- United States

- /

- Diversified Financial

- /

- NasdaqCM:RPAY

What Repay Holdings Corporation's (NASDAQ:RPAY) 33% Share Price Gain Is Not Telling You

Repay Holdings Corporation (NASDAQ:RPAY) shareholders have had their patience rewarded with a 33% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 76% in the last year.

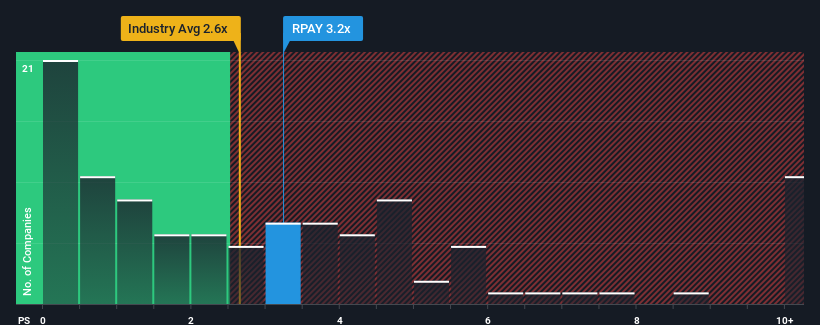

Since its price has surged higher, when almost half of the companies in the United States' Diversified Financial industry have price-to-sales ratios (or "P/S") below 2.6x, you may consider Repay Holdings as a stock probably not worth researching with its 3.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Repay Holdings

How Repay Holdings Has Been Performing

With revenue growth that's inferior to most other companies of late, Repay Holdings has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think Repay Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Repay Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.2%. The latest three year period has also seen an excellent 91% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 8.2% per annum over the next three years. With the industry predicted to deliver 6.5% growth per year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Repay Holdings is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Repay Holdings' P/S

Repay Holdings' P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Repay Holdings currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Repay Holdings with six simple checks will allow you to discover any risks that could be an issue.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RPAY

Repay Holdings

A payments technology company, provides integrated payment processing solutions that enables consumers and businesses to make payments using electronic payment methods in the United States.

Adequate balance sheet and slightly overvalued.