- United States

- /

- Diversified Financial

- /

- NasdaqCM:SEZL

Sezzle (SEZL): Examining Valuation After Strong Q2 Results and Surprising Stock Drop

Reviewed by Simply Wall St

If you are watching Sezzle (NasdaqCM:SEZL), the past week has been quite an emotional ride. The company delivered impressive Q2 2025 results, showing sharp jumps in revenue and gross merchandise volume alongside stronger adjusted net income and EBITDA margins. However, shares tumbled by roughly 34% after management emphasized a slowdown in future growth and maintained earlier guidance, catching many by surprise given the momentum in the headline numbers.

This disconnect between operational results and the stock’s trajectory is the kind of thing that gets investors talking. Over the past year, Sezzle’s stock has soared an eye-catching 256%. However, gains have clearly waned, with a sharp dip over the past 3 months erasing much of this year’s upside. Strong performance metrics and headline growth have clashed with shifting expectations, and it appears sentiment around risk and future potential could be rapidly changing.

After such a dramatic move, some may wonder if Sezzle is now a bargain with more growth to come, or if the market has already adjusted for everything on the horizon.

Most Popular Narrative: 25.1% Undervalued

The most widely followed narrative considers Sezzle to be significantly undervalued, suggesting there is high potential upside based on current analyst consensus projections.

Strategic expansion of product offerings (On-Demand, Premium, and Anywhere) and cross-selling efforts targeting migration from low-margin On-Demand to higher-margin subscription products lay the groundwork for increased consumer lifetime value and sustained improvement to net margins and earnings.

What is fueling this bullish target? The main value drivers behind this estimate rely on aggressive growth forecasts and profit assumptions typically reserved for category disruptors. Explore which future milestones and bold performance expectations analysts believe could move Sezzle to an even higher valuation.

Result: Fair Value of $119.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased marketing expenses or persistent reliance on lower-margin products could undermine Sezzle’s future profit growth and challenge the optimistic narrative.

Find out about the key risks to this Sezzle narrative.Another View: Market-Based Valuation

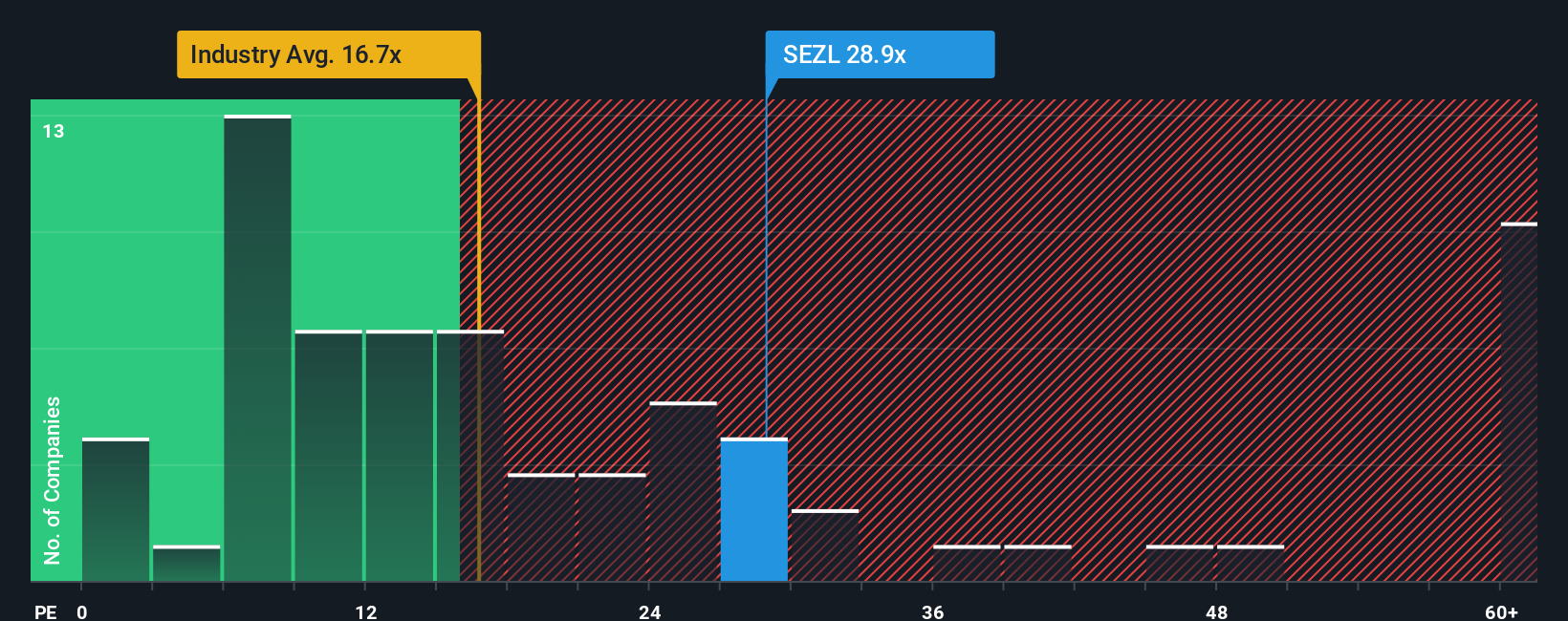

Looking from a market perspective, Sezzle trades at a much higher earnings multiple than the average company in its industry. This challenges the notion of undervaluation. Are expectations for future growth simply too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sezzle Narrative

If you see the story differently or want to dive into your own analysis, it only takes a few minutes to build your own perspective. Do it your way.

A great starting point for your Sezzle research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next great investment might be just a click away. Give yourself an edge by checking out these powerful stock screens. Don’t let the market’s potential pass you by.

- Uncover overlooked gems with strong balance sheets by tapping into penny stocks with strong financials and see which budget-friendly companies are poised for impressive growth.

- Capture tomorrow’s innovations by using quantum computing stocks to spot cutting-edge quantum computing players leading the frontier of technology.

- Lock in reliable returns by pursuing dividend stocks with yields > 3% for stocks offering dividends above 3 percent, perfect for investors who want income and stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SEZL

Sezzle

Operates as a technology-enabled payments company primarily in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives