The United States market has recently shown robust performance with a 1.1% climb over the last week and an impressive 32% increase over the past year, while earnings are anticipated to grow by 15% annually in the coming years. In such a dynamic environment, identifying promising stocks often involves finding those that offer strong growth potential and resilience amidst broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| QDM International | 36.42% | 107.08% | 78.76% | ★★★★★☆ |

| Chain Bridge Bancorp | 10.64% | 41.34% | 18.53% | ★★★★☆☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Sezzle (NasdaqCM:SEZL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sezzle Inc. is a technology-enabled payments company operating mainly in the United States and Canada, with a market capitalization of $1.12 billion.

Operations: The primary revenue stream for Sezzle Inc. is lending to end-customers, generating $192.69 million.

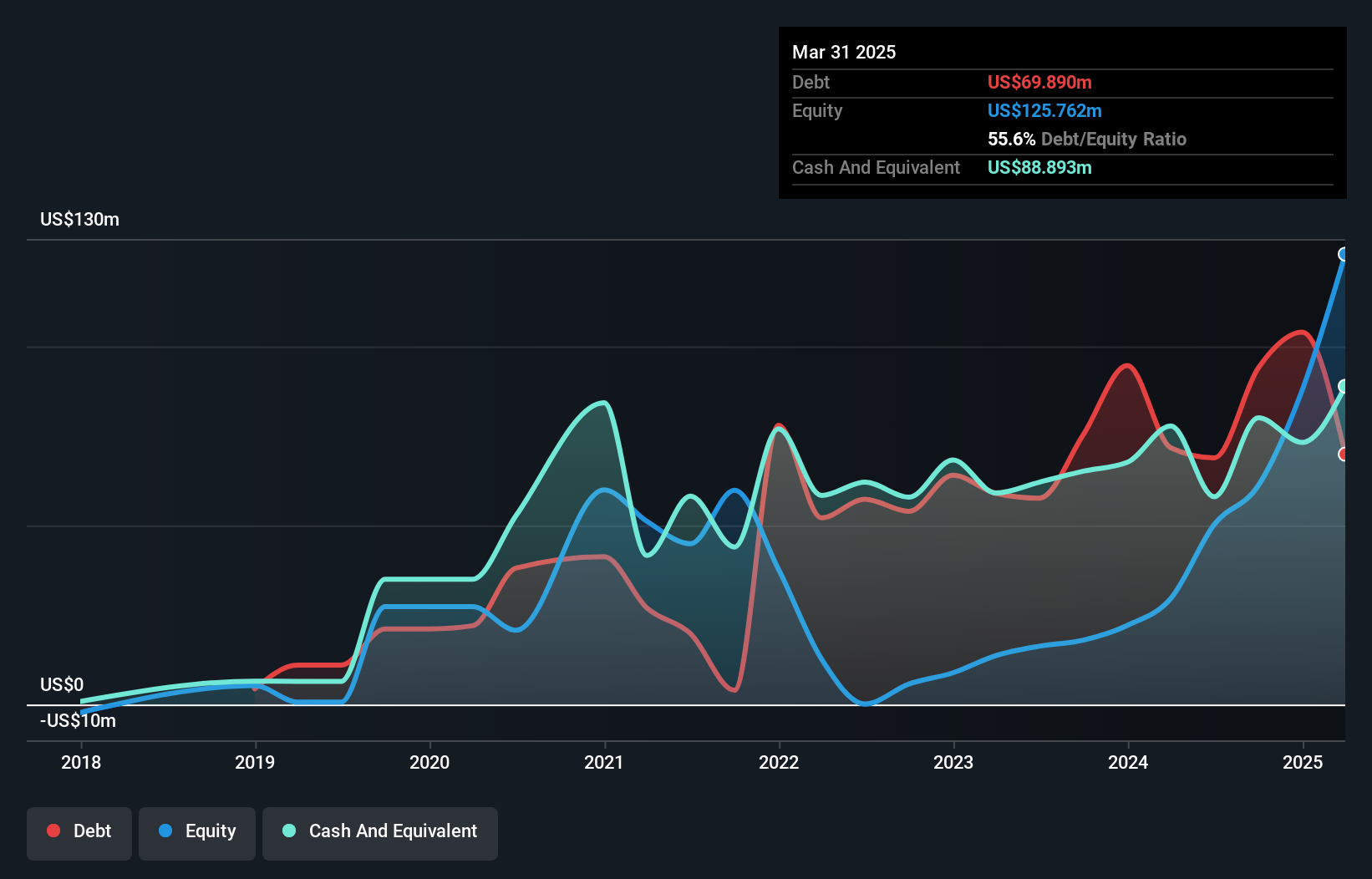

Sezzle, a dynamic player in the financial sector, has shown impressive growth with earnings surging 434.8% over the past year, outpacing industry averages. The company's debt to equity ratio improved significantly from 1676.6% to 137% in five years, showcasing effective financial management. Despite recent insider selling and share price volatility, Sezzle's strategic moves like its partnership with WebBank and Spanish-language app capability highlight its commitment to innovation and inclusivity.

Pathward Financial (NasdaqGS:CASH)

Simply Wall St Value Rating: ★★★★★★

Overview: Pathward Financial, Inc. is a bank holding company for Pathward, National Association, offering a range of banking products and services in the United States with a market cap of approximately $1.83 billion.

Operations: Pathward Financial generates revenue primarily from its Consumer segment, contributing $401.69 million, and its Commercial segment at $248.43 million. The company's net profit margin is 22%, reflecting efficient cost management relative to its revenue streams.

With total assets of US$7.5 billion and equity of US$765.2 million, Pathward Financial stands out with a net interest margin of 6.1%. Total deposits are at US$6.4 billion, while loans reach US$4.5 billion, backed by a sufficient bad loan allowance at 1% of total loans. Despite significant insider selling recently, the company trades at 67.8% below its fair value estimate and has repurchased shares worth $14.99 million this year, reflecting strategic financial management amidst industry challenges.

- Delve into the full analysis health report here for a deeper understanding of Pathward Financial.

Examine Pathward Financial's past performance report to understand how it has performed in the past.

IDT (NYSE:IDT)

Simply Wall St Value Rating: ★★★★★★

Overview: IDT Corporation operates in the communications and payment services sectors across the United States, the United Kingdom, and internationally, with a market capitalization of approximately $1.18 billion.

Operations: IDT generates revenue primarily from its Traditional Communications segment, contributing $899.60 million, followed by Fintech at $120.70 million, and National Retail Solutions (NRS) at $103.10 million. The Net2phone segment adds another $82.30 million to its revenue streams.

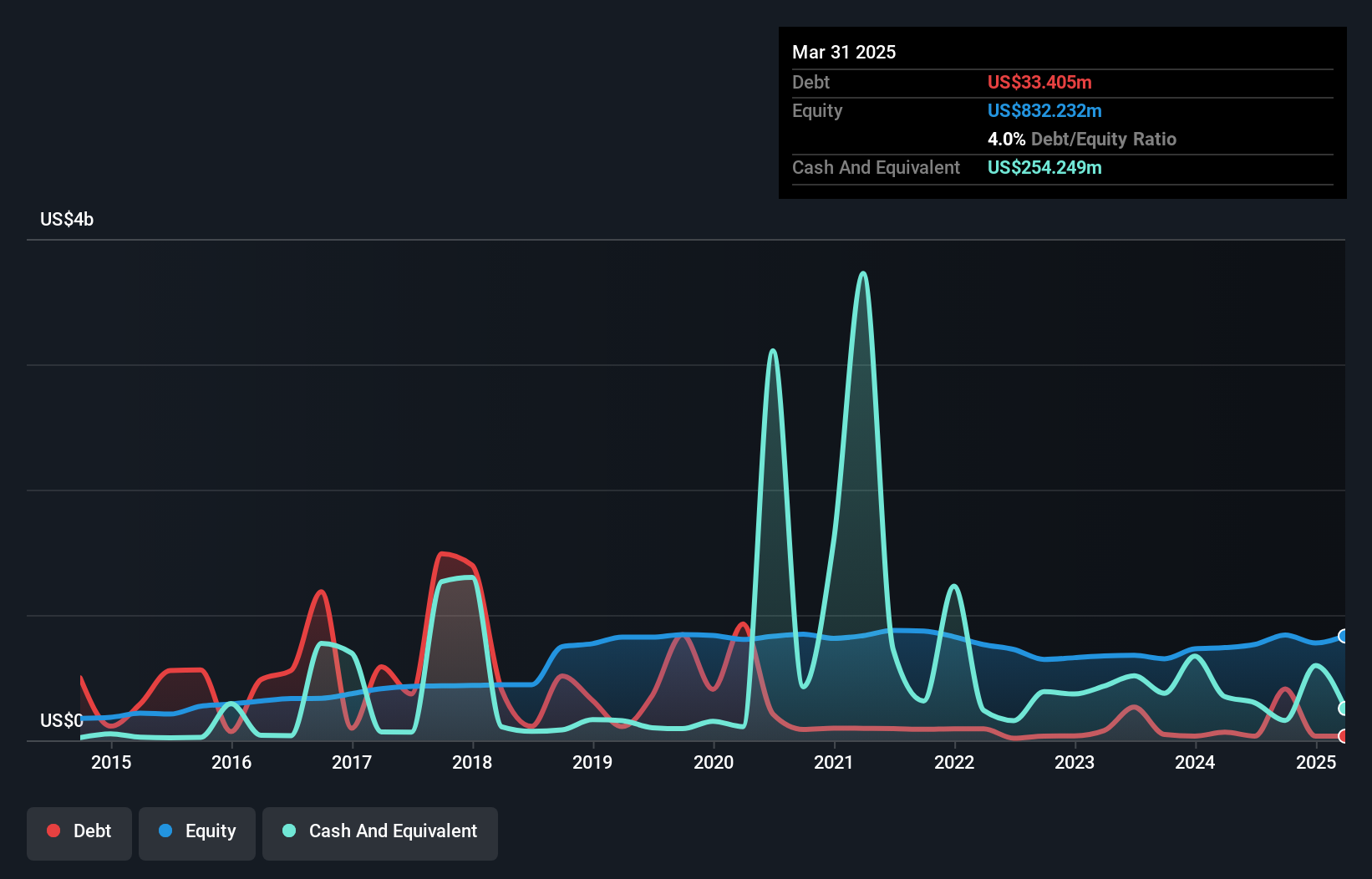

IDT seems to be a promising player in the telecom sector, showcasing an impressive earnings growth of 59.2% over the past year, outpacing the industry's -18.2%. With no debt on its books for five years and trading at 73.4% below estimated fair value, it presents an attractive valuation proposition. The company repurchased a notable 132,028 shares for $4.71 million recently and declared a quarterly dividend of $0.05 per share, reflecting solid financial health and shareholder commitment.

- Dive into the specifics of IDT here with our thorough health report.

Assess IDT's past performance with our detailed historical performance reports.

Taking Advantage

- Click this link to deep-dive into the 223 companies within our US Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IDT

IDT

Provides communications and payment services in the United States, the United Kingdom, and internationally.

Outstanding track record with flawless balance sheet.