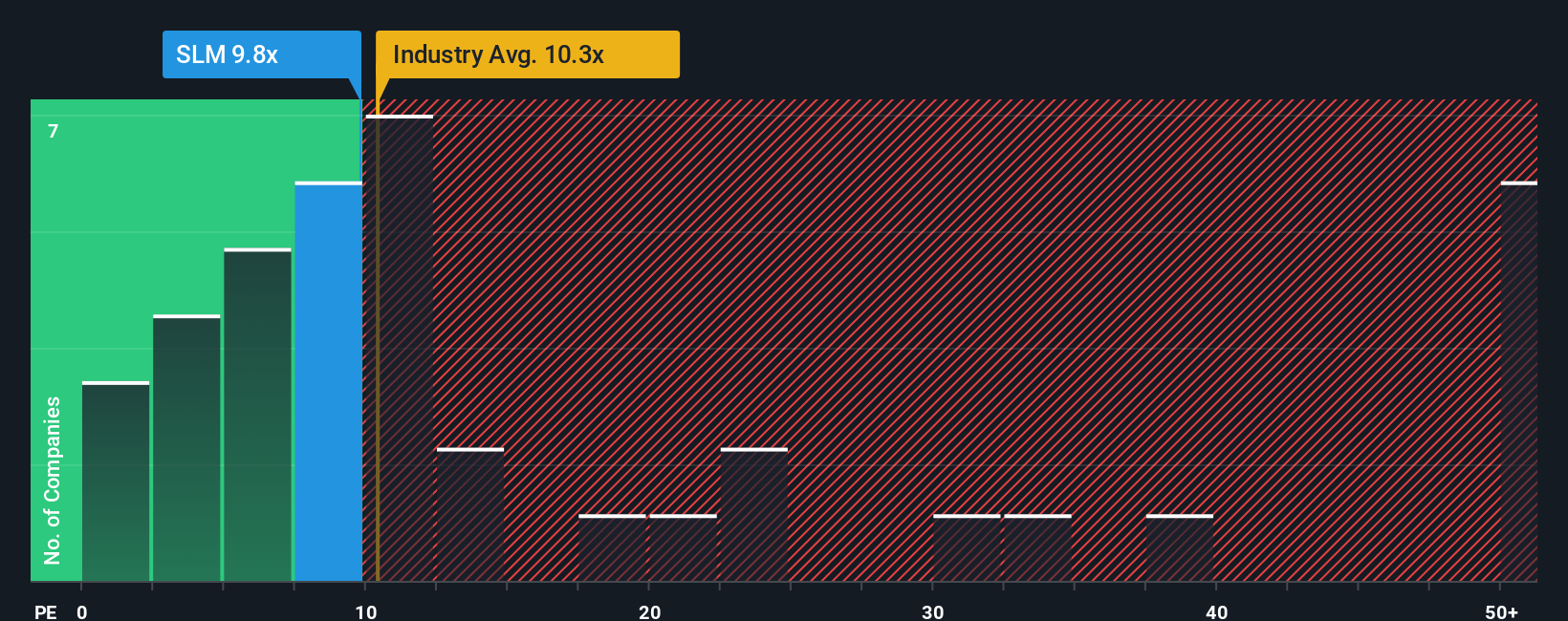

Looking through a different lens, SLM’s current price-to-earnings ratio of 13.2x sits above the US Consumer Finance industry average of 10.1x as well as its peers at 10.3x. However, this is still below the fair ratio of 17.6x that the market could eventually move towards. This suggests there is plenty of room for opinions to differ on valuation risk or upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own SLM Narrative

If you want to put your own perspective to the test or dive deeper into the numbers, you can easily build your own SLM narrative in just a few minutes. Do it your way.

A great starting point for your SLM research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to broaden your portfolio and spot tomorrow’s winners? Supercharge your strategy with fresh insights from these smart stock ideas tailored for real opportunities:

- Unlock potential in emerging sectors by tapping into these 26 AI penny stocks, which are harnessing artificial intelligence for exceptional growth.

- Capture steady income streams by checking out these 17 dividend stocks with yields > 3%, offering high yields and financial resilience no matter the market cycle.

- Ride the wave of technological transformation and gain exposure to next-generation tech by backing these 27 quantum computing stocks, reshaping the computing landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLM

SLM

Through its subsidiaries, originates and services private education loans to students and their families to finance the cost of their education in the United States.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives