- United States

- /

- Capital Markets

- /

- NasdaqGM:SAMG

Silvercrest Asset Management Group (NASDAQ:SAMG) Is Increasing Its Dividend To $0.21

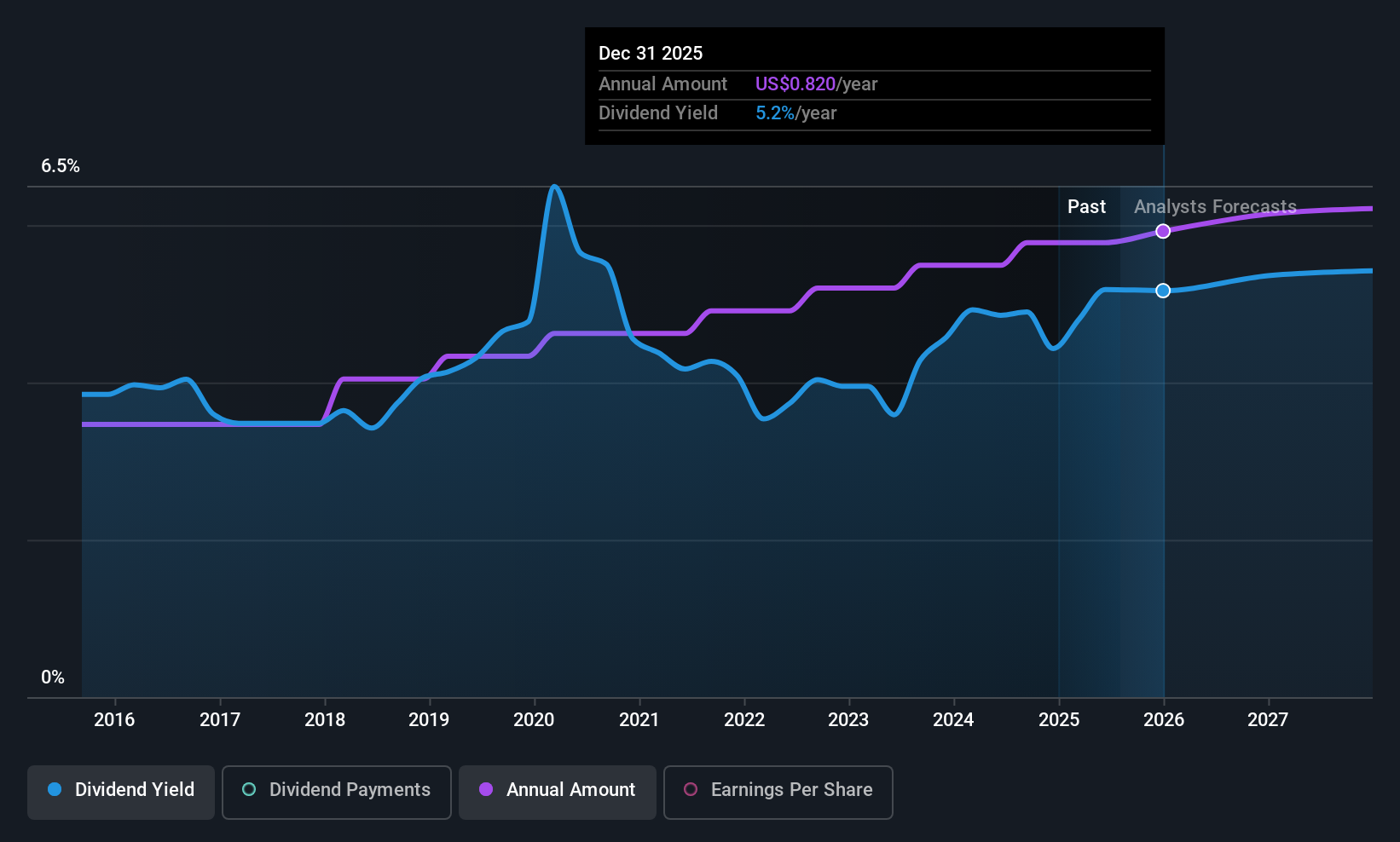

Silvercrest Asset Management Group Inc. (NASDAQ:SAMG) will increase its dividend from last year's comparable payment on the 19th of September to $0.21. This will take the dividend yield to an attractive 5.3%, providing a nice boost to shareholder returns.

Silvercrest Asset Management Group's Payment Could Potentially Have Solid Earnings Coverage

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before this announcement, Silvercrest Asset Management Group was paying out 92% of earnings, but a comparatively small 61% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Earnings per share is forecast to rise by 11.1% over the next year. If recent patterns in the dividend continues, the payout ratio in 12 months could be 77% which is a bit high but can definitely be sustainable.

View our latest analysis for Silvercrest Asset Management Group

Silvercrest Asset Management Group Has A Solid Track Record

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of $0.48 in 2015 to the most recent total annual payment of $0.84. This implies that the company grew its distributions at a yearly rate of about 5.8% over that duration. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. However, things aren't all that rosy. Silvercrest Asset Management Group has seen earnings per share falling at 4.0% per year over the last five years. A modest decline in earnings isn't great, and it makes it quite unlikely that the dividend will grow in the future unless that trend can be reversed. Earnings are predicted to grow over the next year, but we would remain cautious until a track record of earnings growth is established.

Our Thoughts On Silvercrest Asset Management Group's Dividend

Overall, we always like to see the dividend being raised, but we don't think Silvercrest Asset Management Group will make a great income stock. The company is generating plenty of cash, but we still think the dividend is a bit high for comfort. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've picked out 1 warning sign for Silvercrest Asset Management Group that investors should know about before committing capital to this stock. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SAMG

Silvercrest Asset Management Group

A wealth management firm, provides financial advisory and related family office services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026